Under Armour 2015 Annual Report Download - page 66

Download and view the complete annual report

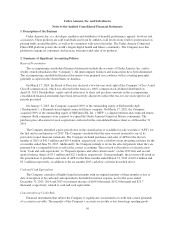

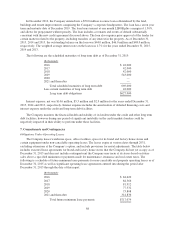

Please find page 66 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income taxes include the largest amount of tax benefit for an uncertain tax position that is more likely than

not to be sustained upon audit based on the technical merits of the tax position. Settlements with tax authorities,

the expiration of statutes of limitations for particular tax positions, or obtaining new information on particular tax

positions may cause a change to the effective tax rate. The Company recognizes accrued interest and penalties

related to unrecognized tax benefits in the provision for income taxes on the consolidated statements of income.

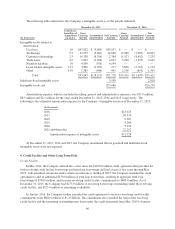

Property and Equipment

Property and equipment are stated at cost, including the cost of internal labor for software customized for

internal use, less accumulated depreciation and amortization. Property and equipment is depreciated using the

straight-line method over the estimated useful lives of the assets: 3 to 10 years for furniture, office equipment,

software and plant equipment and 10 to 35 years for site improvements, buildings and building equipment.

Leasehold and tenant improvements are amortized over the shorter of the lease term or the estimated useful lives

of the assets. The cost of in-store apparel and footwear fixtures and displays are capitalized, included in furniture,

fixtures and displays, and depreciated over 3 years. The Company periodically reviews assets’ estimated useful

lives based upon actual experience and expected future utilization. A change in useful life is treated as a change

in accounting estimate and is applied prospectively.

The Company capitalizes the cost of interest for long term property and equipment projects based on the

Company’s weighted average borrowing rates in place while the projects are in progress. Capitalized interest was

$1.0 million and $0.4 million as of December 31, 2015 and 2014, respectively.

Upon retirement or disposition of property and equipment, the cost and accumulated depreciation are

removed from the accounts and any resulting gain or loss is reflected in selling, general and administrative

expenses for that period. Major additions and betterments are capitalized to the asset accounts while maintenance

and repairs, which do not improve or extend the lives of assets, are expensed as incurred.

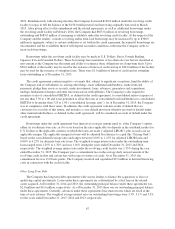

Goodwill, Intangible Assets and Long-Lived Assets

Goodwill and intangible assets are recorded at their estimated fair values at the date of acquisition and are

allocated to the reporting units that are expected to receive the related benefits. Goodwill and indefinite lived

intangible assets are not amortized and are required to be tested for impairment at least annually or sooner

whenever events or changes in circumstances indicate that the assets may be impaired. In conducting an annual

impairment test, the Company first reviews qualitative factors to determine whether it is more likely than not that

the fair value of the reporting unit is less than its carrying amount. If factors indicate that is the case, or if

goodwill is allocated to a reporting unit for the first time, the Company performs the two-step goodwill

impairment test. The first step, identifying a potential impairment, compares the fair value of the reporting unit

with its carrying amount. We calculate fair value using the discounted cash flows model, which indicates the fair

value of the reporting unit based on the present value of the cash flows that we expect the reporting unit to

generate in the future. Our significant estimates in the discounted cash flows model include: our weighted

average cost of capital, long-term rate of growth and profitability of the reporting unit’s business, and working

capital effects. If the carrying amount exceeds its fair value, the second step will be performed. The second step,

measuring the impairment loss, compares the implied fair value of the goodwill with the carrying amount of the

goodwill. Any excess of the goodwill carrying amount over the applied fair value is recognized as an impairment

loss, and the carrying value of goodwill is written down to fair value.The Company performs its annual

impairment tests in the fourth quarter of each fiscal year. As of December 31, 2015, no impairment of goodwill

was identified, and no reporting unit was at risk of failing step one of the impairment test.

The Company continually evaluates whether events and circumstances have occurred that indicate the

remaining estimated useful life of long-lived assets may warrant revision or that the remaining balance may not

be recoverable. These factors may include a significant deterioration of operating results, changes in business

plans, or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible

58