Under Armour 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

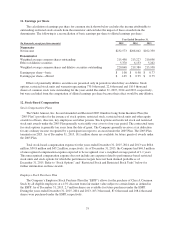

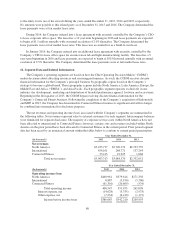

During the year ended December 31, 2015, the Company deemed the achievement of certain operating

income targets probable for the performance-based stock options granted in 2015, and recorded $2.4 million for

these awards, including a cumulative adjustment of $0.9 million during the three months ended September 30,

2015. The Company will assess the probability of the achievement of the operating income targets at the end of

each reporting period. If it becomes probable that any remaining performance targets related to these

performance-based stock options will be achieved, a cumulative adjustment will be recorded as if ratable stock-

based compensation expense had been recorded since the grant date. Additional stock based compensation of up

to $0.6 million would have been recorded through December 31, 2015 for all performance-based stock options

had the full achievement of these operating income targets been deemed probable.

The intrinsic value of stock options exercised during the years ended December 31, 2015, 2014 and 2013

was $27.5 million, $73.0 million and $44.1 million, respectively.

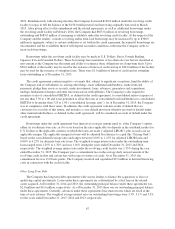

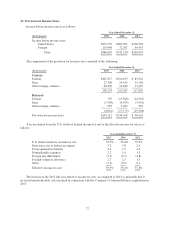

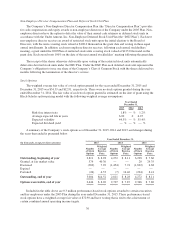

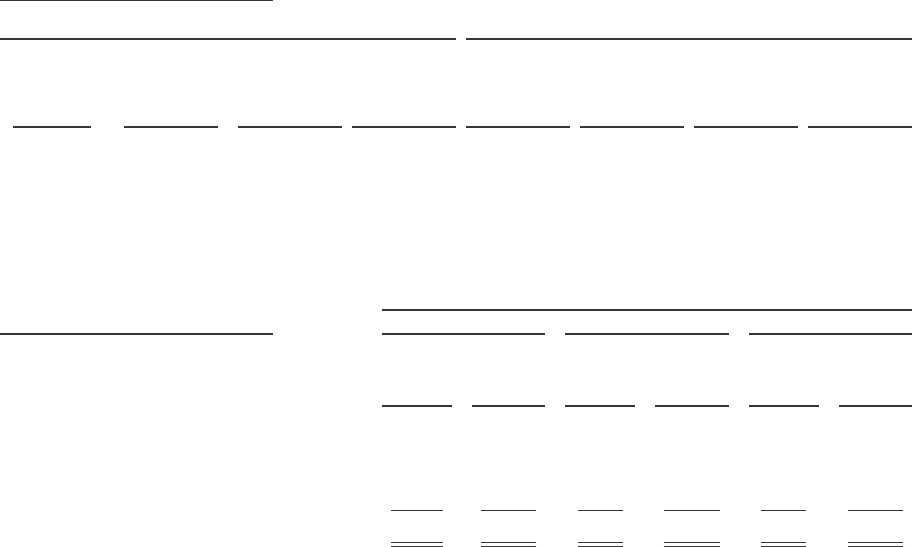

The following table summarizes information about stock options outstanding and exercisable as of

December 31, 2015:

(In thousands, except per share amounts)

Options Outstanding Options Exercisable

Number of

Underlying

Shares

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Intrinsic

Value

Number of

Underlying

Shares

Weighted

Average

Exercise

Price Per

Share

Weighted

Average

Remaining

Contractual

Life (Years)

Total

Intrinsic

Value

3,004 $14.52 4.91 $198,535 2,446 $8.26 4.05 $176,973

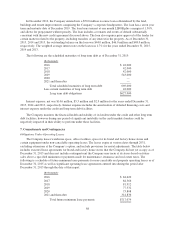

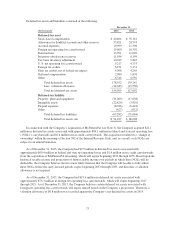

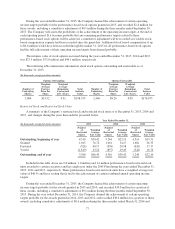

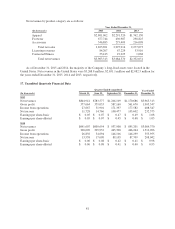

Restricted Stock and Restricted Stock Units

A summary of the Company’s restricted stock and restricted stock units as of December 31, 2015, 2014 and

2013, and changes during the years then ended is presented below:

Year Ended December 31,

(In thousands, except per share amounts) 2015 2014 2013

Number

of

Restricted

Shares

Weighted

Average

Fair Value

Number

of

Restricted

Shares

Weighted

Average

Fair Value

Number

of

Restricted

Shares

Weighted

Average

Fair Value

Outstanding, beginning of year 4,510 $30.42 5,244 $22.19 4,514 $19.51

Granted 1,015 76.72 1,061 54.17 1,682 26.35

Forfeited (326) 48.57 (958) 20.98 (410) 17.37

Vested (1,819) 23.22 (837) 19.49 (542) 16.76

Outstanding, end of year 3,380 $46.45 4,510 $30.42 5,244 $22.19

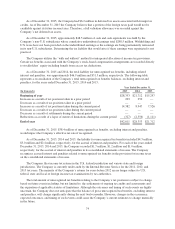

Included in the table above are 0.8 million, 1.0 million and 1.4 million performance-based restricted stock

units awarded to certain executives and key employees under the 2005 Plan during the years ended December 31,

2015, 2014 and 2013, respectively. These performance-based restricted stock units have a weighted average fair

value of $46.91 and have vesting that is tied to the achievement of certain combined annual operating income

targets.

During the year ended December 31, 2015, the Company deemed the achievement of certain operating

income targets probable for the awards granted in 2015 and 2014, and recorded $30.8 million for a portion of

these awards, including a cumulative adjustment of $9.1 million during the three months ended September 30,

2015. During the year ended December 31, 2014, the Company deemed the achievement of certain operating

targets probable for the awards granted in 2014, 2013 and 2012, and recorded $38.4 million for a portion of these

awards, including cumulative adjustments of $6.6 million during the three months ended March 31, 2014 and

77