Under Armour 2015 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

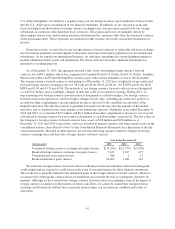

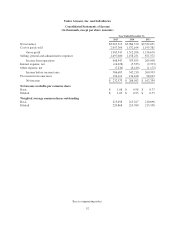

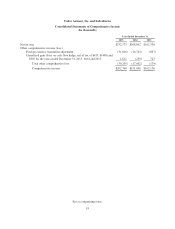

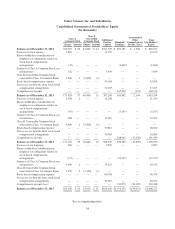

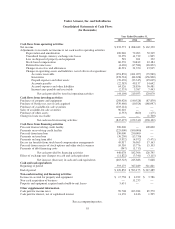

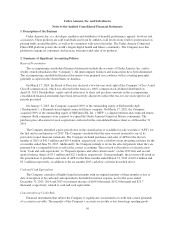

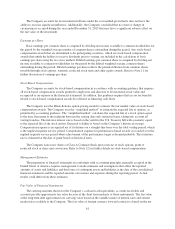

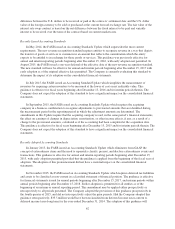

Under Armour, Inc. and Subsidiaries

Consolidated Statements of Stockholders’ Equity

(In thousands)

Class A

Common Stock

Class B

Convertible

Common Stock Additional

Paid-In

Capital

Retained

Earnings

Accumulated

Other

Comprehensive

Income (Loss)

Total

Stockholders’

EquityShares Amount Shares Amount

Balance as of December 31, 2012 166,922 $ 56 42,600 $ 14 $321,303 $ 493,181 $ 2,368 $ 816,922

Exercise of stock options 1,822 — — — 12,159 — — 12,159

Shares withheld in consideration of

employee tax obligations relative to

stock-based compensation

arrangements (47) — — — — (1,669) — (1,669)

Issuance of Class A Common Stock, net

of forfeitures 332 — — — 3,439 — — 3,439

Class B Convertible Common Stock

converted to Class A Common Stock 2,600 1 (2,600) (1) — — — —

Stock-based compensation expense — — — — 43,184 — — 43,184

Net excess tax benefits from stock-based

compensation arrangements — — — — 17,163 — — 17,163

Comprehensive income — — — — — 162,330 (174) 162,156

Balance as of December 31, 2013 171,629 57 40,000 13 397,248 653,842 2,194 1,053,354

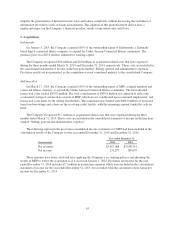

Exercise of stock options 1,454 1 — — 11,258 — — 11,259

Shares withheld in consideration of

employee tax obligations relative to

stock-based compensation

arrangements (95) — — — — (5,197) — (5,197)

Issuance of Class A Common Stock, net

of forfeitures 908 — — — 12,067 — — 12,067

Class B Convertible Common Stock

converted to Class A Common Stock 3,400 1 (3,400) (1) — — — —

Stock-based compensation expense — — — — 50,812 — — 50,812

Net excess tax benefits from stock-based

compensation arrangements — — — — 36,965 — — 36,965

Comprehensive income — — — — — 208,042 (17,002) 191,040

Balance as of December 31, 2014 177,296 59 36,600 12 508,350 856,687 (14,808) 1,350,300

Exercise of stock options 360 — — — 2,852 — — 2,852

Shares withheld in consideration of

employee tax obligations relative to

stock-based compensation

arrangements (172) — — — — (12,727) — (12,727)

Issuance of Class A Common Stock, net

of forfeitures 1,996 1 — — 19,135 — — 19,136

Class B Convertible Common Stock

converted to Class A Common Stock 2,150 1 (2,150) (1) — — — —

Stock-based compensation expense — — — — 60,376 — — 60,376

Net excess tax benefits from stock-based

compensation arrangements — — — — 45,917 — — 45,917

Comprehensive income (loss) — — — — — 232,573 (30,205) 202,368

Balance as of December 31, 2015 181,630 $ 61 34,450 $ 11 $636,630 $1,076,533 $(45,013) $1,668,222

See accompanying notes.

54