Under Armour 2015 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At December 31, 2015, $48.5 million, or approximately 37.4%, of our cash was held by our foreign

subsidiaries where a repatriation of those funds to the United States would likely result in an additional tax

expense. However, based on the capital and liquidity needs of our foreign operations, as well as the status of

current tax law, we intend to indefinitely reinvest these funds outside the United States. In addition, our United

States operations do not require the repatriation of these funds to meet our currently projected liquidity needs.

Should we require additional capital in the United States, we may elect to repatriate indefinitely reinvested

foreign funds or raise capital in the United States. If we were to repatriate indefinitely reinvested foreign funds,

we would be required to accrue and pay additional U.S. taxes less applicable foreign tax credits. Determining the

tax liability that would arise if these earnings were repatriated is not practical.

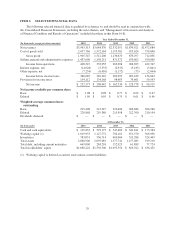

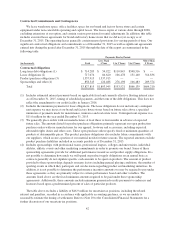

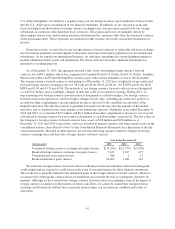

Cash Flows

The following table presents the major components of net cash flows used in and provided by operating,

investing and financing activities for the periods presented:

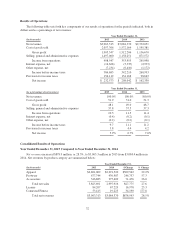

Year Ended December 31,

(In thousands) 2015 2014 2013

Net cash provided by (used in):

Operating activities $ (44,104) $ 219,033 $ 120,070

Investing activities (847,475) (152,312) (238,102)

Financing activities 440,078 182,306 126,795

Effect of exchange rate changes on cash and cash

equivalents (11,822) (3,341) (3,115)

Net increase in cash and cash equivalents $(463,323) $ 245,686 $ 5,648

Operating Activities

Operating activities consist primarily of net income adjusted for certain non-cash items. Adjustments to net

income for non-cash items include depreciation and amortization, unrealized foreign currency exchange rate

gains and losses, losses on disposals of property and equipment, stock-based compensation, deferred income

taxes and changes in reserves and allowances. In addition, operating cash flows include the effect of changes in

operating assets and liabilities, principally inventories, accounts receivable, income taxes payable and receivable,

prepaid expenses and other assets, accounts payable and accrued expenses.

Cash flows used in operating activities decreased $263.1 million to $44.1 million in 2015 from $219.0

million of cash provided by operating activities in 2014. The decrease in cash from operating activities was due

to decreased net cash flows from operating assets and liabilities of $370.1 million, partially offset by adjustments

to net income for non-cash items, which increased $82.5 million, and an increase in net income of $24.5 million

year over year. The decrease in cash outflows related to changes in operating assets and liabilities period over

period was primarily driven by the following:

• an increase in inventory investments of $193.9 million primarily due to early deliveries of product to

meet key seasonal floor set dates, as well as strategic investments in auto-replenishment products.

• a larger increase in accounts receivable of $90.8 million in 2015 as compared to 2014, primarily due to

the timing of shipments.

Adjustments to net income for non-cash items increased in 2015 as compared to 2014 primarily due to

higher depreciation and amortization expense in 2015 as compared to 2014 related to the expansion of our

distribution and corporate facilities as well as our two Connected Fitness acquisitions.

Cash provided by operating activities increased $98.9 million to $219.0 million in 2014 from $120.1 million

in 2013. The increase in cash provided by operating activities was due to adjustments to net income for non-cash

38