Under Armour 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The Company capitalizes the cost of interest for long term property and equipment projects based on the

Company’s weighted average borrowing rates in place while the projects are in progress. Capitalized interest was

$0.4 million and $0.5 million as of December 31, 2013 and 2012, respectively.

Upon retirement or disposition of property and equipment, the cost and accumulated depreciation are

removed from the accounts and any resulting gain or loss is reflected in selling, general and administrative

expenses for that period. Major additions and betterments are capitalized to the asset accounts while maintenance

and repairs, which do not improve or extend the lives of assets, are expensed as incurred.

Goodwill, Intangible Assets and Long-Lived Assets

Goodwill and intangible assets are recorded at their estimated fair values at the date of acquisition and are

allocated to the reporting units that are expected to receive the related benefits. Goodwill and indefinite lived

intangible assets are not amortized and are required to be tested for impairment at least annually or sooner

whenever events or changes in circumstances indicate that the assets may be impaired. In conducting an annual

impairment test, the Company first reviews qualitative factors to determine whether it is more likely than not that

the fair value of the reporting unit is less than its carrying amount. If factors indicate that is the case, the

Company performs a quantitative assessment over relevant reporting units, analyzing the expected present value

of future cash flows and quantifies the amount of impairment, if any. The Company performs its annual

impairment tests in the fourth quarter of each fiscal year.

The Company continually evaluates whether events and circumstances have occurred that indicate the

remaining estimated useful life of long-lived assets may warrant revision or that the remaining balance may not

be recoverable. These factors may include a significant deterioration of operating results, changes in business

plans, or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible

impairment, the Company reviews long-lived assets to assess recoverability from future operations using

undiscounted cash flows. If future undiscounted cash flows are less than the carrying value, an impairment is

recognized in earnings to the extent that the carrying value exceeds fair value.

No material impairments were recorded related to goodwill, intangible assets or long-lived assets during the

years ended December 31, 2013, 2012 and 2011.

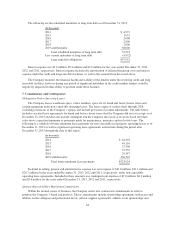

Accrued Expenses

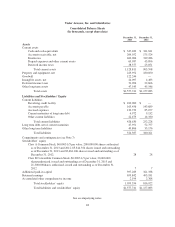

At December 31, 2013, accrued expenses primarily included $56.7 million and $11.9 million of accrued

compensation and benefits and marketing expenses, respectively. At December 31, 2012, accrued expenses

primarily included $37.9 million and $13.6 million of accrued compensation and benefits and marketing

expenses, respectively.

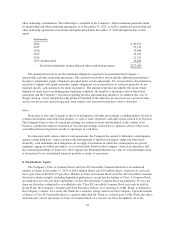

Foreign Currency Translation and Transactions

The functional currency for each of the Company’s wholly owned foreign subsidiaries is generally the

applicable local currency. The translation of foreign currencies into U.S. dollars is performed for assets and

liabilities using current foreign currency exchange rates in effect at the balance sheet date and for revenue and

expense accounts using average foreign currency exchange rates during the period. Capital accounts are

translated at historical foreign currency exchange rates. Translation gains and losses are included in stockholders’

equity as a component of accumulated other comprehensive income. Adjustments that arise from foreign

currency exchange rate changes on transactions, primarily driven by intercompany transactions, denominated in a

currency other than the functional currency are included in other expense, net on the consolidated statements of

income.

55