TCF Bank 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

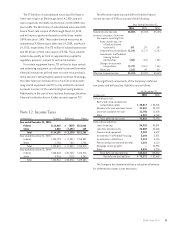

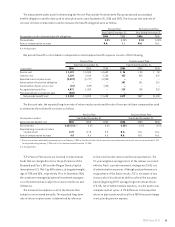

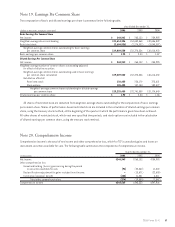

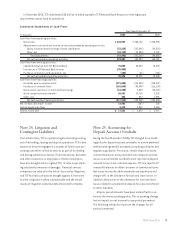

The discount rate used to determine TCF’s pension and

postretirement benefit obligations as of December 31,

2006 and December 31, 2005 was determined by matching

estimated benefit cash flows to a yield curve derived from

corporate bonds rated AA by Moody’s. Bonds containing

call or put provisions were excluded. The average estimated

duration of TCF’s Pension and Postretirement Plans varied

between seven and eight years. In prior years, the discount

rate was determined based on the Moody’s AA and Citigroup

Pension Liability long-term bond indexes.

The actual return on plan assets, net of administrative

expenses was 8.5% for 2006 and 11.5% for 2005. In 2005,

the actuarial loss decreased by $1.7 million due to the

11.5% rate of return on plan assets. In 2006, the amendment

to discontinue compensation credits effective April 1, 2006

decreased the actuarial loss by $6.5 million, net of an

increase due to the vesting of all participants. The increase

in the discount rate from 5.25% at December 31, 2005 to 5.5%

at December 31, 2006 decreased the actuarial loss by $926

thousand. The increase in the interest crediting rate from

4.75% at December 31, 2005 to 5.0% at December 31, 2006

increased the actuarial loss by $657 thousand. Various plan

participant census changes increased the actuarial loss by

$3.6 million in 2006. The decrease in the actuarial loss in

2005 was primarily due to the actual return on plan assets

and various plan participant census changes, partially offset

by an increase due to the change in the discount rate

assumption from 6.0% to 5.25%.

For 2006, TCF is eligible to contribute an additional $4.5

million to the Pension Plan until the 2006 federal income

tax return has been filed under various IRS funding methods,

but is not required to make any contributions. TCF currently

has no plans to contribute to the Pension Plan in 2007. TCF

expects to contribute $1 million to the Postretirement Plan

in 2007. TCF contributed $1 million to the Postretirement

Plan in 2006. TCF currently has no plans to pre-fund the

Postretirement Plan in 2007.

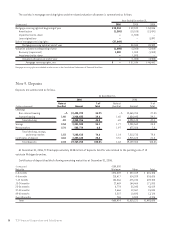

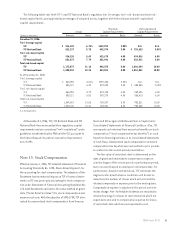

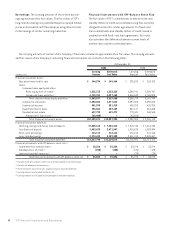

The following are expected future benefit payments used

to determine projected benefit obligations.

Pension Postretirement

(In thousands) Plan Plan

2007 $ 6,994 $ 987

2008 5,234 980

2009 4,836 964

2010 4,795 925

2011 4,463 893

2012-2016 19,724 4,020

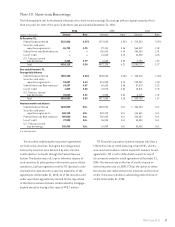

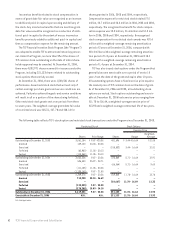

The following table presents assumed health care cost

trend rates for the Postretirement Plan at December 31,

2006 and 2005.

2006 2005

Health care cost trend rate assumed

for next year 7.4% 8.6%

Final health care cost trend rate 5% 5%

Year that final health care trend

rate is reached 2009 2009

Assumed health care cost trend rates have an effect on

the amounts reported for the Postretirement Plan. A one-

percentage-point change in assumed health care cost trend

rates would have the following effects:

1-Percentage-Point

(In thousands) Increase Decrease

Effect on total of service and

interest cost components $ 19 $ (16)

Effect on postretirement

benefits obligations 379 (342)

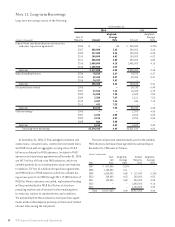

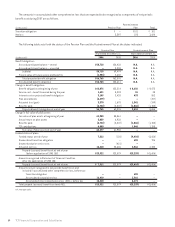

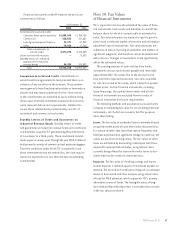

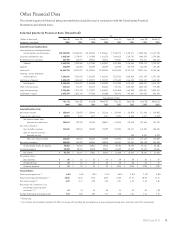

Note 17. Financial Instruments

with Off-Balance Sheet Risk

TCF is a party to financial instruments with off-balance

sheet risk, primarily to meet the financing needs of its cus-

tomers. These financial instruments, which are issued or

held for purposes other than trading, involve elements of

credit and interest-rate risk in excess of the amount recog-

nized in the Consolidated Statements of Financial Condition.

TCF’s exposure to credit loss, in the event of non-

performance by the counterparty to the financial instrument,

for commitments to extend credit and standby letters of

credit is represented by the contractual amount of the

commitments. TCF uses the same credit policies in making

these commitments as it does for making direct loans. TCF

evaluates each customer’s creditworthiness on a case-by-

case basis. The amount of collateral obtained is based on

management’s credit evaluation of the customer.

66 TCF Financial Corporation and Subsidiaries