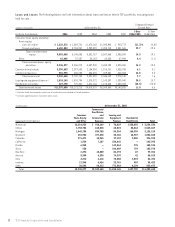

TCF Bank 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

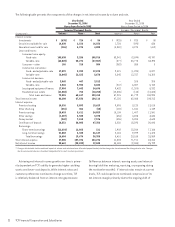

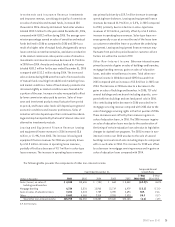

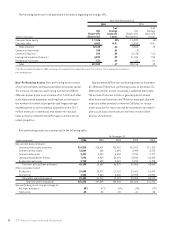

Compensation and Employee Benefits Compensation

and employee benefits, representing 52.7%, 53.8% and 55.8%

of total non-interest expense in 2006, 2005 and 2004, respec-

tively, increased $15.3 million, or 4.7%, in 2006, and $3.7

million, or 1.1%, in 2005. The $12.2 million increase in com-

pensation expense from 2005 was primarily due to a $11.5

million increase in the banking segment of which $6.6 million

was attributable to branch expansion. The 2005 increase in

compensation expense of $1.4 million was primarily due to

continued branch expansion, partially offset by decreases

in mortgage banking and commissions and incentives.

Employee benefits and payroll taxes totaled $55.1 mil-

lion in 2006, up $3.1 million from 2005, primarily due to

an increase of $1.4 million in health care plan expense,

an increase of $849 thousand in payroll tax expense and a

$552 thousand increase in retirement plan expenses. In

2005, employee benefits and payroll expense increased

$2.3 million, primarily due to an increase in retirement ben-

efits expense of $1.9 million and an increase in payroll taxes

of $1.5 million, partially offset by a decrease of $1.8 million

in healthcare plan expenses. See Note 16 of Notes to

Consolidated Financial Statements for further information

on postretirement plans.

Occupancy and Equipment Occupancy and equipment

expenses increased $10.7 million in 2006 and $8.3 million in

2005. These increases were primarily due to costs associated

with branch expansion.

Advertising and Promotions Advertising and promo-

tions expense increased $1.2 million in 2006 following a

decrease of $662 thousand in 2005. The increase in 2006

was primarily due to a $1.4 million increase in promotional

expenses for new customers, partially offset by a $827

thousand decrease in advertising. The decrease in 2005 was

primarily due to a $3.7 million decrease in marketing and

promotions, partially offset by an increase of $2.1 million

in loyalty program expenses.

Operating Lease Depreciation Operating lease

depreciation totaled $14.3 million for 2006, up from $7.3

million and $1.8 million for 2005 and 2004, respectively.

The increase in depreciation was primarily driven by growth

in average operating lease balances.

Other Non-Interest Expense Other non-interest

expense increased $8 million, or 5.6%, in 2006, primarily

driven by a $2.3 million increase in card and internet

processing expenses related to transaction increases and

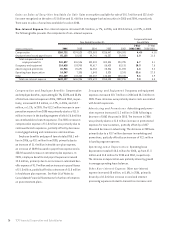

Gains on Sales of Securities Available for Sale Gains on securities available for sale of $10.7 million and $22.6 mil-

lion were recognized on the sales of $1 billion and $1.4 billion in mortgage-backed securities in 2005 and 2004, respectively.

There were no sales of securities available for sale in 2006.

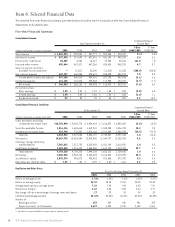

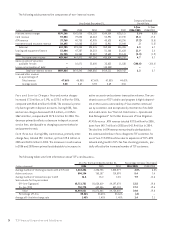

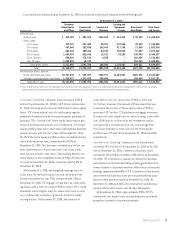

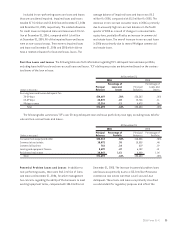

Non-Interest Expense Non-interest expense increased $42.3 million, or 7%, in 2006, and $28.3 million, or 4.9%, in 2005.

The following table presents the components of non-interest expense.

Compound Annual

Year Ended December 31, Growth Rate

1-Year 5-Year

(Dollars in thousands) 2006 2005 2004 2003 2002 2006/2005 2006/2001

Compensation $286,722 $274,523 $273,083 $256,447 $254,341 4.4% 4.1%

Employee benefits and payroll taxes 55,135 52,003 49,741 46,357 39,954 6.0 11.0

Total compensation and

employee benefits 341,857 326,526 322,824 302,804 294,295 4.7 5.1

Occupancy and equipment 114,618 103,900 95,617 88,423 83,131 10.3 7.8

Advertising and promotions 26,926 25,691 26,353 25,536 21,894 4.8 5.2

Operating lease depreciation 14,347 7,335 1,843 3,320 3,241 95.6 27.3

Other 151,449 143,484 132,037 133,342 130,415 5.6 2.9

Total non-interest expense $649,197 $606,936 $578,674 $553,425 $532,976 7.0 5.3

26 TCF Financial Corporation and Subsidiaries