TCF Bank 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Form10-K

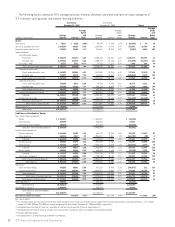

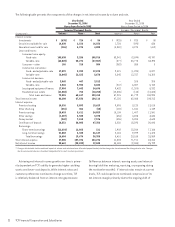

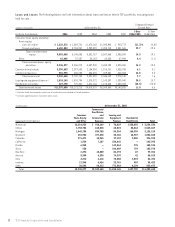

Year Ended Year Ended

December 31, 2005 December 31, 2004 Change

Average

Average Average Yields

Yields Yields and

Average and Average and Average Rates

(Dollars in thousands) Balance Interest(1) Rates Balance Interest(1) Rates Balance Interest(1) (bps)

Assets:

Investments $ 95,349 $ 3,450 3.62% $ 124,833 $ 3,455 2.77% $ (29,484) $ (5) 85

Securities available for sale (2) 1,569,808 81,479 5.19 1,536,673 80,643 5.25 33,135 836 (6)

Education loans held for sale 214,588 10,921 5.09 331,529 11,533 3.48 (116,941) (612) 161

Loans and leases:

Consumer home equity:

Fixed-rate 2,304,340 154,241 6.69 1,509,055 104,494 6.92 795,285 49,747 (23)

Variable-rate 2,450,634 171,133 6.98 2,457,343 137,735 5.61 (6,709) 33,398 137

Consumer – other 34,763 3,213 9.24 39,161 3,210 8.20 (4,398) 3 104

Total consumer home equity and other 4,789,737 328,587 6.86 4,005,559 245,439 6.13 784,178 83,148 73

Commercial real estate:

Fixed- and adjustable-rate 1,385,905 85,214 6.15 1,237,634 77,187 6.24 148,271 8,027 (9)

Variable-rate 826,934 49,561 5.99 771,309 33,259 4.31 55,625 16,302 168

Total commercial real estate 2,212,839 134,775 6.09 2,008,943 110,446 5.50 203,896 24,329 59

Commercial business:

Fixed- and adjustable-rate 85,390 4,959 5.81 85,382 4,754 5.57 8 205 24

Variable-rate 340,314 19,575 5.75 346,411 13,815 3.99 (6,097) 5,760 176

Total commercial business 425,704 24,534 5.76 431,793 18,569 4.30 (6,089) 5,965 146

Leasing and equipment finance 1,423,264 97,596 6.86 1,285,925 89,364 6.95 137,339 8,232 (9)

Subtotal 8,851,544 585,492 6.61 7,732,220 463,818 6.00 1,119,324 121,674 61

Residential real estate 885,735 50,680 5.72 1,104,814 63,360 5.73 (219,079) (12,680) (1)

Total loans and leases(3) 9,737,279 636,172 6.53 8,837,034 527,178 5.97 900,245 108,994 56

Total interest-earning assets 11,617,024 732,022 6.30 10,830,069 622,809 5.75 786,955 109,213 55

Other assets(4) (5) 1,113,850 1,056,903 56,947

Total assets $12,730,874 $11,886,972 $ 843,902

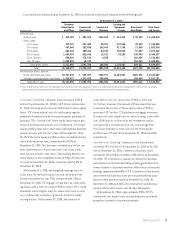

Liabilities and Stockholders’ Equity:

Non-interest bearing deposits:

Retail $ 1,548,027 $ 1,504,392 $ 43,635

Small business 585,860 508,162 77,698

Commercial and custodial 311,497 342,446 (30,949)

Total non-interest bearing deposits 2,445,384 2,355,000 90,384

Interest-bearing deposits:

Premier checking 641,672 15,910 2.48 198,651 2,892 1.46 443,021 13,018 102

Other checking 1,026,017 2,067 .20 1,140,242 928 .08 (114,225) 1,139 12

Subtotal 1,667,689 17,977 1.08 1,338,893 3,820 .29 328,796 14,157 79

Premier savings 427,070 13,246 3.10 85,478 1,705 1.99 341,592 11,541 111

Other savings 1,558,423 9,419 .60 1,738,374 5,785 .33 (179,951) 3,634 27

Subtotal 1,985,493 22,665 1.14 1,823,852 7,490 .41 161,641 15,175 73

Money market 640,576 7,640 1.19 763,925 2,992 .39 (123,349) 4,648 80

Subtotal 4,293,758 48,282 1.12 3,926,670 14,302 .36 367,088 33,980 76

Certificates of deposit 1,740,440 49,124 2.82 1,493,938 28,279 1.89 246,502 20,845 93

Total interest-bearing deposits 6,034,198 97,406 1.61 5,420,608 42,581 .79 613,590 54,825 82

Total deposits 8,479,582 97,406 1.15 7,775,608 42,581 .55 703,974 54,825 60

Borrowings:

Short-term borrowings 917,665 29,830 3.25 809,106 12,664 1.57 108,559 17,166 168

Long-term borrowings 2,038,561 87,096 4.27 1,984,069 75,673 3.81 54,492 11,423 46

Total borrowings 2,956,226 116,926 3.96 2,793,175 88,337 3.16 163,051 28,589 80

Total interest-bearing liabilities 8,990,424 214,332 2.38 8,213,783 130,918 1.59 776,641 83,414 79

Total deposits and borrowings 11,435,808 214,332 1.87 10,568,783 130,918 1.24 867,025 83,414 63

Other liabilities(5) 349,216 374,409 (25,193)

Total liabilities 11,785,024 10,943,192 841,832

Stockholders’ equity(5) 945,850 943,780 2,070

Total liabilities and stockholders’

equity $12,730,874 $11,886,972 $ 843,902

Net interest income and margin $517,690 4.46% $491,891 4.54% $ 25,799 (8)

bps = basis points.

(1) Tax-exempt income was not significant and thus yields on interest-earning assets and net interest margin have not been presented on a tax equivalent basis. Tax-exempt

income of $954,000 and $638,000 was recognized during the years ended December 31, 2005 and 2004, respectively.

(2) Average balance and yield of securities available for sale are based upon the historical amortized cost.

(3) Average balance of loans and leases includes non-accrual loans and leases, and is presented net of unearned income.

(4) Includes operating leases.

(5) Average balance is a simple average of month-end balances.

21