Under Armour 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

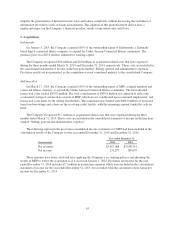

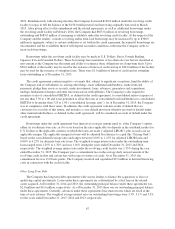

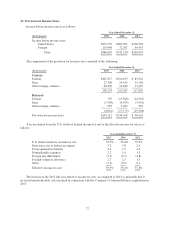

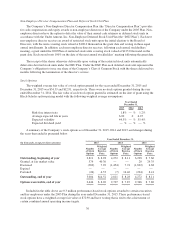

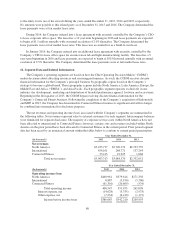

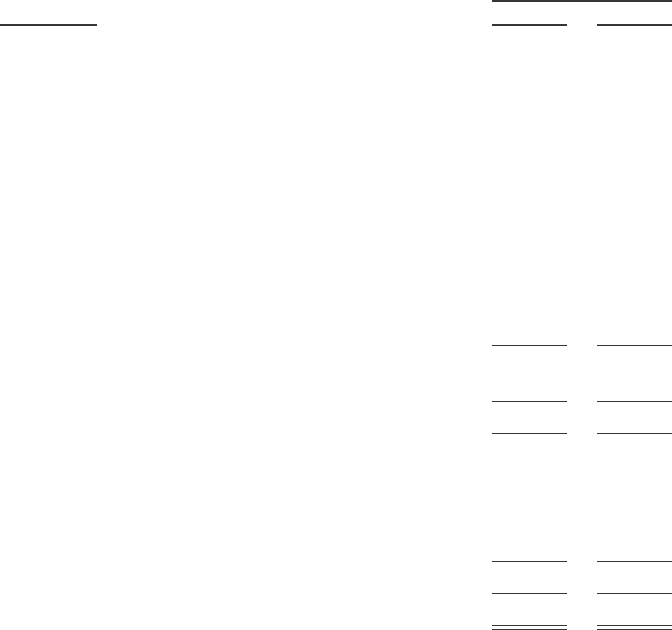

Deferred tax assets and liabilities consisted of the following:

December 31,

(In thousands) 2015 2014

Deferred tax asset

Stock-based compensation $ 40,406 $ 35,161

Allowance for doubtful accounts and other reserves 33,821 24,774

Accrued expenses 19,999 11,398

Foreign net operating loss carryforward 19,600 16,302

Deferred rent 13,991 11,005

Inventory obsolescence reserves 11,956 8,198

Tax basis inventory adjustment 10,019 5,845

U. S. net operating loss carryforward 9,217 4,733

Foreign tax credits 6,151 5,131

State tax credits, net of federal tax impact 4,966 4,245

Deferred compensation 2,080 1,858

Other 6,346 4,592

Total deferred tax assets 178,552 133,242

Less: valuation allowance (24,043) (15,550)

Total net deferred tax assets 154,509 117,692

Deferred tax liability

Property, plant and equipment (31,069) (17,638)

Intangible assets (22,820) (7,010)

Prepaid expenses (8,766) (6,424)

Other (627) (612)

Total deferred tax liabilities (63,282) (31,684)

Total deferred tax assets, net $ 91,227 $ 86,008

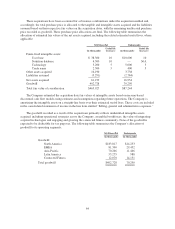

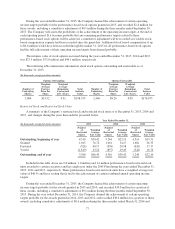

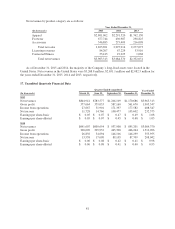

In connection with the Company’s acquisition of MyFitnessPal (see Note 3), the Company acquired $21.1

million in deferred tax assets associated with approximately $89.1 million in federal and state net operating loss

(“NOLs”) carryforwards and $1.4 million in tax credit carryforwards. The acquisition resulted in a “change of

ownership” within the meaning of Section 382 of the Internal Revenue Code, and, as a result, such NOLs are

subject to an annual limitation.

As of December 31, 2015, the Company had $9.9 million in deferred tax assets associated with

approximately $60.4 million in federal and state net operating losses and $1.4 million in tax credit carryforwards

from the acquisition of MyFitnessPal remaining, which will expire beginning 2033 through 2035. Based upon the

historical taxable income and projections of future taxable income over periods in which these NOLs will be

deductible, the Company believes that it is more likely than not that the Company will be able to fully utilize

these NOLs before the carry-forward periods expire beginning 2033 through 2035, and therefore a valuation

allowance is not required.

As of December 31, 2015, the Company had $19.6 million in deferred tax assets associated with

approximately $75.3 million in foreign net operating loss carryforwards, which will expire beginning 2017

through 2021. As of December 31, 2015, the Company believes certain deferred tax assets associated with

foreign net operating loss carryforwards will expire unused based on the Company’s projections. Therefore, a

valuation allowance of $6.8 million was recorded against the Company’s net deferred tax assets in 2015.

73