Under Armour 2013 Annual Report Download

Download and view the complete annual report

Please find the complete 2013 Under Armour annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

Table of contents

-

Page 1

-

Page 2

... THE JING AN KERRY CENTRE IN SHANGHAI, CHINA. CLOCKWISE FROM TOP: RETAIL THEATRE FEATURING A 270-DEGREE SCREEN; THE FIRST VISITORS WEARING THE UA ALTER EGO COLLECTION; MICHAEL PHELPS MEETS WITH THE MEDIA AT THE GRAND OPENING.

UA SPEEDFORM LAUNCH AT HARRODS IN LONDON

CENTRO SANTA FE MEXICO CITY, DF

-

Page 3

.... At our 2013 Investor Day, we laid out the roadmap to double our business by 2016, and with more offices located outside of North America than in, we're building a global infrastructure to be 2X Ready! In 2013, that meant adding two more football teams to our international roster, and introducing...

-

Page 4

... revenue growth in 2013, is the ï¬rst true performance the scoreboard shows our LIMITED EDITION UNDER ARMOUR® ALTER EGO HIGHLIGHT CLEAT running shoe made entirely game plan is working and in a clothing factory and is we are winning. Net revenues surpassed $2.3 billion as a game-changing innovation...

-

Page 5

...ANNUAL GROWTH RATE* 26.3%

* Based on ï¬scal year 2008 net revenues of $725,244

INCOME FROM OPERATIONS $ IN THOUSANDS; YEAR 2009-2013

265,098 +27% 208,695 +28% 162,767 +45% 112,355 85,273 +11% +32%

2009

2010

2011

2012

2013

Kevin A. Plank Chairman of the Board of Directors and Chief Executive...

-

Page 6

...

BUILDING OUR TEAM TO BE THE BEST, WE WORK WITH THE BEST. And make them even better. Whether it's hiring Teammates who are the experts in their ï¬eld or partnering with teams and athletes who have built a legacy of their own, Under Armour competes to win. Period. And the partnerships we formed...

-

Page 7

...Class A Common Stock and 20,000,000 shares of Class B Convertible Common Stock outstanding. DOCUMENTS INCORPORATED BY REFERENCE Portions of Under Armour, Inc.'s Proxy Statement for the Annual Meeting of Stockholders to be held on May 13, 2014 are incorporated by reference in Part III of this Form 10...

-

Page 8

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 9

UNDER ARMOUR, INC. ANNUAL REPORT ON FORM 10-K TABLE OF CONTENTS PART I. Item 1. Business General ...Products ...Marketing and Promotion ...Sales and Distribution ...Seasonality ...Product Design and Development ...Sourcing, Manufacturing and Quality Assurance ...Inventory Management ...Intellectual ...

-

Page 10

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 11

... appearing in this Annual Report on Form 10-K are the property of their respective holders. Products Our product offerings consist of apparel, footwear and accessories for men, women and youth. We market our products at multiple price levels and provide consumers with products that we believe...

-

Page 12

... agreements with our licensees to develop Under Armour apparel and accessories. Our product, marketing and sales teams are actively involved in all steps of the design process in order to maintain brand standards and consistency. During 2013, our licensees offered socks, team uniforms, baby and kids...

-

Page 13

...in game uniforms in connection with our basketball footwear. Internationally, we are providing and selling our products to European soccer and rugby teams. Beginning with the 2012 season, we provide the Tottenham Hotspur Football Club with performance apparel, including training wear and playing kit...

-

Page 14

... house stores in North America. Consumers can purchase our products directly from our e-commerce website, www.underarmour.com. In addition, we earn licensing income in North America based on our licensees' sale of socks, team uniforms, baby and kids' apparel, eyewear and inflatable footballs and...

-

Page 15

... not have direct sales operations. We sell our products in China through a limited number of brand and factory house stores we directly operate and stores operated by our franchise partners, primarily located in Shanghai and Beijing, China. We also distribute our products to our retail customers in...

-

Page 16

... the fall selling season, including our higher priced cold weather products, along with a larger proportion of higher margin direct to consumer sales. The level of our working capital generally reflects the seasonality and growth in our business. We generally expect inventory, accounts payable and...

-

Page 17

...production lead time reduction, and better planning and execution in selling of excess inventory through our factory house stores and other liquidation channels. Our practice, and the general practice in the apparel, footwear and accessory industries, is to offer retail customers the right to return...

-

Page 18

... and marketing of performance products. Many of the fabrics and technology used in manufacturing our products are not unique to us, and we own a limited number of fabric or process patents. Many of our competitors are large apparel and footwear companies with strong worldwide brand recognition and...

-

Page 19

... in general economic or market conditions that could affect consumer spending and the financial health of our retail customers; our ability to effectively manage our growth and a more complex global business; our ability to effectively develop and launch new, innovative and updated products; our...

-

Page 20

... in markets in which we sell our products may materially harm our sales, profitability and financial condition. If the financial condition of our retail customers declines, our financial condition and results of operations could be adversely impacted. We extend credit to our customers based on...

-

Page 21

...and managing an increasing number of employees. In addition, as our business becomes more complex through the introduction of more new products and the expansion of our distribution channels, including additional brand and factory house stores and expanded distribution in malls and department stores...

-

Page 22

... greater financial, distribution, marketing and other resources, longer operating histories, better brand recognition among consumers, more experience in global markets and greater economies of scale. In addition, our competitors have long term relationships with our key retail customers that are...

-

Page 23

... the display and sale of those products. Our inability to compete successfully against our competitors and maintain our gross margin could have a material adverse effect on our business, financial condition and results of operations. Our profitability may decline as a result of increasing pressure...

-

Page 24

...business, potentially resulting in canceled orders by customers, unanticipated inventory accumulation or shortages and reduced net revenues and net income. Our limited operating experience and limited brand recognition in new markets may limit our expansion strategy and cause our business and growth...

-

Page 25

... with all conditions of the revolving credit facility, upon a material adverse change to our business, properties, assets, financial condition or results of operations. In addition, we must maintain a certain leverage ratio and interest coverage ratio as defined in the credit agreement. Failure to...

-

Page 26

... growth and operating plans based on available funding, if any, which would harm our ability to grow our business. Our operating results are subject to seasonal and quarterly variations in our net revenues and income from operations, which could adversely affect the price of our Class A Common Stock...

-

Page 27

... operate our business. Our ability to effectively manage and maintain our inventory and internal reports, and to ship products to customers and invoice them on a timely basis depends significantly on our enterprise resource planning, warehouse management, and other information systems. The...

-

Page 28

... new team members, including senior management, we may not be able to achieve our business objectives. Our growth has largely been the result of significant contributions by our current senior management, product design teams and other key employees. However, to be successful in continuing to grow...

-

Page 29

... our competitors. The intellectual property rights in the technology, fabrics and processes used to manufacture our products are generally owned or controlled by our suppliers and are generally not unique to us. Our ability to obtain patent protection for our products is limited and we currently own...

-

Page 30

... among our customers and our brand image. Our financial results could be adversely impacted by currency exchange rate fluctuations. Although we currently generate a majority of our consolidated net revenues in the United States, as our international business grows, our results of operations could be...

-

Page 31

..., as of December 31, 2013, we leased 127 brand and factory house stores located in the United States, Canada and China with lease end dates in 2014 through 2028. We also lease additional office space for sales, quality assurance and sourcing, marketing, and administrative functions. We anticipate...

-

Page 32

... Officer and President of Product Chief Supply Chain Officer President, International Executive Vice President, Global Marketing Senior Vice President of Sales, North America President, North America

Kevin A. Plank has served as our Chief Executive Officer and Chairman of the Board of Directors...

-

Page 33

... Senior Vice President of Apparel, Outdoor & Accessories from September 2011 to September 2013 and Senior Vice President of Apparel from June 2010 to August 2011. Prior to joining our company, he worked with American Eagle Outfitters as Senior Vice President and Chief Merchandising Officer of The AE...

-

Page 34

... Liquidity" within Management's Discussion and Analysis and Note 6 to the Consolidated Financial Statements for further discussion of our credit facility. Stock Compensation Plans The following table contains certain information regarding our equity compensation plans.

Number of securities remaining...

-

Page 35

... Note 12 to the Consolidated Financial Statements for a further discussion on the warrants. Recent Sales of Unregistered Equity Securities On December 20, 2013, we issued 50.0 thousand shares of Class A Common Stock upon the exercise of previously granted stock options to an employee at an exercise...

-

Page 36

... graph below compares cumulative total return on Under Armour, Inc. Class A Common Stock to the cumulative total return of the NYSE Market Index and S&P 500 Apparel, Accessories and Luxury Goods Index from December 31, 2008 through December 31, 2013. The graph assumes an initial investment of $100...

-

Page 37

... Discussion and Analysis of Financial Condition and Results of Operations" included elsewhere in this Form 10-K.

(In thousands, except per share amounts) 2013 Year Ended December 31, 2012 2011 2010 2009

Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses Income...

-

Page 38

..., footwear and accessories, expansion of our wholesale distribution sales channel, growth in our direct to consumer sales channel and expansion in international markets. Our direct to consumer sales channel includes our brand and factory house stores and websites. New offerings for 2013 include UA...

-

Page 39

...cost of brand and factory house store leases. Product innovation and supply chain costs include our apparel, footwear and accessories product innovation, sourcing and development costs, distribution facility operating costs, and costs relating to our Hong Kong and Guangzhou, China offices which help...

-

Page 40

... forth key components of our results of operations for the periods indicated, both in dollars and as a percentage of net revenues:

(In thousands) 2013 Year Ended December 31, 2012 2011

Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses Income from operations...

-

Page 41

... to higher personnel and other costs incurred primarily for the continued expansion of our direct to consumer distribution channel. As a percentage of net revenues, selling costs increased to 10.3% in 2013 from 9.6% in 2012. Product innovation and supply chain costs increased $50.7 million to $209...

-

Page 42

...apparel, Armour Bra and Under Armour scent control products and our UA Spine footwear; and increased average selling prices due to a higher mix in the current year period of direct to consumer sales, along with increasing sales of our higher priced products such as Fleece, our women's UA Studio line...

-

Page 43

... to higher distribution facilities operating and personnel costs to support our growth in net revenues and higher personnel costs for the design and sourcing of our expanding apparel, footwear and accessory lines. As a percentage of net revenues, product innovation and supply chain costs decreased...

-

Page 44

... our international expansion in our EMEA, Asia and Latin American operating segments. Investments in 2013 primarily include the opening of brand and factory house stores in China and offices and distribution facilities in Brazil and Chile, along with higher personnel costs and incentive compensation...

-

Page 45

... the fall selling season, including our higher priced cold weather products, along with a larger proportion of higher margin direct to consumer sales. The level of our working capital generally reflects the seasonality and growth in our business. We generally expect inventory, accounts payable and...

-

Page 46

...and processes, key areas of focus that we believe will enhance inventory performance are added discipline around the purchasing of product, production lead time reduction, and better planning and execution in selling of excess inventory through our factory house stores and other liquidation channels...

-

Page 47

..., unrealized foreign currency exchange rate gains and losses, losses on disposals of property and equipment, stock-based compensation, deferred income taxes and changes in reserves and allowances. In addition, operating cash flows include the effect of changes in operating assets and liabilities...

-

Page 48

... used in investing activities was primarily related to the purchase of MapMyFitness in December 2013 and increased capital expenditures to improve and expand our offices and distribution facilities, along with brand and factory house openings and expansions in 2013, as compared to 2012. Cash used in...

-

Page 49

...are fixed at the time of each advance. The weighted average interest rates on outstanding borrowings were 3.3%, 3.7% and 3.5% for the years ended December 31, 2013, 2012 and 2011, respectively. In July 2011, in connection with the acquisition of our corporate headquarters, we assumed a $38.6 million...

-

Page 50

... credit facility and cash on hand. Through this acquisition, we expect to engage and grow the acquired connected fitness community, while also increasing awareness and sales of our existing product offerings through our North American wholesale and direct to consumer channels. Corporate Headquarters...

-

Page 51

...the year ended December 31, 2013. (3) We generally place orders with our manufacturers at least three to four months in advance of expected future sales. The amounts listed for product purchase obligations primarily represent our open production purchase orders with our manufacturers for our apparel...

-

Page 52

... from product sales are presented on a net basis on the consolidated statements of income and therefore do not impact net revenues or costs of goods sold. We record reductions to revenue for estimated customer returns, allowances, markdowns and discounts. We base our estimates on historical rates of...

-

Page 53

... probable, which requires management judgment. For example, the achievement of certain operating income targets related to the performance-based restricted stock units granted in 2012 and 2013 were not deemed probable as of December 31, 2013. Additional stock-based compensation of up to $5.6 million...

-

Page 54

operating targets been deemed probable. As a result, if factors change and we use different assumptions, our stock-based compensation expense could be materially different in the future. Refer to Note 2 and Note 12 to the Consolidated Financial Statements for a further discussion on stock-based ...

-

Page 55

... position or results of operations in recent periods, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net revenues if the selling prices of our products do...

-

Page 56

... LLP, an independent registered public accounting firm, as stated in their report which appears herein. /S/ KEVIN A. PLANK

Kevin A. Plank

Chairman of the Board of Directors and Chief Executive Officer Chief Financial Officer

/S/

BRAD DICKERSON

Brad Dickerson

Dated: February 21, 2014

46

-

Page 57

... position of Under Armour, Inc. and its subsidiaries (the "Company") at December 31, 2013 and December 31, 2012, and the results of their operations and their cash flows for each of the three years in the period ended December 31, 2013 in conformity with accounting principles generally accepted in...

-

Page 58

... share data)

December 31, 2013 December 31, 2012

Assets Current assets Cash and cash equivalents Accounts receivable, net Inventories Prepaid expenses and other current assets Deferred income taxes Total current assets Property and equipment, net Goodwill Intangible assets, net Deferred income...

-

Page 59

Under Armour, Inc. and Subsidiaries Consolidated Statements of Income (In thousands, except per share amounts)

2013 Year Ended December 31, 2012 2011

Net revenues Cost of goods sold Gross profit Selling, general and administrative expenses Income from operations Interest expense, net Other expense,...

-

Page 60

Under Armour, Inc. and Subsidiaries Consolidated Statements of Comprehensive Income (In thousands)

Year Ended December 31, 2013 2012 2011

Net income Other comprehensive income (loss): Foreign currency translation adjustment Unrealized gain (loss) on cash flow hedge, net of tax of $ 505 and $ 58 for...

-

Page 61

...Common Stock Paid-In Retained Comprehensive Stockholders' Shares Amount Shares Amount Capital Earnings Income (Loss) Equity

Balance as of December 31, 2010 77,320 $ 26 Exercise of stock options 1,126 - Shares withheld in consideration of employee tax obligations relative to stock-based compensation...

-

Page 62

... foreign currency exchange rate (gains) losses Loss on disposal of property and equipment Stock-based compensation Gain on bargain purchase of corporate headquarters (excludes transaction costs of $1.9 million) Deferred income taxes Changes in reserves and allowances Changes in operating assets and...

-

Page 63

... Audited Consolidated Financial Statements 1. Description of the Business Under Armour, Inc. is a developer, marketer and distributor of branded performance apparel, footwear and accessories. These products are sold worldwide and worn by athletes at all levels, from youth to professional on playing...

-

Page 64

... rate. The Company recognizes accrued interest and penalties related to unrecognized tax benefits in the provision for income taxes on the consolidated statements of income. Property and Equipment Property and equipment are stated at cost, including the cost of internal labor for software customized...

-

Page 65

... of operating results, changes in business plans, or changes in anticipated cash flows. When factors indicate that an asset should be evaluated for possible impairment, the Company reviews long-lived assets to assess recoverability from future operations using undiscounted cash flows. If...

-

Page 66

... the sale and the agreement with the customer. In some instances, transfer of title and risk of loss takes place at the point of sale, for example, at the Company's brand and factory house stores. The Company may also ship product directly from its supplier to the customer and recognize revenue when...

-

Page 67

... costs associated with preparing goods to ship to customers and certain costs to operate the Company's distribution facilities. These costs, included within selling, general and administrative expenses, were $46.1 million, $34.8 million and $26.1 million for the years ended December 31, 2013, 2012...

-

Page 68

... estimated at the date of grant based on historical rates. The Company issues new shares of Class A Common Stock upon exercise of stock options, grant of restricted stock or share unit conversion. Refer to Note 12 for further details on stock-based compensation. Management Estimates The preparation...

-

Page 69

... awareness and sales of the Company's existing product offerings through our North American wholesale and direct to consumer channels. The acquisition was accounted for as a business combination. The Company allocated the total purchase price to the tangible and intangible assets acquired and...

-

Page 70

... acquisition, the Company incurred acquisition related expenses of approximately $1.9 million. Both the acquisition related expenses and pre-tax bargain purchase gain were included in selling, general and administrative expenses on the consolidated statements of income during the year ended December...

-

Page 71

... base, even if the Company is in compliance with all conditions of the credit agreement, upon a material adverse change to the business, properties, assets, financial condition or results of operations of the Company. The credit agreement contains a number of restrictions that limit the Company...

-

Page 72

... at the time of each advance. The weighted average interest rates on outstanding borrowings were 3.3%, 3.7% and 3.5% for the years ended December 31, 2013, 2012 and 2011, respectively. In July 2011, in connection with the Company's acquisition of its corporate headquarters, the Company assumed a $38...

-

Page 73

... ended December 31, 2013, 2012 and 2011, respectively. Sponsorships and Other Marketing Commitments Within the normal course of business, the Company enters into contractual commitments in order to promote the Company's brand and products. These commitments include sponsorship agreements with teams...

-

Page 74

... to the sponsorships depends on many factors including general playing conditions, the number of sporting events in which they participate and the Company's decisions regarding product and marketing initiatives. In addition, the costs to design, develop, source and purchase the products furnished to...

-

Page 75

... shares of Class A Common Stock on a one-for-one basis in connection with stock sales. 9. Fair Value Measurements Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date...

-

Page 76

...

The increase in the 2013 full year effective income tax rate, as compared to 2012, is primarily due to increased foreign investments driving a lower proportion of foreign taxable income, along with increased non-deductible expenses, including acquisition related expenses, in the current year.

66

-

Page 77

...the meaning of Section 382 of the Internal Revenue Code, and, as a result, such NOLs are subject to an annual limitation. Based upon the historical taxable income and projections of future taxable income over periods in which these NOLs will be deductible, the Company believes that it is more likely...

-

Page 78

... each of the years ended December 31, 2013, 2012 and 2011, the Company recorded $1.0 million, $0.7 million and $0.4 million, respectively, for the accrual of interest and penalties in its consolidated statements of income. The Company recognizes accrued interest and penalties related to unrecognized...

-

Page 79

... million shares of common stock were outstanding for each of the years ended December 31, 2013, 2012 and 2011, but were excluded from the computation of diluted earnings per share because their effect would be anti-dilutive. 12. Stock-Based Compensation Stock Compensation Plans The Under Armour, Inc...

-

Page 80

... per share amounts) 2013 Weighted Number Average of Stock Exercise Options Price Year Ended December 31, 2012 2011 Weighted Weighted Number Average Number Average of Stock Exercise of Stock Exercise Options Price Options Price

Outstanding, beginning of year Granted, at fair market value Exercised...

-

Page 81

... key employees under the 2005 Plan during the years ended December 31, 2013, 2012 and 2011, respectively. These performance-based restricted stock units have a weighted average fair value of $42.81 and have vesting that is tied to the achievement of certain combined annual operating income targets...

-

Page 82

... million for the years ended December 31, 2013, 2012 and 2011, respectively. Shares of the Company's Class A Common Stock are not an investment option in this plan. In addition, the Company offers the Under Armour, Inc. Deferred Compensation Plan which allows a select group of management or highly...

-

Page 83

...December 31, 2012, and was included in other long term liabilities on the consolidated balance sheet. The Company enters into derivative contracts with major financial institutions with investment grade credit ratings and is exposed to credit losses in the event of non-performance by these financial...

-

Page 84

... the years ended December 31, 2013, 2012 and 2011, respectively. No amounts were payable to this related party as of December 31, 2013 and 2012. The Company determined the lease payments charged are at or below fair market lease rates. 16. Segment Data and Related Information The Company's operating...

-

Page 85

...

$150,559 12,208 162,767 (3,841) (2,064) $156,862

Net revenues by product category are as follows:

(In thousands) 2013 Year Ended December 31, 2012 2011

Apparel Footwear Accessories Total net sales Licensing and other revenues Total net revenues

$1,762,150 298,825 216,098 2,277,073 54,978 $2,332...

-

Page 86

... Compensation In February 2014, 0.4 million performance-based restricted stock units were awarded to certain officers and key employees under the 2005 Plan. The performance-based restricted stock units have vesting that is tied to the achievement of certain combined annual operating income targets...

-

Page 87

... in ensuring that information required to be disclosed in our Exchange Act reports is (1) recorded, processed, summarized and reported in a timely manner and (2) accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial Officer, as appropriate to...

-

Page 88

... Also refer to Item 5 "Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities." ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE The information required by this Item is incorporated by reference herein from the...

-

Page 89

... Income for the Years Ended December 31, 2013, 2012 and 2011 Consolidated Statements of Comprehensive Income for the Years Ended December 31, 2013, 2012 and 2011 Consolidated Statements of Stockholders' Equity for the Years Ended December 31, 2013, 2012 and 2011 Consolidated Statements of Cash Flows...

-

Page 90

... Form 10-K for the year ended December 31, 2012.

Exhibit No.

2.01

Agreement and Plan of Merger, dated as of November 8, 2013, among Under Armour, Inc., MMF Merger Sub, Inc., MapMyFitness, Inc. and Fortis Advisors LLC (incorporated by reference to Exhibit 2.1 of the Company's Current Report on Form...

-

Page 91

... 10.15 of the Company's 2012 Form 10-K).* Under Armour, Inc. 2013 Non-Employee Director Compensation Plan (incorporated by reference to Exhibit 10.01 of the Company's Form 10-Q for the quarterly period ended March 31, 2013), Form of Initial Restricted Stock Unit Grant (incorporated by reference to...

-

Page 92

... duly authorized. UNDER ARMOUR, INC. By: /s/ KEVIN A. PLANK Kevin A. Plank Chairman of the Board of Directors and Chief Executive Officer Dated: February 21, 2014 Pursuant to the requirements of the Securities Act of 1934, this report has been signed below by the following persons on behalf of the...

-

Page 93

...to Costs and Expenses Write-Offs Net of Recoveries Balance at End of Year

Description

Allowance for doubtful accounts For the year ended December 31, 2013 For the year ended December 31, 2012 For the year ended December 31, 2011 Sales returns and allowances For the year ended December 31, 2013 For...

-

Page 94

[THIS PAGE INTENTIONALLY LEFT BLANK]

-

Page 95

... OF THE NEXT GENERATION. They are at the core of our brand vision and are the backbone of our growth...unprecedented growth, actually. In 2013, our youth business doubled the growth rate we saw in Men's and Women's apparel, gaining momentum in apparel, footwear, and accessories. Why? Because WILL...

-

Page 96

... willingly, each day, and this year has been 365-days of never-back-down progress. We opened our doors to inventors everywhere during the 2013 Future Show, opened our minds by reinventing the zipper using a magnet, proved that WILLpower™ can be measured with the Armour39® Performance Monitor, and...

-

Page 97

MAPPING OUT THE FUTURE GETTING BETTER MEANS WORKING SMARTER. And with our ï¬rst acquisition in MapMyFitness, that's exactly what we plan to do. But, this isn't just about going digital - this is about changing the game...AGAIN.

-

Page 98

...'s one of our pinnacle innovations of 2013, a Runner's World Best Debut product, and the launchpad for our growth in the category. Our commitment to redeï¬ning Footwear represents our tenacity as a brand and our goals as a business. From the UA Micro G® Anatomix Basketball Shoe to the UA Highlight...

-

Page 99

... W. DEERING FOR FORMER CHIEF EXECUTIVE OFFICER & CHAIRMAN OF THE TH BOARD OF DIRECTORS, THE ROUSE COMPANY A.B. KRONGARD FORMER CHIEF EXECUTIVE OFFICER & CHAIRMAN OF THE BOARD OF DIRECTORS, ALEX.BROWN, INCORPORATED WILLIAM R. MCDERMOTT CO-CHIEF EXECUTIVE OFFICER & EXECUTIVE BOARD MEMBER, SAP AG ERIC...

-

Page 100

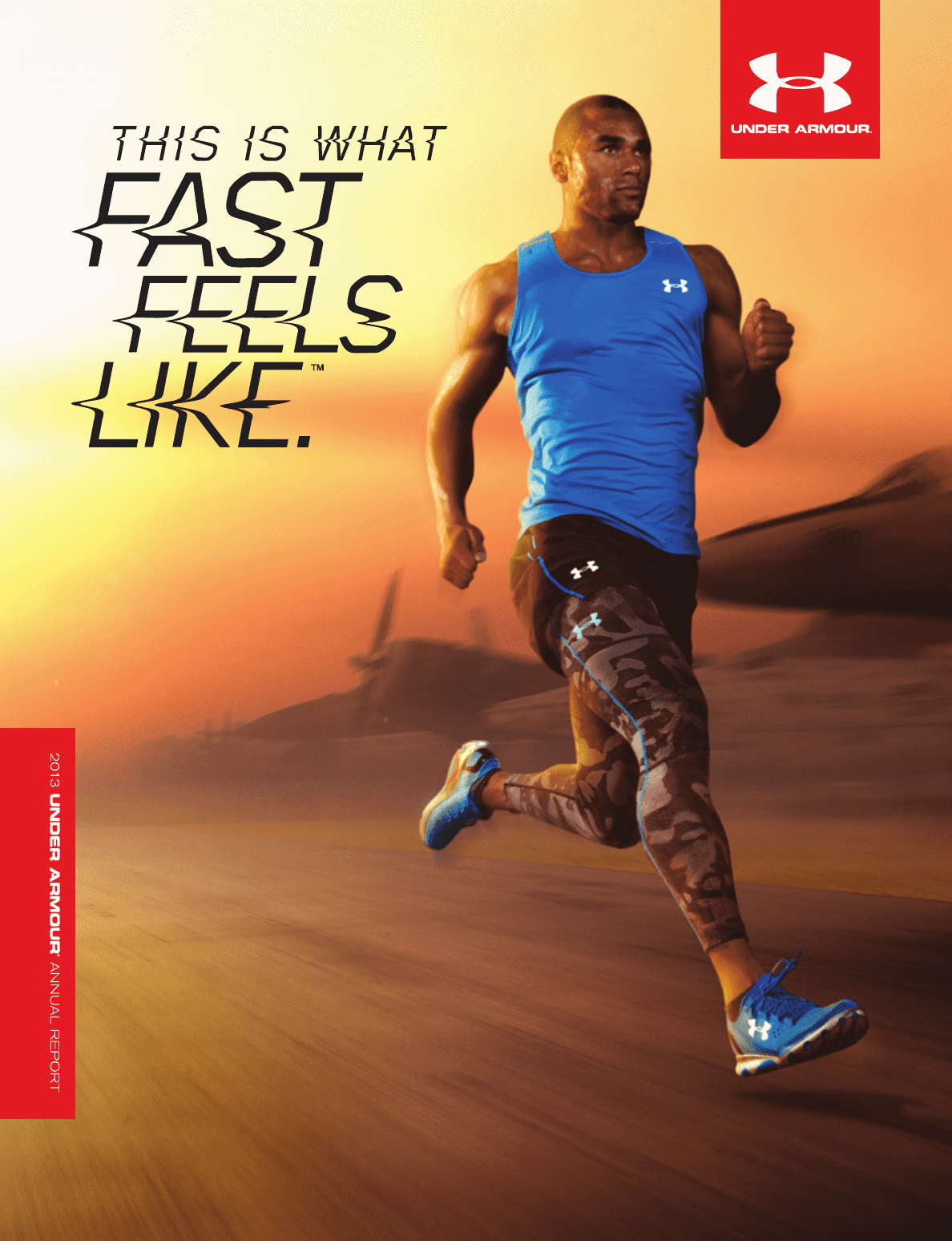

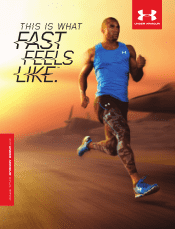

INTRODUCING THE UA SPEEDFORMâ„¢ APOLLO. THE FIRST TRUE PERFORMANCE RUNNING SHOE MADE COMPLETELY IN A CLOTHING FACTORY.