Under Armour 2015 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of December 31, 2015, the Company had $6.2 million in deferred tax assets associated with foreign tax

credits. As of December 31, 2015 the Company believes that a portion of the foreign taxes paid would not be

creditable against its future income taxes. Therefore, a full valuation allowance was recorded against the

Company’s net deferred tax assets.

As of December 31, 2015, approximately $48.5 million of cash and cash equivalents was held by the

Company’s non-U.S. subsidiaries whose cumulative undistributed earnings total $298.5 million. Withholding and

U.S. taxes have not been provided on the undistributed earnings as the earnings are being permanently reinvested

in its non-U.S. subsidiaries. Determining the tax liability that would arise if these earnings were repatriated is not

practical.

The Company utilizes the “with and without” method for intraperiod allocation of income tax provisions.

Certain tax benefits associated with the Company’s stock-based compensation arrangements are recorded directly

to stockholders’ equity including benefit from excess tax deductions.

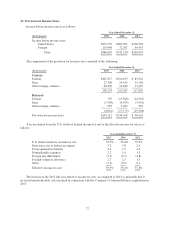

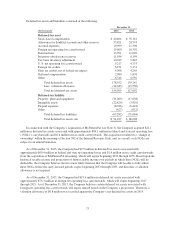

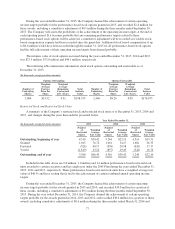

As of December 31, 2015 and 2014, the total liability for unrecognized tax benefits, including related

interest and penalties, was approximately $46.9 million and $31.3 million, respectively. The following table

represents a reconciliation of the Company’s total unrecognized tax benefits balances, excluding interest and

penalties, for the years ended December 31, 2015, 2014 and 2013:

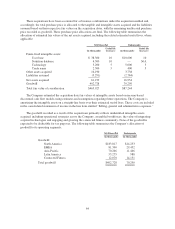

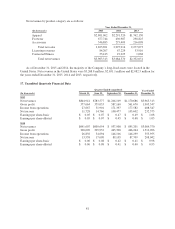

Year Ended December 31,

(In thousands) 2015 2014 2013

Beginning of year $28,353 $21,712 $15,297

Increases as a result of tax positions taken in a prior period 203 250 —

Decreases as a result of tax positions taken in a prior period — — —

Increases as a result of tax positions taken during the current period 14,382 8,947 7,526

Decreases as a result of tax positions taken during the current period — — —

Decreases as a result of settlements during the current period — — —

Reductions as a result of a lapse of statute of limitations during the current period (327) (2,556) (1,111)

End of year $42,611 $28,353 $21,712

As of December 31, 2015, $38.4 million of unrecognized tax benefits, excluding interest and penalties,

would impact the Company’s effective tax rate if recognized.

As of December 31, 2015, 2014 and 2013, the liability for unrecognized tax benefits included $4.3 million,

$3.0 million and $2.4 million, respectively, for the accrual of interest and penalties. For each of the years ended

December 31, 2015, 2014 and 2013, the Company recorded $1.7 million, $1.2 million and $1.0 million,

respectively, for the accrual of interest and penalties in its consolidated statements of income. The Company

recognizes accrued interest and penalties related to unrecognized tax benefits in the provision for income taxes

on the consolidated statements of income.

The Company files income tax returns in the U.S. federal jurisdiction and various state and foreign

jurisdictions. The Company is currently under audit by the Internal Revenue Service for the 2011, 2012, and

2013 tax years. The majority of the Company’s returns for years before 2012 are no longer subject to U.S.

federal, state and local or foreign income tax examinations by tax authorities.

The total amount of unrecognized tax benefits relating to the Company’s tax positions is subject to change

based on future events including, but not limited to, the settlements of ongoing tax audits and assessments and

the expiration of applicable statutes of limitations. Although the outcomes and timing of such events are highly

uncertain, the Company does not anticipate that the balance of gross unrecognized tax benefits, excluding interest

and penalties, will change significantly during the next twelve months. However, changes in the occurrence,

expected outcomes, and timing of such events could cause the Company’s current estimates to change materially

in the future.

74