Under Armour 2015 Annual Report Download - page 78

Download and view the complete annual report

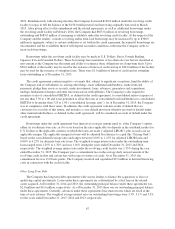

Please find page 78 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.against the Company and the members of the Company’s Board of Directors on behalf of the stockholders of the

Company, the first of which was filed on June 18, 2015. These lawsuits were filed in the Circuit Court for

Baltimore City, Maryland (the “Court”), and were consolidated into one action, In re: Under Armour Shareholder

Litigation, Case No. 24-C-15-003240. The lawsuits generally alleged that the individual defendants breached

their fiduciary duties in connection with approving the creation of the Class C common stock, as well as in

connection with recommending for approval by stockholders certain governance related changes to the

Company’s charter.

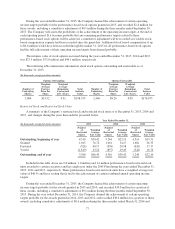

On October 7, 2015, the Company announced that it had reached an agreement on settlement terms with the

lead plaintiff. The Court has preliminarily approved the settlement terms, and is expected to determine whether to

grant final approval of the settlement at hearing on February 29, 2016. Under the terms of the settlement,

following the initial distribution of the Class C common stock, the Company has agreed to issue additional

consideration to the holders of Class C common stock in the form of a dividend with a value of $59 million,

which will be payable in the form of the Company’s Class A common stock, Class C common stock, cash or a

combination thereof, to be determined at the sole discretion of the Company’s Board of Directors. This dividend

must be authorized by the Board of Directors within approximately 60 days following the initial distribution of

the Class C common stock. Additionally, the settlement agreement includes certain non-monetary remedies,

including an amendment to the Confidentiality, Non-Competition and Non-Solicitation Agreement between the

Company and Kevin A. Plank, the Company’s Chairman and Chief Executive Officer, and an agreement that the

Company’s Board of Directors will undertake certain considerations when using more than a specified amount of

shares of Class C common stock as consideration in certain acquisition transactions.

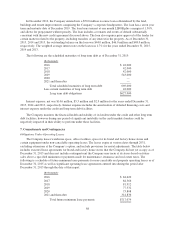

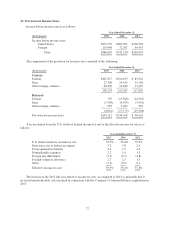

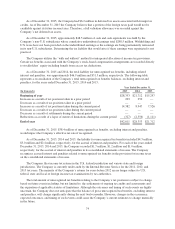

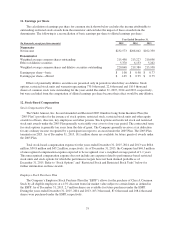

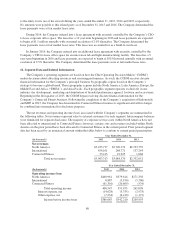

8. Stockholders’ Equity

The Company’s Class A Common Stock and Class B Convertible Common Stock have an authorized

number of shares at December 31, 2015 of 400.0 million shares and 34.5 million shares, respectively, and each

have a par value of $0.0003 1/3 per share. Holders of Class A Common Stock and Class B Convertible Common

Stock have identical rights, including liquidation preferences, except that the holders of Class A Common Stock

are entitled to one vote per share and holders of Class B Convertible Common Stock are entitled to 10 votes per

share on all matters submitted to a stockholder vote. Class B Convertible Common Stock may only be held by

Kevin Plank, the Company’s founder and Chief Executive Officer, or a related party of Mr. Plank, as defined in

the Company’s charter. As a result, Mr. Plank has a majority voting control over the Company. Upon the transfer

of shares of Class B Convertible Stock to a person other than Mr. Plank or a related party of Mr. Plank, the shares

automatically convert into shares of Class A Common Stock on a one-for-one basis. In addition, all of the

outstanding shares of Class B Convertible Common Stock will automatically convert into shares of Class A

Common Stock on a one-for-one basis upon the death or disability of Mr. Plank or on the record date for any

stockholders’ meeting upon which the shares of Class A Common Stock and Class B Convertible Common Stock

beneficially owned by Mr. Plank is less than 15% of the total shares of Class A Common Stock and Class B

Convertible Common Stock outstanding. Holders of the Company’s common stock are entitled to receive

dividends when and if authorized and declared out of assets legally available for the payment of dividends.

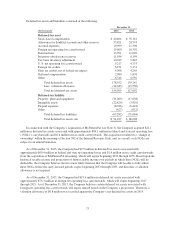

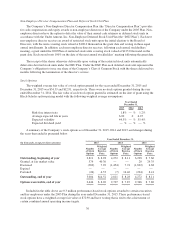

In June 2015, the Company’s Board of Directors (the “Board”) approved Articles Supplementary to the

Company’s charter which designated 400,000,000 shares of common stock as a new class of common stock,

referred to as the Class C common stock, par value $0.0003 1/3 per share. The Articles Supplementary became

effective on June 15, 2015. The Company has not yet issued any shares of Class C common stock, but the

Company has announced the intention of its Board to consider distributing shares of the Class C common stock

as a dividend to the Company’s holders of Class A and Class B common stock. The decision to proceed with, and

timing of, this dividend will be made by the Board in its discretion and there can be no assurance that this

dividend will be declared or paid. The terms of the Class C common stock are substantially identical to those of

the Company’s Class A common stock, except that the Class C common stock has no voting rights (except in

limited circumstances), will automatically convert into Class A common stock under certain circumstances and

includes provisions intended to ensure equal treatment of Class C common stock and Class B common stock in

70