Sharp 2013 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013 39

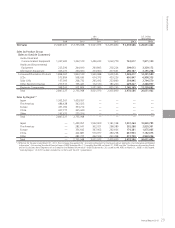

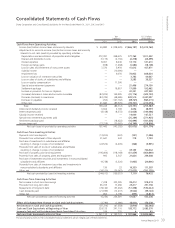

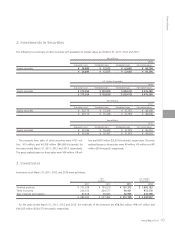

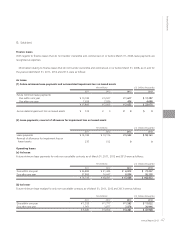

Consolidated Statements of Cash Flows

Sharp Corporation and Consolidated Subsidiaries for the Years Ended March 31, 2011, 2012 and 2013

Financial Section

Yen

(millions)

U.S. Dollars

(thousands)

2011 2012 2013 2013

Cash Flows from Operating Activities:

Income (loss) before income taxes and minority interests ¥ 40,880 ¥ (238,429) ¥ (466,187) $ (5,012,763)

Adjustments to reconcile income (loss) before income taxes and minority

interests to net cash (used in) provided by operating activities —

Depreciation and amortization of properties and intangibles 272,081 248,425 177,765 1,911,452

Interest and dividends income (3,119) (2,730) (2,278) (24,495)

Interest expenses 8,001 8,646 13,170 141,613

Foreign exchange gains (938) (1,268) (1,684) (18,108)

Loss on sales and retirement of noncurrent assets 7,376 5,950 15,612 167,871

Subsidy income — (10,000) — —

Impairment loss — 6,656 78,922 848,624

Loss on valuation of investment securities — — 3,782 40,667

Loss on sales of stocks of subsidiaries and affiliates — — 3,583 38,527

Loss on quality compensation — 11,500 — —

Special extra retirement payments — — 25,496 274,150

Settlement package — 18,857 17,899 192,462

Increase in provision for loss on litigation — — 32,321 347,538

(Increase) decrease in notes and accounts receivable (82,209) 149,905 (41,176) (442,753)

Decrease (increase) in inventories (83,749) (48,686) 228,510 2,457,097

Decrease in payables (762) (147,162) (89,765) (965,215)

Other, net 41,684 (89,976) (19,721) (212,054)

Total 199,245 (88,312) (23,751) (255,387)

Interest and dividends income received 3,664 3,169 2,656 28,559

Interest expenses paid (8,148) (8,572) (13,028) (140,086)

Subsidy income received — — 10,000 107,527

Special extra retirement payments paid — — (25,289) (271,925)

Settlement package paid — (18,622) (16,894) (181,656)

Income taxes paid (27,318) (30,965) (14,769) (158,806)

Net cash (used in) provided by operating activities 167,443 (143,302) (81,075) (871,774)

Cash Flows from Investing Activities:

Payments into time deposits (13,200) (603) (101) (1,086)

Proceeds from withdrawal of time deposits 31,641 443 718 7,720

Purchase of investments in subsidiaries and affiliates

resulting in change in scope of consolidation (24,524) (4,405) (366) (3,935)

Proceeds from sales of stocks of subsidiaries and affiliates

resulting in change in scope of consolidation — — 65,143 700,462

Purchase of property, plant and equipment (195,404) (118,168) (61,459) (660,849)

Proceeds from sales of property, plant and equipment 992 2,547 21,826 234,688

Purchase of investment securities and investments in nonconsolidated

subsidiaries and affiliates (9,738) (3,326) (1,935) (20,806)

Proceeds from sales of investment securities and investments in

nonconsolidated subsidiaries and affiliates 130 22 10,359 111,387

Other, net (34,510) (36,067) (27,075) (291,129)

Net cash provided by (used in) investing activities (244,613) (159,557) 7,110 76,452

Cash Flows from Financing Activities:

Net increase in short-term borrowings 7,328 305,595 85,413 918,419

Proceeds from long-term debt 85,725 13,286 23,417 251,796

Repayments of long-term debt (78,162) (53,462) (51,338) (552,022)

Cash dividends paid (21,999) (13,237) (5,500) (59,140)

Other, net 854 4,199 (355) (3,817)

Net cash provided by (used in) financing activities (6,254) 256,381 51,637 555,236

Effect of Exchange Rate Change on Cash and Cash Equivalents (3,790) (1,080) 16,418 176,538

Net Decrease in Cash and Cash Equivalents (87,214) (47,558) (5,910) (63,548)

Cash and Cash Equivalents at Beginning of Year 328,125 241,110 193,772 2,083,570

Increase in Cash and Cash Equivalents from Newly Consolidated Subsidiary

199 220 4 43

Cash and Cash Equivalents at End of Year ¥ 241,110 ¥ 193,772 ¥ 187,866 $ 2,020,065

The accompanying notes to the consolidated financial statements are an integral part of these statements.