Sharp 2013 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013 3

In fiscal 2012, ended March 31, 2013, the Japanese economy

showed signs of a partial recovery toward the end of the fiscal

year in the form of a rebound in stock prices and an improve-

ment in the export environment due to the yen’s depreciation.

However, overall conditions remained severe, with prolonged

deflation, weak business investment and stagnant employment

situation. Economies overseas remained deeply uncertain amid

the European financial crisis and a slowdown in the growth of

China and emerging countries, although the U.S. economy con-

tinued to be in moderate recovery.

Amid these circumstances, Sharp has worked to create dis-

tinctive devices and original products that meet our custom-

ers’ needs. These efforts include reinforcing mass-production

of IGZO LCDs, launching smartphones and tablet terminals

equipped with IGZO LCDs, and enhancing sales of Black Solar

high-efficiency solar cells. In addition, Sharp Corporation issued

new shares via third-party allotments under the “Capital/Busi-

ness Alliance Agreement with Qualcomm Incorporated for the

Joint Development of Next Generation MEMS*1 Display” and

“Strengthening of Alliance with Samsung Electronics for Liquid

Crystal Business.” We have also taken measures to improve fi-

nancial performance on a company-wide basis, including reduc-

tions in inventories as well as slashing fixed costs centering on

labor costs.

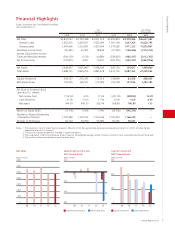

As a result, we were able to return to profitability at the oper-

ating level in the second half of fiscal 2012. However, for the full

year, Sharp recorded a substantial operating loss and net loss,

continuing the trend of the last fiscal year. This is due mainly

to a narrower gross margin caused by intensified competition,

restructuring charges recorded as an extraordinary item in other

expenses, and a reversal of deferred tax assets.

As for the ¥360.0 billion syndicated loan due in June 2013,

Sharp secured an agreement for an extension with its two main

banks, Mizuho Corporate Bank, Ltd.*2 and The Bank of Tokyo-

Mitsubishi UFJ, Ltd., as well as other participating banks. In ad-

dition, we have made an agreement with our main banks on an

additional borrowing facility of ¥150.0 billion to prepare for the

redemption of 20th unsecured convertible bonds with subscrip-

tion rights to shares, due on September 30, 2013.

In order to expand our corporate value so that it enhances

common benefits for our shareholders, we should continuously

strive to solidify our financial foundation and create innovative

products and services in accordance with client needs by making

full use of our advanced electronics technologies.

Based on this vision, we have developed our Medium-Term

Management Plan, aiming to become a new Sharp that achieves

stable growth in profits and steady cash generation. In this Me-

dium-Term Management Plan, we define fiscal 2013, the plan’s

first year, as the Restructuring Stage and fiscal 2014 and 2015

as the Re-growth Stage, where we step up efforts to realize full

“recovery and growth.”

In order to accomplish our goals, we will press forward with

the three basic strategies below.

1. Shift to “advantageous markets and fields”

2. Exit closed innovation and aggressively utilize alliances

3. Strengthen execution capabilities through governance sys-

tem innovation

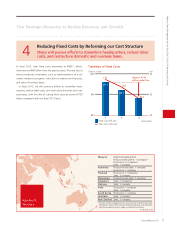

To be specific, we will push ahead with such five strategic

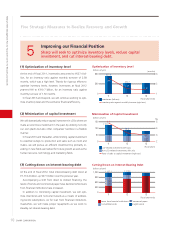

measures as “Restructuring our Business Portfolio,” “Improv-

ing the Profitability of our LCD Business,” “Expanding Overseas

Businesses Focusing on the ASEAN Market,” “Reducing Fixed

Costs by Reforming our Cost Structure,” and “Improving our

Financial Position,” thus raising our corporate value going for-

ward.

In addition, we will work to take steps to expand our CSR

activities company-wide, helping to preserve the global environ-

ment and enforcing compliance in business management to

raise our corporate value. We look forward to your ongoing sup-

port and encouragement.

*1 Micro Electro Mechanical System

*2 Its trade name as of June 2013

Message to our Shareholders

July 2013

President