TCF Bank 2006 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

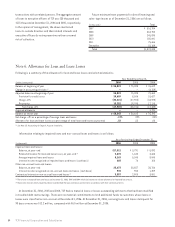

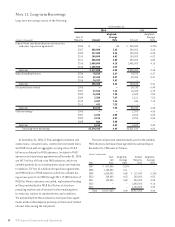

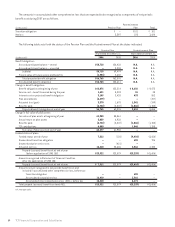

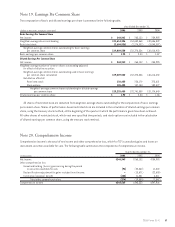

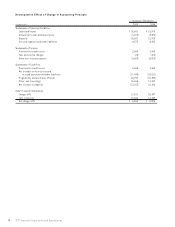

The amounts in accumulated other comprehensive loss that are expected to be recognized as components of net periodic

benefit cost during 2007 are as follows.

Postretirement

(In thousands) Pension Plan Plan Total

Transition obligation $ – $101 $ 101

Net loss 3,397 223 3,620

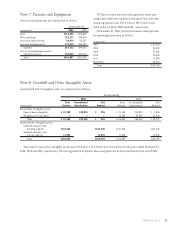

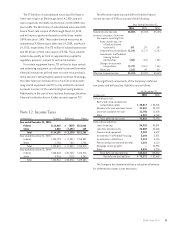

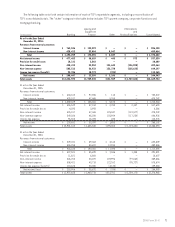

The following table sets forth the status of the Pension Plan and the Postretirement Plan at the dates indicated.

Pension Plan Postretirement Plan

Year Ended December 31, Year Ended December 31,

(In thousands) 2006 2005 2006 2005

Benefit obligation:

Accrued participant balance – vested $58,718 $56,436 N.A. N.A.

Accrued participant balance – unvested –3,038 N.A. N.A.

Subtotal 58,718 59,474 N.A. N.A.

Present value of future service and benefits (1,953) 2,602 N.A. N.A.

Total projected benefit obligation $56,765 $62,076 N.A. N.A.

Accumulated benefit obligation $56,765 $55,611 N.A. N.A.

Change in benefit obligation:

Benefit obligation at beginning of year $62,076 $55,214 $ 8,656 $ 9,675

Service cost – benefits earned during the year 1,421 5,303 26 35

Interest cost on projected benefit obligation 3,109 3,428 433 552

Plan amendments (6,479) – –(207)

Actuarial loss (gain) 3,370 1,678 1,341 (249)

Benefits paid (6,732) (3,547) (1,046) (1,150)

Projected benefit obligation at end of year 56,765 62,076 9,410 8,656

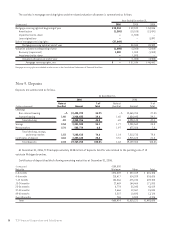

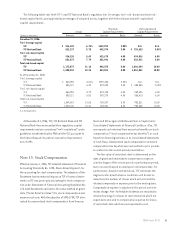

Change in fair value of plan assets:

Fair value of plan assets at beginning of year 61,950 58,561 – –

Actual return on plan assets 5,059 6,936 – –

Benefits paid (6,732) (3,547) (1,046) (1,150)

TCF contributions 4,000 – 1,046 1,150

Fair value of plan assets at end of year 64,277 61,950 – –

Funded status of plans:

Funded status at end of year 7,512 (126) (9,410) (8,656)

Unamortized transition obligation –– 605 706

Unamortized prior service cost –(421) – –

Actuarial net loss 16,410 23,626 3,566 2,344

Prepaid (accrued) benefit cost at end of year

(before application of SFAS 158) $23,922 $23,079 $(5,239) $(5,606)

Amounts recognized in Statement of Financial Condition

after the application of SFAS 158:

Prepaid (accrued) benefit cost at end of year $ 7,512 $23,079 $(9,410) $(5,606)

Amounts not yet recognized in net periodic benefit cost and

included in accumulated other comprehensive loss, before tax:

Transition obligation –– 605 –

Accumulated actuarial net loss 16,410 – 3,566 –

Accumulated other comprehensive loss (AOCL), before tax 16,410 – 4,171 –

Total prepaid (accrued) benefit cost and AOCL $23,922 $23,079 $(5,239) $(5,606)

N.A. Not Applicable.

64 TCF Financial Corporation and Subsidiaries