Under Armour 2013 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2013 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

pledge our assets as a security, guaranty obligations of third parties, make investments, undergo a merger or

consolidation, dispose of assets, or materially change our line of business. The loan requires prior approval of the

lender for certain matters related to the property, including transfers of any interest in the property. In addition,

the loan includes a cross default provision similar to the cross default provision in the credit facility discussed

above. As of December 31, 2013 and 2012, the outstanding balance on the loan was $48.0 million and $50.0

million, respectively. The weighted average interest rate on the loan was 1.7% for the years ended December 31,

2013 and 2012.

We monitor the financial health and stability of the lenders under the revolving credit and long term debt

facilities, however during any period of significant instability in the credit markets lenders could be negatively

impacted in their ability to perform under these facilities.

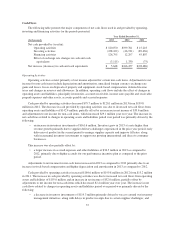

Acquisitions

MapMyFitness

On December 6, 2013, we acquired 100% of the outstanding equity of MapMyFitness, Inc., a digital

connected fitness platform, for $150.0 million in cash, subject to adjustment for final working capital. The

purchase price was financed through $100.0 million in debt under our existing revolving credit facility and cash

on hand. Through this acquisition, we expect to engage and grow the acquired connected fitness community,

while also increasing awareness and sales of our existing product offerings through our North American

wholesale and direct to consumer channels.

Corporate Headquarters

In July 2011, we acquired approximately 400 thousand square feet of office space comprising our corporate

headquarters for $60.5 million. The acquisition included land, buildings, tenant improvements and third party

lease-related intangible assets. As of December 31, 2013, 116 thousand square feet of the 400 thousand square

feet acquired was leased to third party tenants with remaining lease terms ranging from 1 month to 12.5 years.

We intend to occupy additional space as it becomes available.

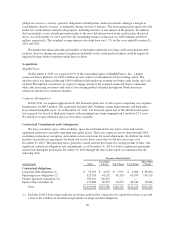

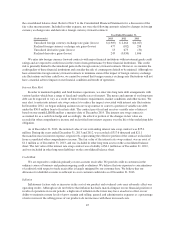

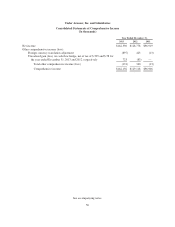

Contractual Commitments and Contingencies

We lease warehouse space, office facilities, space for our brand and factory house stores and certain

equipment under non-cancelable operating and capital leases. The leases expire at various dates through 2028,

excluding extensions at our option, and contain various provisions for rental adjustments. In addition, this table

includes executed lease agreements for brand and factory house stores that we did not yet occupy as of

December 31, 2013. The operating leases generally contain renewal provisions for varying periods of time. Our

significant contractual obligations and commitments as of December 31, 2013 as well as significant agreements

entered into during the period after December 31, 2013 through the date of this report are summarized in the

following table:

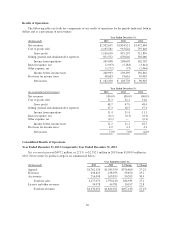

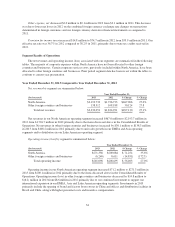

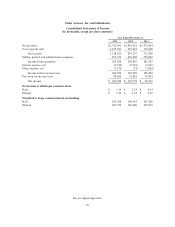

Payments Due by Period

(in thousands) Total

Less Than

1 Year 1 to 3 Years 3 to 5 Years

More Than

5 Years

Contractual obligations

Long term debt obligations (1) $ 52,923 $ 4,972 $ 5,951 $ 4,000 $ 38,000

Operating lease obligations (2) 323,924 44,292 81,424 61,879 136,329

Product purchase obligations (3) 703,447 703,447 — — —

Sponsorships and other (4) 272,689 80,875 94,572 46,546 50,696

Total $1,352,983 $833,586 $181,947 $112,425 $225,025

(1) Excludes $100.0 borrowings under the revolving credit facility, expected to be repaid in less than a year and

a total of $0.1 million of fixed interest payments on long term debt obligations.

40