Under Armour 2015 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

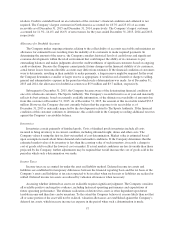

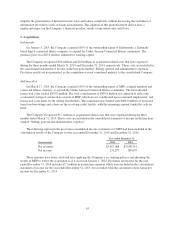

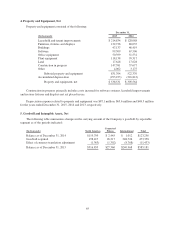

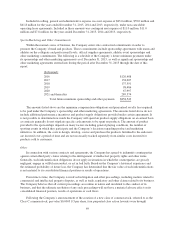

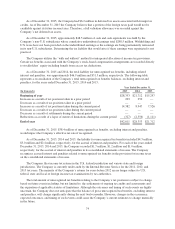

The following table summarizes the Company’s intangible assets as of the periods indicated:

December 31, 2015 December 31, 2014

(In thousands)

Useful Lives

from Date of

Acquisitions

(in years)

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Intangible assets subject to

amortization:

User base 10 $47,922 $ (3,965) $43,957 $ — $ — $ —

Technology 5-7 19,739 (5,041) 14,698 12,000 (1,907) 10,093

Customer relationships 2-3 10,738 (8,354) 2,384 11,927 (4,692) 7,235

Trade name 4-5 7,663 (3,036) 4,627 5,000 (1,353) 3,647

Nutrition database 10 4,500 (356) 4,144 — — —

Lease-related intangible assets 1-15 3,896 (2,919) 977 3,896 (2,762) 1,134

Other 5-10 1,385 (444) 941 2,196 (893) 1,303

Total $95,843 $(24,115) $71,728 $35,019 $(11,607) $23,412

Indefinite-lived intangible assets 3,958 2,818

Intangible assets, net $75,686 $26,230

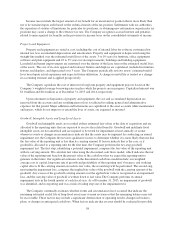

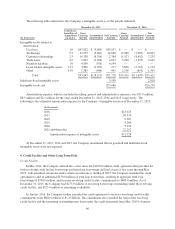

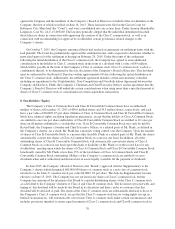

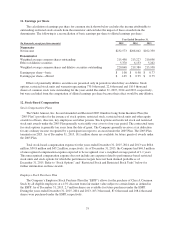

Amortization expense, which is included in selling, general and administrative expenses, was $13.9 million,

$8.5 million and $2.1 million for the years ended December 31, 2015, 2014 and 2013, respectively. The

following is the estimated amortization expense for the Company’s intangible assets as of December 31, 2015:

(In thousands)

2016 $13,023

2017 10,530

2018 9,367

2019 9,260

2020 7,256

2021 and thereafter 22,292

Amortization expense of intangible assets $71,728

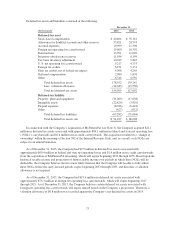

At December 31, 2015, 2014 and 2013, the Company determined that its goodwill and indefinite-lived

intangible assets were not impaired.

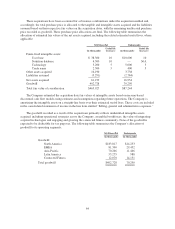

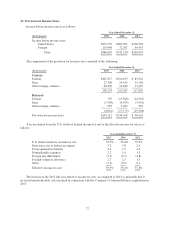

6. Credit Facility and Other Long Term Debt

Credit Facility

In May 2014, the Company entered into a new unsecured $650.0 million credit agreement that provided for

both revolving credit facility borrowings and term loan borrowings and had a term of five years through May

2019, with permitted extensions under certain circumstances. In March 2015, the Company amended the credit

agreement to add an additional $150.0 million of term loan borrowings, resulting in aggregate term loan

borrowings of $350.0 million, and increase revolving credit facility commitments to $800.0 million. As of

December 31, 2015, the Company had $275.0 million of revolving borrowings outstanding under the revolving

credit facility, and $525.0 million of remaining availability.

In January 2016, the Company further amended the credit agreement to increase revolving credit facility

commitments from $800.0 million to $1.25 billion. This amendment also extended the term of the revolving

credit facility and the remaining outstanding term loans under the credit agreement from May 2019 to January

66