Under Armour 2015 Annual Report Download - page 67

Download and view the complete annual report

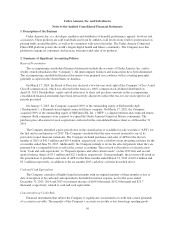

Please find page 67 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.impairment, the Company reviews long-lived assets to assess recoverability from future operations using

undiscounted cash flows. If future undiscounted cash flows are less than the carrying value, an impairment is

recognized in earnings to the extent that the carrying value exceeds fair value.

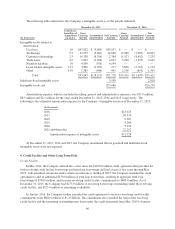

Accrued Expenses

At December 31, 2015, accrued expenses primarily included $63.8 million and $17.8 million of accrued

compensation and benefits and marketing expenses, respectively. At December 31, 2014, accrued expenses

primarily included $61.4 million and $14.0 million of accrued compensation and benefits and marketing

expenses, respectively.

Foreign Currency Translation and Transactions

The functional currency for each of the Company’s wholly owned foreign subsidiaries is generally the

applicable local currency. The translation of foreign currencies into U.S. dollars is performed for assets and

liabilities using current foreign currency exchange rates in effect at the balance sheet date and for revenue and

expense accounts using average foreign currency exchange rates during the period. Capital accounts are

translated at historical foreign currency exchange rates. Translation gains and losses are included in stockholders’

equity as a component of accumulated other comprehensive income. Adjustments that arise from foreign

currency exchange rate changes on transactions, primarily driven by intercompany transactions, denominated in a

currency other than the functional currency are included in other expense, net on the consolidated statements of

income.

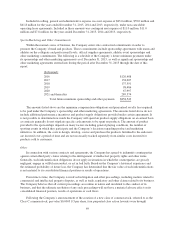

Derivatives and Hedging Activities

The Company uses derivative financial instruments in the form of foreign currency forward and interest rate

swap contracts to minimize the risk associated with foreign currency exchange rate and interest rate fluctuations.

The Company accounts for derivative financial instruments pursuant to applicable accounting guidance. This

guidance establishes accounting and reporting standards for derivative financial instruments and requires all

derivatives to be recognized as either assets or liabilities on the balance sheet and to be measured at fair value.

Unrealized derivative gain positions are recorded as other current assets or other long term assets, and unrealized

derivative loss positions are recorded as accrued expenses or other long term liabilities, depending on the

derivative financial instrument’s maturity date.

Currently, the majority of the Company’s foreign currency forward contracts are not designated as cash flow

hedges, and accordingly, changes in their fair value are included in other expense, net on the consolidated

statements of income. During 2014, the Company began entering into foreign currency forward contracts

designated as cash flow hedges, and consequently, changes in fair value, excluding any ineffective portion, are

recorded in other comprehensive income until net income is affected by the variability in cash flows of the

hedged transaction. The effective portion is generally released to net income after the maturity of the related

derivative and is classified in the same manner as the underlying exposure. Additionally, the Company has

designated its interest rate swap contract as a cash flow hedge and accordingly, the effective portion of changes

in fair value are recorded in other comprehensive income and reclassified into interest expense over the life of the

underlying debt obligation. The ineffective portion, if any, is recognized in current period earnings. The

Company does not enter into derivative financial instruments for speculative or trading purposes.

Revenue Recognition

The Company recognizes revenue pursuant to applicable accounting standards. Net revenues consist of both

net sales and license and other revenues. Net sales are recognized upon transfer of ownership, including passage

of title to the customer and transfer of risk of loss related to those goods. Transfer of title and risk of loss is based

upon shipment under free on board shipping point for most goods or upon receipt by the customer depending on

59