Under Armour 2015 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

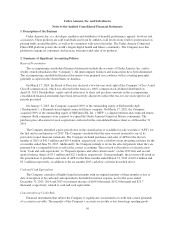

simplify the presentation of deferred income taxes and reduce complexity without decreasing the usefulness of

information provided to users of financial statements. The adoption of this pronouncement did not have a

significant impact on the Company’s financial position, results of operations and cash flows.

3. Acquisitions

Endomondo

On January 5, 2015, the Company acquired 100% of the outstanding equity of Endomondo, a Denmark-

based digital connected fitness company, to expand the Under Armour Connected Fitness community. The

purchase price was $85.0 million, adjusted for working capital.

The Company recognized $0.6 million and $0.8 million in acquisition related costs that were expensed

during the three months ended March 31, 2015 and December 31, 2014, respectively. These costs are included in

the consolidated statements of income in the line item entitled “Selling, general and administrative expenses.”

Pro forma results are not presented, as the acquisition was not considered material to the consolidated Company.

MyFitnessPal

On March 17, 2015, the Company acquired 100% of the outstanding equity of MFP, a digital nutrition and

connected fitness company, to expand the Under Armour Connected Fitness community. The final adjusted

transaction value totaled $474.0 million. The total consideration of $463.9 million was adjusted to reflect the

accelerated vesting of certain share awards of MFP, which are not conditioned upon continued employment, and

transaction costs borne by the selling shareholders. The acquisition was funded with $400.0 million of increased

term loan borrowings and a draw on the revolving credit facility, with the remaining amount funded by cash on

hand.

The Company recognized $5.7 million of acquisition related costs that were expensed during the three

months ended March 31, 2015. These costs are included in the consolidated statement of income in the line item

entitled “Selling, general and administrative expenses.”

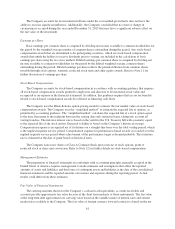

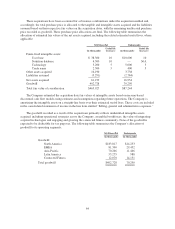

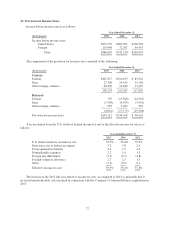

The following represents the pro forma consolidated income statement as if MFP had been included in the

consolidated results of the Company for the year ended December 31, 2015 and December 31, 2014:

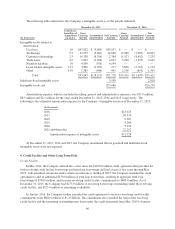

Year ended December 31,

(In thousands) 2015 2014

Net revenues $3,967,008 $3,098,341

Net income 231,277 189,659

These amounts have been calculated after applying the Company’s accounting policies and adjusting the

results of MFP to reflect the acquisition as if it closed on January 1, 2014. Pro forma net income for the year

ended December 31, 2014 includes $5.7 million in transaction expenses which were included in the consolidated

statement of income for the year ended December 31, 2015, but excluded from the calculation of pro forma net

income for December 31, 2015.

63