TCF Bank 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2006 Form10-K 53

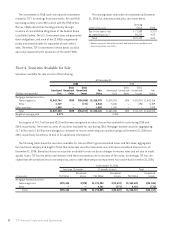

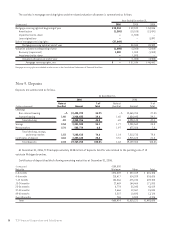

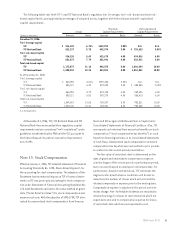

At December 31, 2005

Less than 12 months 12 months or more Total

Unrealized Unrealized Unrealized

(In thousands) Fair Value Losses Fair Value Losses Fair Value Losses

Mortgage-backed securities:

Federal agencies $1,375,282 $(31,250) $64,769 $(2,671) $1,440,051 $(33,921)

Other – – 4,712 (196) 4,712 (196)

Total $1,375,282 $(31,250) $69,481 $(2,867) $1,444,763 $(34,117)

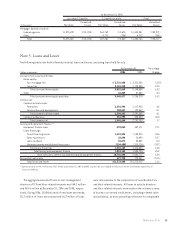

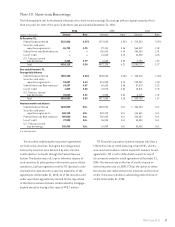

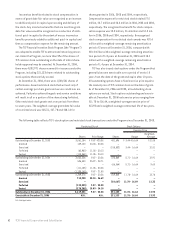

Note 5. Loans and Leases

The following table sets forth information about loans and leases, excluding loans held for sale.

At December 31, Percentage

(Dollars in thousands) 2006 2005 Change

Consumer home equity and other:

Home equity:

First mortgage lien $ 3,781,458 $ 3,375,380 12.0%

Junior lien 2,101,210 1,773,308 18.5

Total consumer home equity 5,882,668 5,148,688 14.3

Other 62,409 57,587 8.4

Total consumer home equity and other 5,945,077 5,206,275 14.2

Commercial:

Commercial real estate:

Permanent 2,201,996 2,117,953 4.0

Construction and development 188,657 179,547 5.1

Total commercial real estate 2,390,653 2,297,500 4.1

Commercial business 551,995 435,203 26.8

Total commercial 2,942,648 2,732,703 7.7

Leasing and equipment finance:(1)

Equipment finance loans 492,062 387,171 27.1

Lease financings:

Direct financing leases 1,423,226 1,180,370 20.6

Sales-type leases 22,694 18,495 22.7

Lease residuals 34,671 32,882 5.4

Unearned income and deferred lease costs (154,488) (115,124) (34.2)

Total lease financings 1,326,103 1,116,623 18.8

Total leasing and equipment finance 1,818,165 1,503,794 20.9

Total consumer, commercial and leasing and equipment finance 10,705,890 9,442,772 13.4

Residential real estate 627,790 770,441 (18.5)

Total loans and leases $11,333,680 $10,213,213 11.0

(1) Operating leases of $80.4 million and $56.7 million at December 31, 2006 and 2005, respectively, are included in Other Assets on the Consolidated Statements of

Financial Condition.

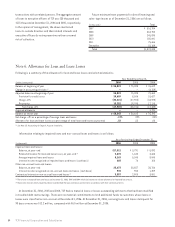

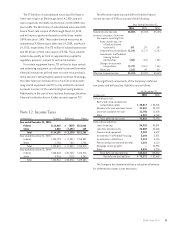

The aggregate amount of loans to non-management

directors of TCF and their related interests was $44.1 million

and $55.5 million at December 31, 2006 and 2005, respec-

tively. During 2006, $105 thousand of new loans were made,

$5.2 million of loans were repaid and $6.3 million of loans

were removed due to the composition of outside directors

and their related interests. All loans to outside directors

and their related interests were made in the ordinary course

of business on normal credit terms, including interest rates

and collateral, as those prevailing at the time for comparable