TCF Bank 2006 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Yield Curve

We anticipate the strong headwinds from the inverted

yield curve to continue. We will still have risk in this

area in 2007.

Increased Competition

For a long time, TCF faced limited competition and

owned the “free checking” market. This is no longer

the case as our strategy has been widely copied and

we face intense competition in all aspects of our retail

banking model.

Credit Quality

Economic conditions are always a major risk for all

banks, including TCF. A weaker than anticipated

economy could adversely impact our results through

increased loan and lease charge-offs and higher loss

provisions. Our risk has increased somewhat in this

area due to the soft Michigan economy and a slowing

housing market.

Expense Control

As discussed previously, this remains a focus for 2007.

We intend to continue our efforts in this area.

Income Taxes

Legislative changes in current state and federal tax laws

could negatively impact TCF in the future.

New Products

We intend to introduce several new products in 2007.

The TCF Power CheckingSM product will give consumers

a new and significantly improved interest-bearing

product in between Totally Free Checking (zero interest)

and TCF® Premier Checking (high rate). We believe

we can increase TCF’s market share and grow balances

in this category. We are also working to launch a new

merchant rewards loyalty program mid year. This will

help differentiate TCF’s checking products from the

competition. There are several other new products on

the drawing board.

Regulatory Burden

Changes in industry regulations and the related com-

pliance burden continue to increase. The Bank Secrecy

Act is a good example of this burden. These burdens

increased in 2006 and will continue to grow in 2007.

We must comply with these regulations in a cost-

effective manner.

8TCF Financial Corporation and Subsidiaries

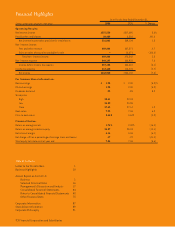

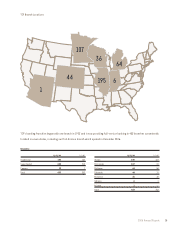

New Branch1 Deposits & Fees

Millions of Dollars

12/0612/0512/0412/0312/02

$980

$442

$238

$142

12/01

1Branches opened since January 1, 2001.

235% annual growth rate (’06 vs. ’05).

330% annual growth rate (’06 vs. ’05).

$24

$1,319

■ Fees & Other Revenue3

■ Total Deposits2

$0

$25

$50

$75

$100

$125