Under Armour 2015 Annual Report Download - page 48

Download and view the complete annual report

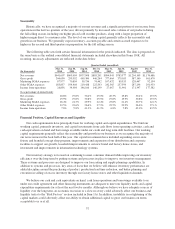

Please find page 48 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.the remaining outstanding term loans under the credit agreement from May 2019 to January 2021.

Simultaneously with entering into the amendment, we borrowed $138.8 million under the revolving credit

facility to repay in full the balance of the $150.0 million term loan originally borrowed in March 2015. After

giving effect to this amendment and the related repayment, as well as additional borrowings under the revolving

credit facility in February 2016, we have $565.0 million of revolving borrowings outstanding and $685.0 million

of remaining availability under our revolving credit facility. At our request and the lenders’ consent, revolving

and/or term loan borrowings may be increased by up to $300.0 million in aggregate, subject to certain conditions

as set forth in the credit agreement, as amended. Incremental borrowings are uncommitted and the availability

thereof will depend on market conditions at the time we seek to incur such borrowings.

Borrowings under the revolving credit facility may be made in U.S. Dollars, Euros, Pounds Sterling,

Japanese Yen and Canadian Dollars. Up to $50.0 million of the facility may be used for the issuance of letters of

credit and up to $50.0 million of the facility may be used for the issuance of swingline loans. There were $1.0

million of letters of credit and no swingline loans outstanding as of December 31, 2015.

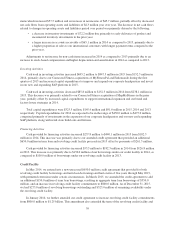

The credit agreement contains negative covenants that, subject to significant exceptions, limit our ability to,

among other things, incur additional indebtedness, make restricted payments, pledge our assets as security, make

investments, loans, advances, guarantees and acquisitions, undergo fundamental changes and enter into

transactions with affiliates. We are also required to maintain a ratio of consolidated EBITDA, as defined in the

credit agreement, to consolidated interest expense of not less than 3.50 to 1.00 and we are not permitted to allow

the ratio of consolidated total indebtedness to consolidated EBITDA to be greater than 3.25 to 1.00. As of

December 31, 2015, we were in compliance with these ratios. In addition, the credit agreement contains events of

default that are customary for a facility of this nature, and includes a cross default provision whereby an event of

default under other material indebtedness, as defined in the credit agreement, will be considered an event of

default under the credit agreement.

Borrowings under the credit agreement bear interest at a rate per annum equal to, at our option, either (a) an

alternate base rate, or (b) the adjusted LIBOR rate, plus in each case an applicable margin. The applicable margin

for loans will be adjusted by reference to the Pricing Grid based on the consolidated leverage ratio and ranges

between 1.00% to 1.25% for adjusted LIBOR rate loans and 0.00% to 0.25% for alternate base rate loans. The

weighted average interest rates under the outstanding term loans ranged from 1.29% to 1.32% and was 1.16%

during the years ended December 31, 2015 and 2014, respectively. The weighted average interest rate under the

revolving credit facility was 1.33% during the year ended December 31, 2015. We pay a commitment fee on the

average daily unused amount of the revolving credit facility and certain fees with respect to letters of credit. As

of December 31, 2015, the commitment fee was 15.0 basis points. We incurred and capitalized $2.9 million

million in deferred financing costs in connection with the credit facility as of December 31, 2015.

Other Long Term Debt

We have long term debt agreements with various lenders to finance the acquisition or lease of qualifying

capital investments. Loans under these agreements are collateralized by a first lien on the related assets acquired.

At December 31, 2014 and 2013, the outstanding principal balance under these agreements was $2.0 million and

$4.9 million, respectively. As of December 31, 2015 there was no outstanding principal balance under these

agreements. Currently, advances under these agreements bear interest rates which are fixed at the time of each

advance. The weighted average interest rates on outstanding borrowings were 3.3%, 3.1% and 3.3% for the years

ended December 31, 2015, 2014 and 2013, respectively.

In December 2012, we entered into a $50.0 million recourse loan collateralized by the land, buildings and

tenant improvements comprising our corporate headquarters. The loan has a seven year term and maturity date of

December 2019. The loan bears interest at one month LIBOR plus a margin of 1.50%, and allows for prepayment

without penalty. The loan includes covenants and events of default substantially consistent with our credit

agreement discussed above. The loan also requires prior approval of the lender for certain matters related to the

40