Under Armour 2015 Annual Report Download - page 53

Download and view the complete annual report

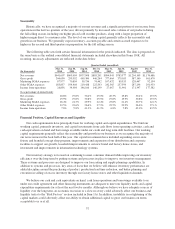

Please find page 53 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We continually evaluate whether events and circumstances have occurred that indicate the remaining

estimated useful life of long-lived assets may warrant revision or that the remaining balance may not be

recoverable. These factors may include a significant deterioration of operating results, changes in business plans,

or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible

impairment, we review long-lived assets to assess recoverability from future operations using undiscounted cash

flows. If future undiscounted cash flows are less than the carrying value, an impairment is recognized in earnings

to the extent that the carrying value exceeds fair value.

Income Taxes

Income taxes are accounted for under the asset and liability method. Deferred income tax assets and

liabilities are established for temporary differences between the financial reporting basis and the tax basis of our

assets and liabilities at tax rates expected to be in effect when such assets or liabilities are realized or settled.

Deferred income tax assets are reduced by valuation allowances when necessary.

Assessing whether deferred tax assets are realizable requires significant judgment. We consider all available

positive and negative evidence, including historical operating performance and expectations of future operating

performance. The ultimate realization of deferred tax assets is often dependent upon future taxable income and

therefore can be uncertain. To the extent we believe it is more likely than not that all or some portion of the asset

will not be realized, valuation allowances are established against our deferred tax assets, which increase income

tax expense in the period when such a determination is made.

Income taxes include the largest amount of tax benefit for an uncertain tax position that is more likely than

not to be sustained upon audit based on the technical merits of the tax position. Settlements with tax authorities,

the expiration of statutes of limitations for particular tax positions, or obtaining new information on particular tax

positions may cause a change to the effective tax rate. We recognize accrued interest and penalties related to

unrecognized tax benefits in the provision for income taxes on the consolidated statements of income.

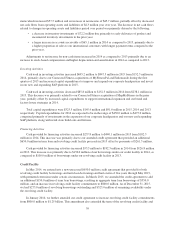

Stock-Based Compensation

We account for stock-based compensation in accordance with accounting guidance that requires all stock-

based compensation awards granted to employees and directors to be measured at fair value and recognized as an

expense in the financial statements. As of December 31, 2015, we had $46.3 million of unrecognized

compensation expense expected to be recognized over a weighted average period of 1.1 years. This unrecognized

compensation expense does not include any expense related to performance-based restricted stock units and stock

options for which the performance targets have not been achieved as of December 31, 2015.

The assumptions used in calculating the fair value of stock-based compensation awards represent

management’s best estimates, but the estimates involve inherent uncertainties and the application of management

judgment. In addition, compensation expense for performance-based awards is recorded over the related service

period when achievement of the performance targets are deemed probable, which requires management

judgment. For example, the achievement of certain operating income targets related to the performance-based

restricted stock units and stock options granted in 2015 were not deemed probable as of December 31, 2015.

Additional stock-based compensation of up to $3.6 million would have been recorded in 2015 for these

performance-based restricted stock units and stock options had the full achievement of all operating targets been

deemed probable. As a result, if factors change and we use different assumptions, our stock-based compensation

expense could be materially different in the future. Refer to Note 2 and Note 12 to the Consolidated Financial

Statements for a further discussion on stock-based compensation.

Recently Issued Accounting Standards

In May 2014, the Financial Accounting Standards Board (“FASB”) issued an Accounting Standards Update

which supersedes the most current requirements. The new revenue recognition standard requires entities to

45