TCF Bank 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TCF Financial Corporation 2006 Annual ReportTCFThe Convenience Franchise

®

Table of contents

-

Page 1

TCF Financial Corporation 2006 Annual Report TCF ® The Convenience Franchise -

Page 2

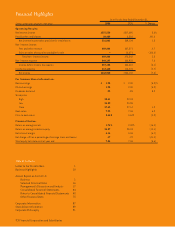

...265,132 3.8% 141.0 1.5 4.7 (100.0) 2.3 7.0 (6.1) (2.7) (7.6) Operating Results: Net interest income Provision for credit losses Net interest income after provision for credit losses Non-interest income: Fees and other revenue Gains on sales of securities available for sale Total non-interest income... -

Page 3

...ï¬cult year for TCF given the interest rate environment. In July 2006, the yield curve inverted (short-term rates exceed long-term rates). This is the most difï¬cult interest rate operating environment for TCF. • TCF's return on average assets (ROA) was 1.74 percent and return on average equity... -

Page 4

...-rate loans. At the same time, depositors took notice of short-term interest rates in excess of ï¬ve percent and began changing their behavior. This resulted in growth of higher interest cost, market-sensitive deposits such as TCF's premier products and certiï¬cates of deposit versus Totally Free... -

Page 5

...progress was made. Fees and service charges increased 2.9 percent in 2006 compared to a 4.5 percent decline in 2005. Checking account customers continued to change their banking behavior by writing fewer checks, using their debit card more frequently to replace check and cash transactions, and doing... -

Page 6

...products totaled $2.1 billion at year-end and increased $516 million in 2006. During 2006, TCF's non-interest bearing average deposits declined by $89.6 million. The decline resulted from customers maintaining slightly lower balances in their accounts, as well as the sale of TCF's mortgage servicing... -

Page 7

... accounts, deposits and consumer loans. Increased incremental operating costs (largely increased occupancy costs) are usually quickly repaid through increased revenues resulting from improved customer growth. These capital expenditures produce a high internal rate of return. The sale of real estate... -

Page 8

... origination activity and improve productivity in 2007. • Outsourcing of TCF's investment and insurance backroom operations. • Review and consolidation of TCF's retail branch backroom operations in early 2007. • Sale of TCF Mortgage Corporation's third-party servicing rights and outsourcing... -

Page 9

...our team has the tools required to support this fast-growing business. We need to continue to execute on our unique marketing and sales strategies to achieve our goals. Colorado Our rapid expansion in Colorado will slow down by design. We currently have 44 branches in Colorado. We plan to open four... -

Page 10

... give consumers a new and signiï¬cantly improved interest-bearing product in between Totally Free Checking (zero interest) and TCF® Premier Checking (high rate). We believe we can increase TCF's market share and grow balances in this category. We are also working to launch a new merchant rewards... -

Page 11

.../04 12/05 12/06 Consumer Home Equity Lending Millions of Dollars In Closing A careful reading of this annual report will tell you almost everything about our company. We try to keep our ï¬nancial reporting simple and our disclosures complete. We continue to have a mutuality of interest with our... -

Page 12

... consolidating, remodeling and relocating some of its existing branches to improve the customer experience and we have seen profitable results from these changes. Initiatives like these will continue in the future. Campus banking at TCF has become a convenient service for the University of Minnesota... -

Page 13

...banking services, which provide expanded account histories and the ability to download transaction detail into financial software applications. TCF's products and services help small business owners manage their businesses. In 2006, TCF introduced Express Check Conversion and Express Remote Deposit... -

Page 14

... teams are responsible for business development, customer relations and community involvement within their bank. TCF also believes functional product line management benefits from a centralized approach. Centralized functional management, with support and direction from specific bank presidents... -

Page 15

...large number of these accounts through convenient services and products targeted to a broad range of customers. TCF was one of the first banks in the country to introduce Totally Free Checking to its and its hard working, well-trained and properly compensated staff. In 2006, TCF increased its loans... -

Page 16

We are Open 7 Days a week to ensure our customers can bank when it is convenient for them. SM Both TCF Equipment Finance and Winthrop Resources Corporation had an exceptional year in loan and lease originations and growth. The leasing and equipment finance portfolio increased $339 million, or 22 ... -

Page 17

... full-service banking in 453 branches conveniently located in seven states, including our first Arizona branch which opened in December 2006. Branches: 12/31/06 1/1/01 12/31/06 1/1/01 Traditional Supermarket Campus Total 196 244 13 453 132 213 7 352 Illinois Minnesota Michigan Colorado Wisconsin... -

Page 18

... for a new stadium. "TCF Bank Stadiumâ„¢" adds to a long-running relationship between TCF and the University of Minnesota. Since 1995, TCF has been the exclusive provider of banking services tied to a campus card - called the U Card - at the University's Twin Cities and Duluth campuses. TCF is also... -

Page 19

... or organization) 41-1591444 (I.R.S. Employer Identification No.) 200 Lake Street East, Mail Code EX0-03-A, Wayzata, Minnesota 55391-1693 (Address of principal executive offices and zip code) Registrant's telephone number, including area code: 612-661-6500 Securities registered pursuant... -

Page 20

... 14. Directors, Executive Officers and Corporate Governance Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions, and Director Independence Principal Accountant Fees and Services 78 78 79... -

Page 21

...is a financial holding company based in Wayzata, Minnesota. Its principal subsidiaries, TCF National Bank and TCF National Bank Arizona, collectively, ("TCF Bank"), are headquartered in Minnesota and Arizona and operate bank branches in Minnesota, Illinois, Michigan, Colorado, Wisconsin, Indiana and... -

Page 22

... rate. TCF's consumer lending activities are primarily home equity real estate secured loans. They also include loans secured by personal property and to a limited extent, unsecured personal loans. Consumer loans may be made on a revolving line of credit or fixed-term basis. Education Lending TCF... -

Page 23

... through the offering of a broad selection of deposit instruments including consumer, small business and commercial demand deposit accounts, interest-bearing checking accounts, money market accounts, regular savings accounts, certificates of deposit and retirement savings plans. 2006 Form 10-K 3 -

Page 24

..., mutual funds, life insurance and broker-assisted securities. Real Estate Investment Trust TCF has a Real Estate Investment Trust ("REIT") and a related foreign operating company ("FOC") that acquire, hold and manage real estate loans and other assets. These companies are consolidated with TCF Bank... -

Page 25

... - Consolidated Financial Condition Analysis - Liquidity Management" and Note 13 and Note 14 of Notes to Consolidated Financial Statements. Regulation of TCF and Affiliates and Insider Transactions TCF Financial is subject to FRB regulations, examinations and reporting requirements relating to bank... -

Page 26

... than those of banking, managing or controlling banks, providing services for its subsidiaries, or conducting activities permitted by the FRB as being closely related to the business of banking. Restrictions on Change in Control Federal and state laws and regulations contain a number of provisions... -

Page 27

... Funds Availability Act and Regulation CC, and the Truth-in-Savings Act and Regulation DD. TCF is also subject to laws and regulations that may impose liability on lenders and owners for cleanup costs and other costs stemming from hazardous waste located on property securing real estate loans... -

Page 28

...Operations - Consolidated Income Statement Analysis - Income Taxes" and Notes 1 and 12 of Notes to Consolidated Financial Statements for additional information regarding TCF's income taxes. Available Information TCF's website, www.tcfbank.com, includes free access to Company news releases, investor... -

Page 29

... which relate to the behavior of interest rates and spreads, changes in product balances, the repricing characteristics of products, and the behavior of loan and deposit customers in different rate environments. The simulation analysis does not necessarily take into account actions management may... -

Page 30

... the Liquidity Management Policy, the Treasurer reviews current and forecasted funding needs for the Company and periodically reviews market conditions for issuing debt securities to wholesale investors. Key liquidity ratios and the amount available from alternative funding sources are reported to... -

Page 31

... customer behavior and adjusts policies and marketing efforts accordingly to attract new and retain existing checking account customers. New Branch Expansion Opening new branches is an integral part of TCF's growth strategy for generating new customers, deposit accounts and loans and the related... -

Page 32

... of operations, and financial condition. The financial services industry is extensively regulated. Federal and state laws and regulations are designed primarily to protect the deposit insurance funds and consumers, and not necessarily to benefit a financial company's shareholders. These laws and... -

Page 33

... of its lending, leasing and deposit operations. TCF is and expects to become engaged in a number of foreclosure proceedings and other collection actions as part of its lending and leasing collection activities. From time to time, borrowers and other customers, or employees or former employees have... -

Page 34

... depend on circumstances existing at the time, including TCF's earnings, financial condition and capital requirements, the cash available to pay such dividends (derived mainly from dividends and distributions from TCF Bank), as well as regulatory and contractual limitations and such other factors as... -

Page 35

... Corporation. Five of the companies, which were in the 2005 TCF Peer Group are not in the 2006 TCF Peer Group due to merger and acquisition activity or changes in asset size. Those five companies are: Independence Community Bank Corp.; Westcorp; FirstFed Financial Corp.; Whitney Holding Corporation... -

Page 36

... 5-Year 2006/2005 2006/2001 13.4% 10.2 (18.5) 1.0 9.6 1.0 29.7 7.0 20.3 3.5 6.2 14.2% 2.8 (25.5) (10.8) 5.2 8.8 1.4 6.6 3.5 2.4 5.9 Loans and leases excluding residential real estate loans Securities available for sale Residential real estate loans Subtotal Total assets Checking, savings and money... -

Page 37

... is to originate high credit quality, primarily secured, loans and leases. Commercial loans are generally made on local properties or to local customers. TCF's largest core lending business is its consumer home equity loan operation, which offers fixed- and variable-rate loans 2006 Form 10-K 17 -

Page 38

...factor in TCF's results of operations. A key driver of non-interest income is its number of checking accounts and the related transaction activity. Increasing fee and service charge revenues has been challenging as a result of slower growth in deposit accounts and changing customer behaviors. TCF is... -

Page 39

Operating Segment Results BANKING, consisting of deposits and investment products, commercial banking, small business banking, consumer lending and treasury services, reported net income of $208.4 million for 2006, down 9.3% from $229.9 million in 2005. Banking net interest income for 2006 was $477... -

Page 40

... Securities available for sale (2) Education loans held for sale Loans and leases: Consumer home equity: Fixed-rate Variable-rate Consumer - other Total consumer home equity and other Commercial real estate: Fixed- and adjustable-rate Variable-rate Total commercial real estate Commercial business... -

Page 41

...2005 Year Ended December 31, 2004 Change Average (Dollars in thousands) Assets: Investments Securities available for sale (2) Education loans held for sale Loans and leases: Consumer home equity: Fixed-rate Variable-rate Consumer - other Total consumer home equity and other Commercial real estate... -

Page 42

... $ (670) Securities available for sale 14,030 Education loans held for sale (186) Loans and leases: Consumer home equity: Fixed-rate 105,630 Variable-rate (62,828) Consumer - other 186 Commercial real estate: Fixed- and adjustable-rate 17,592 Variable-rate (6,845) Commercial business: Fixed- and... -

Page 43

... a flattening yield curve, making fixed-rate loans more attractive to customers, and changes in the funding mix as the majority of deposit growth in 2005 was in higher interest cost products. Provision for Credit Losses TCF provided $20.7 million for credit losses in 2006, compared with $8.6 million... -

Page 44

... declines in fees charged to TCF customers for use of non-TCF ATM machines due to expansion of TCF's ATM network and growth in TCF's fee free checking products, partially offset by the increased number of TCF customers. The following table sets forth information about TCF's card business. (Dollars... -

Page 45

... volumes totaled $188.2 million for the year ended December 31, 2005 compared with $212.2 million during 2004. The increased sales volumes during 2006 were the result of increased sales of mutual funds resulting from additional marketing focus and market conditions. Sales of fixed annuity products... -

Page 46

...in average operating lease balances. Other Non-Interest Expense Other non-interest expense increased $8 million, or 5.6%, in 2006, primarily driven by a $2.3 million increase in card and internet processing expenses related to transaction increases and 26 TCF Financial Corporation and Subsidiaries -

Page 47

...tax returns, clarification of existing state legislation and favorable developments in income tax audits. TCF has a Real Estate Investment Trust ("REIT") and a related foreign operating company ("FOC") that acquire, hold and manage real estate loans and other assets. These companies are consolidated... -

Page 48

...for sale. (Dollars in thousands) At December 31, 2006 2005 2004 2003 2002 Portfolio Distribution: Consumer home equity and other: Home equity: Lines of credit (1) Closed-end loans Total consumer home equity Other Total consumer home equity and other Commercial real estate Commercial business Total... -

Page 49

...business and commercial real estate lending activity generally to borrowers located in its primary markets. With a focus on secured lending, approximately 98% of TCF's commercial real estate and commercial business loans were secured either by properties or other business assets at December 31, 2006... -

Page 50

...02 - - - - 4.23 .76% 2005 Over 30-Day Delinquency Rate as a Percentage of Balance -% 1.32 .68 - - - .07 .44% (Dollars in thousands) Retail services Apartments Office buildings Warehouse/industrial buildings Hotels and motels Health care facilities Other Total Balance $ 574,691 516,970 405,843 307... -

Page 51

... and credit losses, due to diminished collateral value, and may result in lower sales-type revenue at the end of the contractual lease term. See Note 1 to Consolidated Financial Statements-Policies Related to Critical Accounting Estimates for information on lease accounting. At December 31, 2006 and... -

Page 52

... of making comparisons to other banks. Most of TCF's non-performing assets and past due loans and leases are secured by real estate. Given the nature of these assets and the related mortgage foreclosure, property sale and, if applicable, mortgage insurance claims processes, it can take 18 months or... -

Page 53

... information detailing the allowance for loan and lease losses. (In thousands) Balance at beginning of year Change in accounting principle (1) Adjusted balance at beginning of year Charge-offs: Consumer home equity Consumer other Total consumer Commercial real estate Commercial business Leasing... -

Page 54

... Loans and Leases .10% N.M. .19 - (.51) 1.50 .01 .29 (Dollars in thousands) Consumer home equity Consumer other Total consumer Commercial real estate Commercial business Leasing and equipment finance (1) Residential real estate Total (1) For the year ended December 31, 2005, net charge-offs... -

Page 55

...% (Dollars in thousands) Consumer home equity and other Commercial real estate Commercial business Leasing and equipment finance Residential real estate Total Principal Balances $34,313 18,072 762 8,499 10,047 $71,693 Potential Problem Loans and Leases In addition to non-performing assets, there... -

Page 56

... credit. TCF Bank's ability to pay dividends or make other capital distributions to TCF is restricted by regulation and may require regulatory approval. Deposits Deposits totaled $9.8 billion at December 31, 2006, up $639.9 million from December 31, 2005. Checking, savings and money market deposits... -

Page 57

... new branches opened during the year: Traditional Supermarket Campus Total Number of new branches at year end: Traditional Supermarket Campus Total Percent of total branches Number of deposit accounts Deposits: Checking Savings Money market Subtotal Certificates of deposit Total deposits Total fees... -

Page 58

... represent future cash requirements. Collateral predominantly consists of residential and commercial real estate. Campus marketing agreements consist of fixed or minimum obligations for exclusive marketing and naming rights with 13 campuses. TCF is obligated to make various annual payments... -

Page 59

...and 14 of Notes to Consolidated Financial Statements. TCF has to a limited extent used stock options as a form of employee compensation in prior years. At December 31, 2006, the number of incentive stock options (fully vested) outstanding was 231,133, or .18%, of total shares outstanding. Summary of... -

Page 60

... deposit account losses (fraudulent checks, etc.) may increase; impact of legal, legislative or other changes affecting customer account charges and fee income; reduced demand for financial services and loan and lease products; adverse developments affecting TCF's supermarket banking relationships... -

Page 61

...information; adverse changes in securities markets; and results of litigation, including reductions in card revenues resulting from litigation brought by various merchants or merchant organizations against Visa; or other significant uncertainties. Investors should consult TCF's Annual Report on Form... -

Page 62

... assets: Loans held for sale Securities available for sale (1) Real estate loans (1) Leasing and equipment finance (1) Commercial loans (1) Consumer loans (1) Investments Total Interest-bearing liabilities: Checking deposits (2) Savings deposits (2) Money market deposits (2) Certificates of deposit... -

Page 63

... consolidated statements of financial condition of TCF Financial Corporation and subsidiaries (the Company) as of December 31, 2006 and 2005, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2006... -

Page 64

... 229,820 Assets Cash and due from banks Investments Securities available for sale Education loans held for sale Loans and leases: Consumer home equity and other Commercial real estate Commercial business Leasing and equipment finance Subtotal Residential real estate Total loans and leases Allowance... -

Page 65

...income: Fees and service charges Card revenue ATM revenue Investments and insurance revenue Subtotal Leasing and equipment finance Other Fees and other revenue Gains on sales of securities available for sale Total non-interest income Non-interest expense: Compensation and employee benefits Occupancy... -

Page 66

Consolidated Statements of Stockholders' Equity (Dollars in thousands) Number of Common Shares Issued Common Stock Additional Paid-in Capital Accumulated Other Comprehensive Retained (Loss)/ Earnings Income Treasury Stock and Other Total Balance, December 31, 2003 Comprehensive income (loss):... -

Page 67

... banks Cash and due from banks at beginning of year Cash and due from banks at end of year Supplemental disclosures of cash flow information: Cash paid for: Interest on deposits and borrowings Income taxes Transfer of loans and leases to other assets See accompanying notes to consolidated financial... -

Page 68

...financial holding company engaged primarily in community banking and leasing and equipment finance through its primary subsidiaries, TCF National Bank and TCF National Bank Arizona, collectively ("TCF Bank"). TCF Bank owns leasing and equipment finance, investment and insurance sales and Real Estate... -

Page 69

...as operating leases. Operating leases represent a rental agreement where ownership of the underlying equipment resides with the lessor. Such leased equipment and related initial direct costs are included in other assets on the balance sheet and are depreciated on a straight-line basis over the term... -

Page 70

..., are reviewed regularly by management and are placed on non-accrual status when the collection of interest or principal is 90 days or more past due (150 days or six payments past due for loans secured by residential real estate), unless the loan or lease is adequately secured and in the process of... -

Page 71

... fees and service charges and a related reserve for uncollectible deposit fees is maintained in other liabilities. Other deposit account losses are reported in other noninterest expense. See Note 25 for additional information concerning deposit account overdrafts. Note 2. Cash and Due from Banks... -

Page 72

... below. (Dollars in thousands) Due in one year or less No stated maturity (1) Total (1) Carrying Value $ 71,859 98,270 $170,129 Yield 5.21% 4.55 4.83 Balance represents Federal Reserve Bank and Federal Home Loan Bank stock, required regulatory investments. Note 4. Securities Available for Sale... -

Page 73

...loans and leases, excluding loans held for sale. (Dollars in thousands) At December 31, 2006 2005 Percentage Change Consumer home equity and other: Home equity: First mortgage lien Junior lien Total consumer home equity Other Total consumer home equity and other Commercial: Commercial real estate... -

Page 74

.... In the opinion of management, the above mentioned loans to outside directors and their related interests and executive officers do not represent more than a normal risk of collection. Future minimum lease payments for direct financing and sales-type leases as of December 31, 2006 are as follows... -

Page 75

... servicing rights Total Unamortizable intangible assets: Goodwill related to the banking segment Goodwill related to the leasing segment Total $141,245 11,354 $152,599 Amortization expense for intangible assets was $2.9 million, $11.8 million and $14.8 million for the years ended December 31, 2006... -

Page 76

... bearing Total checking Savings Money market Total checking, savings, and money market Certificates of deposit Total deposits At December 31, 2006, TCF had approximately $235 million of deposits held for sale related to the pending sale of 10 outstate Michigan branches. Certificates of deposit had... -

Page 77

... 2004 Rate 2.29% 2.38 2.41 3.18 1.92 2.37 Year ended December 31, Average daily balance Federal funds purchased Securities sold under repurchase agreements Federal Home Loan Bank advances Line of credit U.S. Treasury, tax and loan borrowings Total Maximum month-end balance Federal funds purchased... -

Page 78

... and securities sold under repurchase agreements Subtotal Subordinated bank notes Subtotal Discounted lease rentals Subtotal Other borrowings Subtotal Total long-term borrowings At December 31, 2006, TCF has pledged residential real estate loans, consumer loans, commercial real estate loans and... -

Page 79

...losses Securities available for sale Other Total deferred tax assets Deferred tax liabilities: Lease financing Loan fees and discounts Premises and equipment Investments in affordable housing Investments in FHLB Stock Pension and postretirement benefits Mortgage servicing rights Other Total deferred... -

Page 80

...The amounts deferred are invested in TCF stock or other publicly traded stocks, bonds or mutual funds. Directors were and still are allowed to defer up to 100% of their fees and restricted stock awards. At December 31, 2006, the fair value of the assets in the plans totaled $140 million and included... -

Page 81

...00 At December 31, 2006, TCF, TCF National Bank and TCF National Bank Arizona exceeded their regulatory capital requirements and are considered "well-capitalized" under guidelines established by the FRB and the OCC pursuant to the Federal Deposit Insurance Corporation Improvement Act of 1991. Note... -

Page 82

...become exercisable over a period of one to 10 years from the date of the grant and expire after 10 years. All outstanding options have a fixed exercise price equal to the market price of TCF common stock on the date of grant. As of December 31, 2006 and 2005, all outstanding stock options are vested... -

Page 83

... five years. Employees have the opportunity to diversify and invest their vested account balance in various mutual funds or TCF common stock. At December 31, 2006, the fair value of the assets in the plan totaled $227.6 million and included $207.8 million invested in TCF common stock. The Company... -

Page 84

... return on plan assets Benefits paid TCF contributions Fair value of plan assets at end of year Funded status of plans: Funded status at end of year Unamortized transition obligation Unamortized prior service cost Actuarial net loss Prepaid (accrued) benefit cost at end of year (before application... -

Page 85

... 1, 2006 for the Pension Plan, the discount rate used to determine net benefit cost was increased from 5.25% for the period ending February 1, 2006 to 5.5% for the period ended December 31, 2006. N.A. Not Applicable. TCF's Pension Plan assets are invested in index mutual funds that are designed to... -

Page 86

... of TCF's Pension and Postretirement Plans varied between seven and eight years. In prior years, the discount rate was determined based on the Moody's AA and Citigroup Pension Liability long-term bond indexes. The actual return on plan assets, net of administrative expenses was 8.5% for 2006 and... -

Page 87

... years through the year 2018. Collateral held primarily consists of commercial real estate mortgages. Since the conditions under which TCF is required to fund these commitments may not materialize, the cash requirements are expected to be less than the total outstanding commitments. 2006 Form... -

Page 88

...(1) Closed-end loans and other Total consumer home equity and other Commercial real estate Commercial business Equipment finance loans Residential real estate Allowance for loan losses (2) Total financial instrument assets Financial instrument liabilities: Checking, savings and money market deposits... -

Page 89

...over specified time periods,...securities available for sale Reclassification adjustment for gains included in net income Income tax (expense) benefit Total other comprehensive loss Comprehensive income 2006 $244,943 Year Ended December 31, 2005 2004 $265,132 $254,993 (20,360) (10,671) 11,231 (19,800... -

Page 90

...reportable operating segments. Banking includes the following operating units that provide financial services to customers: deposits and investments products, commercial banking, consumer lending and treasury services. Management of TCF's banking operations are organized by state. The separate state... -

Page 91

... of TCF's consolidated totals. The "other" category in the table below includes TCF's parent company, corporate functions and mortgage banking. Leasing and Equipment Finance Eliminations and Reclassifications (In thousands) Banking Other Consolidated At or For the Year Ended December 31, 2006... -

Page 92

Note 23. Parent Company Financial Information TCF Financial Corporation's (parent company only) condensed statements of financial condition as of December 31, 2006 and 2005, and the condensed statements of income and cash flows for the years ended December 31, 2006, 2005 and 2004 are as follows. ... -

Page 93

... of its lending, leasing and deposit operations. TCF is and expects to become engaged in a number of foreclosure proceedings and other collection actions as part of its lending and leasing collection activities. From time to time, borrowers and other customers, or employees or former employees, have... -

Page 94

...Statements of Financial Condition Loans and leases Allowance for loan and lease losses Deposits Accrued expenses and other liabilities Statements of Income Provision for credit losses Fees and service charges Other non-interest expense Statements of Cash Flow Provision for credit losses Net increase... -

Page 95

...real estate loans Securities available for sale Residential real estate loans Subtotal Goodwill Total assets Checking, savings and money market deposits Certificates of deposit Total deposits Short-term borrowings Long-term borrowings Stockholders' equity Dec. 31, 2006 Sept. 30, 2006 June 30, 2006... -

Page 96

...KPMG LLP, TCF's registered public accounting firm that audited the consolidated financial statements included in this annual report, has issued an unqualified attestation report on management's assessment of the Company's internal control over financial reporting as of December 31, 2006. Any control... -

Page 97

... condition of TCF Financial Corporation and subsidiaries as of December 31, 2006 and 2005, and the related consolidated statements of income, stockholders' equity, and cash flows for each of the years in the three-year period ended December 31, 2006, and our report dated February 15, 2007 expressed... -

Page 98

..., Compensation Committee Report, Summary Compensation Table, Grants of Plan Based Awards, Outstanding Equity Awards at Fiscal Year End; Option Exercises and Stock Vested; Pension Benefits; Nonqualified Deferred Compensation and Potential Payments Upon Termination or Change in Control. 78 TCF... -

Page 99

... Stock Ownership of Directors, Officers and 5% Owners and Equity Compensation Plans Approved by Shareholders of TCF's definitive Proxy Statement dated March 7, 2007 and incorporated herein by reference. Item 14. Principal Accountant Fees and Services Information regarding principal accounting fees... -

Page 100

... 2006 Consolidated Statements of Cash Flows for each of the years in the three-year period ended December 31, 2006 Notes to Consolidated Financial Statements Other Financial Data Management's Report on Internal Control Over Financial Reporting Reports of Independent Registered Public Accounting Firm... -

Page 101

... (Principal Executive Officer) Executive Vice President and Chief Financial Officer (Principal Financial Officer) February 15, 2007 February 15, 2007 February 15, 2007 Senior Vice President, Controller February 15, 2007 and Assistant Treasurer (Principal Accounting Officer) Vice Chairman, General... -

Page 102

... 10(a) to TCF Financial Corporation's Annual Report on Form 10-K for the fiscal year ended December 31, 1987, No. 0-16431]; Fifth Amendment to the Plan [incorporated by reference to Exhibit 10(a) to TCF Financial Corporation's Annual Report on Form 10-K for the fiscal year ended December 31, 1989... -

Page 103

... for Consumer Lending and Business Banker Divisions Form of Year 2006 Executive Stock Grant Award Agreement dated January 23, 2006 [incorporated by reference to Exhibit 10(b)-4 to TCF Financial Corporation's Current Report on Form 8-K filed January 25, 2006 No. 001-10253] TCF Financial Corporation... -

Page 104

...2005] Form of Non-solicitation Agreement and Change in Control Contract as executed by certain Senior Officers dated December 15, 2005 [incorporated by reference to Exhibit 10(i)-3 of TCF Financial Corporation's Report 8-K filed December 19, 2005] Supplemental Employee Retirement Plan - ESPP Plan as... -

Page 105

..., No. 00110253]; Restated Trust Agreement as executed with First National Bank in Sioux Falls as trustee effective as of October 1, 2000 [incorporated by reference to Exhibit 10(m) of TCF Financial Corporation's Annual Report on Form 10 K for the fiscal year ended December 31] 2000, No. 001-10253... -

Page 106

...October 24, 1995 [incorporated by reference to Exhibit 10(y) to TCF Financial Corporation's Annual Report on Form 10-K for the fiscal year ended December 31, 1995, No. 001-10253] Supplemental Employee Retirement Plan for TCF Cash Balance Pension Plan, as amended and restated through January 24, 2005... -

Page 107

... J. Campos Mark B. Dillon Michael R. Klemz David J. Veurink TCF Investments and Insurance President and Chief Executive Officer Peter O. Torvik Executive Vice President Mathew G. Lamb Senior Vice President James R. Scattergood Senior Vice Presidents Timothy J. Bosiacki 2006 Annual Report 87 -

Page 108

... - TCF Employees Stock Purchase Plan Shareholder Relations/ De Novo Banking Committee Executive Committee Traditional Branches Metro Denver Area (23) Colorado Springs (6) Supermarket Branches Minneapolis/ St. Paul Area (51) Greater Minnesota (4) 3 CPA/Managing Director, George Johnson & Company... -

Page 109

....com Investor/Analyst Contact Jason Korstange Senior Vice President Corporate Communications (952) 745-2755 Stacey Ronshaugen Assistant Vice President Investor Relations (952) 745-2762 Available Information Trading of Common Stock The common stock of TCF Financial Corporation is listed on the New... -

Page 110

... A-2 TCF National Bank: Long-term counterparty AShort-term counterparty A-2 Last Rating Action FITCH Outlook TCF Financial Corporation: Long-term senior Short-term TCF National Bank: Long-term deposits Short-term deposits Last Review May 2006 Stable AF1 AF1 Stock Price Performance (In Dollars) $35... -

Page 111

... open 12 hours a day, seven days a week, 364 days per year. TCF banks a large and diverse customer base. We provide customers innovative products through multiple banking channels, including traditional, supermarket and campus branches, TCF EXPRESS TELLER® and other ATMs, debit cards, phone banking... -

Page 112

Open 7 Days SM TCF Financial Corporation 200 Lake Street East Wayzata, MN 55391-1693 www.tcfbank.com 002CS-13003 TCFIR9335