Under Armour 2013 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2013 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The information contained in this section should be read in conjunction with our Consolidated Financial

Statements and related notes and the information contained elsewhere in this Form 10-K under the captions

“Risk Factors,” “Selected Financial Data,” and “Business.”

Overview

We are a leading developer, marketer and distributor of branded performance apparel, footwear and

accessories. The brand’s moisture-wicking fabrications are engineered in many different designs and styles for

wear in nearly every climate to provide a performance alternative to traditional products. Our products are sold

worldwide and worn by athletes at all levels, from youth to professional, on playing fields around the globe, as

well as by consumers with active lifestyles.

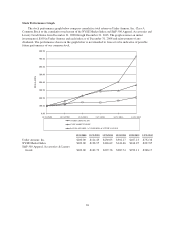

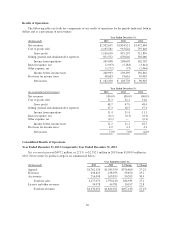

Our net revenues grew to $2,332.1 million in 2013 from $856.4 million in 2009. We believe that our growth

in net revenues has been driven by a growing interest in performance products and the strength of the Under

Armour brand in the marketplace. We plan to continue to increase our net revenues over the long term by

increased sales of our apparel, footwear and accessories, expansion of our wholesale distribution sales channel,

growth in our direct to consumer sales channel and expansion in international markets. Our direct to consumer

sales channel includes our brand and factory house stores and websites. New offerings for 2013 include UA

COLDGEAR®Infrared and UA HEATGEAR®Sonic apparel, UA SpeedFormTM and UA SpineTM Venom

running footwear, and the ARMOUR39TM performance monitoring and tracking system.

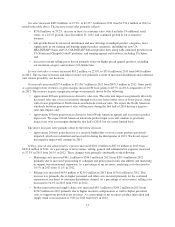

A large majority of our products are sold in North America; however, we believe our products appeal to

athletes and consumers with active lifestyles around the globe. Internationally, our net revenues are generated

from a mix of wholesale sales to retailers, sales to distributors and sales through our direct to consumer sales

channels in over fifteen countries in Europe, Latin America, and Asia. In addition, a third party licensee sells our

products in Japan and Korea. We hold a minority investment in our licensee in Japan.

Our operating segments include North America; Latin America; Europe, the Middle East and Africa

(“EMEA”); Asia; and MapMyFitness. Due to the insignificance of the EMEA, Latin America, Asia and

MapMyFitness operating segments, they have been combined into other foreign countries and businesses for

disclosure purposes.

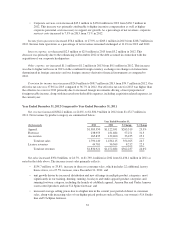

We believe there is an increasing recognition of the health benefits of an active lifestyle. We believe this

trend provides us with an expanding consumer base for our products. We also believe there is a continuing shift

in consumer demand from traditional non-performance products to performance products, which are intended to

provide better performance by wicking perspiration away from the skin, helping to regulate body temperature

and enhancing comfort. We believe that these shifts in consumer preferences and lifestyles are not unique to the

United States, but are occurring in a number of markets globally, thereby increasing our opportunities to

introduce our performance products to new consumers. We plan to continue to grow our business over the long

term through increased sales of our apparel, footwear and accessories, expansion of our wholesale distribution,

growth in our direct to consumer sales channel and expansion in international markets.

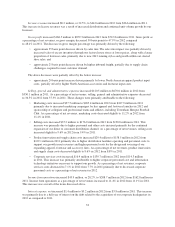

Although we believe these trends will facilitate our growth, we also face potential challenges that could

limit our ability to take advantage of these opportunities, including, among others, the risk of general economic

or market conditions that could affect consumer spending and the financial health of our retail customers. In

addition, we may not be able to effectively manage our growth and a more complex global business. We may not

consistently be able to anticipate consumer preferences and develop new and innovative products that meet

changing preferences in a timely manner. Furthermore, our industry is very competitive, and competition

pressures could cause us to reduce the prices of our products or otherwise affect our profitability. We also rely on

28