Sharp 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 SHARP CORPORATION

Financial Section

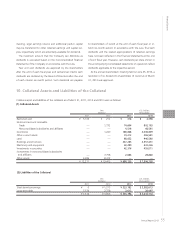

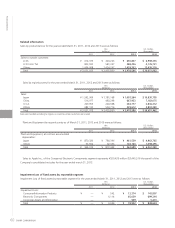

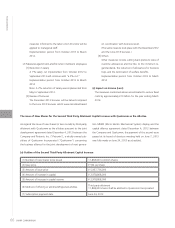

Adjustments of segment income or loss were ¥(33,954) mil-

lion ($(365,097) thousand), and comprised elimination of in-

tersegment transactions and corporate expenses not allocated to

each reportable segment. The elimination of intersegment trans-

actions was ¥1,117 million ($12,011 thousand). Corporate ex-

penses not allocated to each reportable segment were ¥(36,306)

million ($(390,387) thousand). Corporate expenses were mainly

attributable to basic R&D expenses and expenses related to the

administrative groups of the Company’s headquarters.

Adjustments of segment assets were ¥463,172 million

($4,980,344 thousand), and comprised elimination of interseg-

ment transactions and corporate assets not allocated to each re-

portable segment. The elimination of intersegment transactions

was ¥(11,217) million ($(120,613) thousand). Corporate assets

not allocated to each reportable segment were ¥474,389 million

($5,100,957 thousand). Corporate assets not allocated to each

reportable segment were mainly attributable to cash and cash

equivalents, the Company’s investments in securities, and depre-

ciable assets related to the Company’s R&D groups as well as the

administrative, sales and distribution groups of the Company’s

headquarters.

Adjustments of investments in nonconsolidated subsidiar-

ies and affiliates accounted for using the equity methods were

¥25,245 million ($271,452 thousand), and mainly comprised in-

vestments in Sharp Finance Corporation.

Adjustments of increase in plant, equipment and intangible

assets was ¥8,142 million ($87,548 thousand), and mainly com-

prised increase in the Company’s R&D groups and the admin-

istrative, sales and distribution groups of the Company’s head-

quarters.

Depreciation and amortization includes the amortization of

long-term prepaid expenses.

Increase in plant, equipment and intangible assets includes

the increase in long-term prepaid expenses.

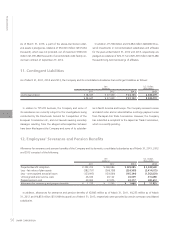

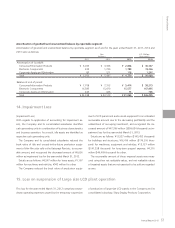

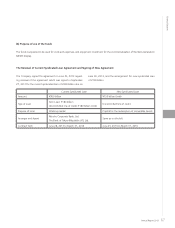

The Company passed a resolution at its board of directors meet-

ing held on May 14, 2013 to submit a proposal on reduction of

common stock, capital reserve and legal reserve, and on appro-

priation of surpluses to the Ordinary General Meeting of Share-

holders to be held on June 25, 2013, and the resolution was

then approved.

(a) Purpose of Reduction of Common Stock, Capital

Reserve and Legal Reserve, and Appropriation of

Surpluses

The Company recorded a ¥525,030,530,462 loss of retained

earnings carried forward for the year ended March 2013. In

order to regain financial strength at an early stage, and to

prepare for mobile and flexible implementation of future capi-

tal policy, by covering the deficit, the Company will reduce

common stock, capital reserve and legal reserve pursuant to

the provisions of Article 447, Paragraph 1 and Article 448,

Paragraph 1, of the Companies Act, and will then appropriate

the surpluses pursuant to the provision of Article 452 of the

Companies Act.

In addition, since these actions are accounting transfers within

the “Net Assets section” in the balance sheet of the Com-

pany, they will not change the Company’s net assets, and will

not affect the total number of issued shares and the number

of shares owned by each shareholder, etc.

(b) Details of Reduction of Common Stock

The Company will reduce common stock by ¥162,336,938,238

out of the amount of common stock as of March 31, 2013, of

¥212,336,938,238, and will transfer the entire amount of the

reduction of common stock to other capital surplus.

(c) Details of Reduction of Capital Reserve and Legal

Reserve

(1) Capital Reserve

The Company will reduce capital reserve by

¥256,576,762,667 out of the amount of capital reserve as

of March 31, 2013, of ¥269,076,762,667, and will trans-

fer the entire amount of the reduction of capital reserve to

other capital surplus.

Reduction of Common Stock, Capital Reserve and Legal Reserve, and Appropriation of Surpluses