Under Armour 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

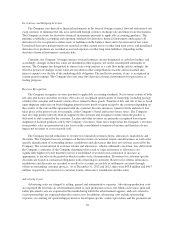

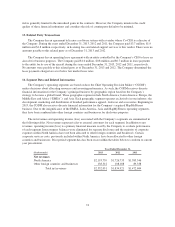

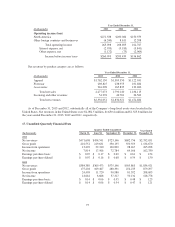

10. Provision for Income Taxes

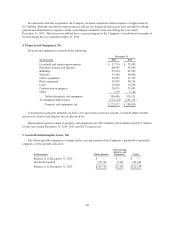

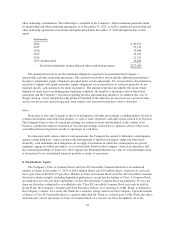

Income before income taxes is as follows:

Year Ended December 31,

(In thousands) 2013 2012 2011

Income before income taxes:

United States $196,558 $155,514 $122,774

Foreign 64,435 47,925 34,088

Total $260,993 $203,439 $156,862

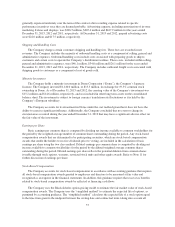

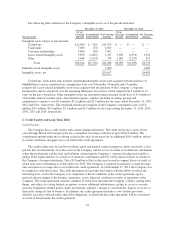

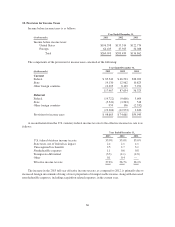

The components of the provision for income taxes consisted of the following:

Year Ended December 31,

(In thousands) 2013 2012 2011

Current

Federal $ 85,542 $ 66,533 $38,209

State 19,130 12,962 10,823

Other foreign countries 13,295 8,139 7,291

117,967 87,634 56,323

Deferred

Federal (14,722) (9,606) 5,604

State (5,541) (3,563) 548

Other foreign countries 959 196 (2,532)

(19,304) (12,973) 3,620

Provision for income taxes $ 98,663 $ 74,661 $59,943

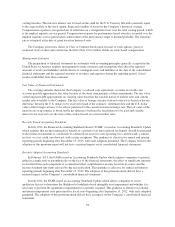

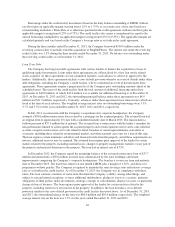

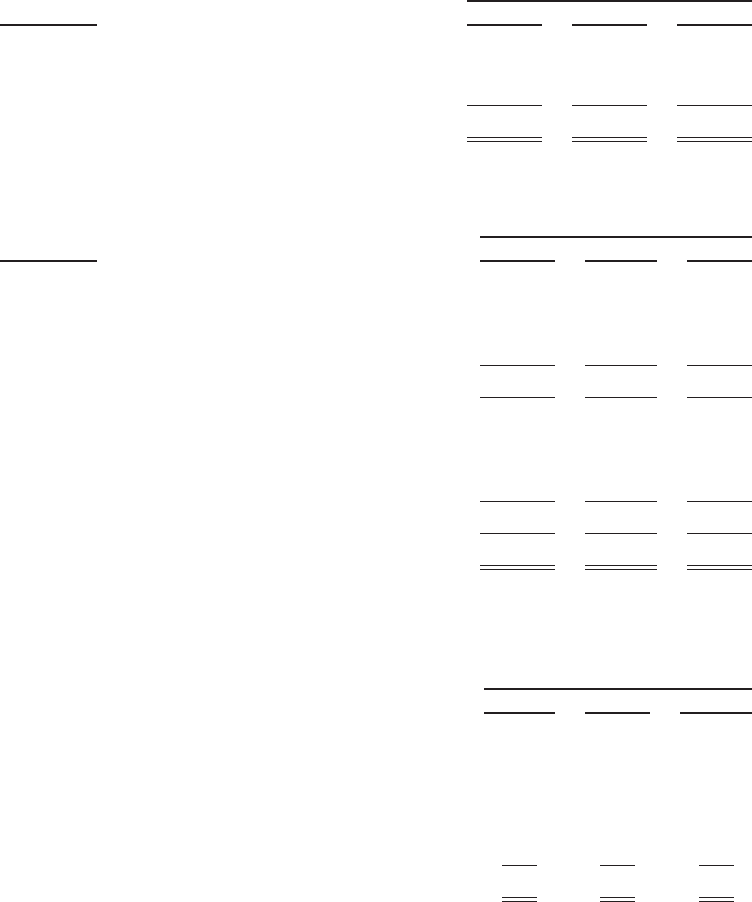

A reconciliation from the U.S. statutory federal income tax rate to the effective income tax rate is as

follows:

Year Ended December 31,

2013 2012 2011

U.S. federal statutory income tax rate 35.0% 35.0% 35.0%

State taxes, net of federal tax impact 2.4 2.1 4.1

Unrecognized tax benefits 2.5 2.7 3.1

Nondeductible expenses 1.1 0.6 0.8

Foreign rate differential (3.3) (4.1) (4.8)

Other 0.1 0.4 —

Effective income tax rate 37.8% 36.7% 38.2%

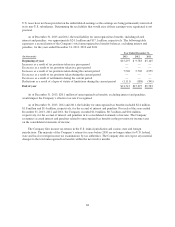

The increase in the 2013 full year effective income tax rate, as compared to 2012, is primarily due to

increased foreign investments driving a lower proportion of foreign taxable income, along with increased

non-deductible expenses, including acquisition related expenses, in the current year.

66