Sharp 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2013 49

Financial Section

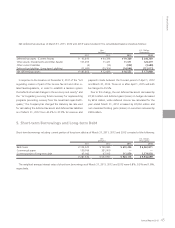

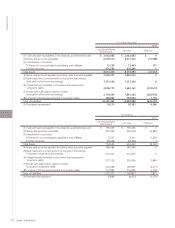

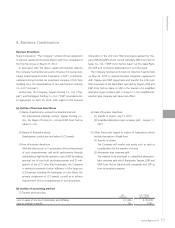

For other securities and investments in capital, The Com-

pany regularly monitors prices and the issuer’s financial

position, and continually reviews the possession by taking

these indices as well as the relationship with issuers into

consideration.

[3] Management of liquidity risk in financing activities

The Treasury Department manages liquidity risk by making

and updating financial plans based on reports from each

section, and maintains ready liquidity.

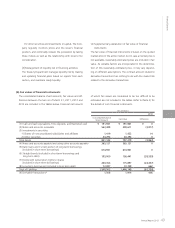

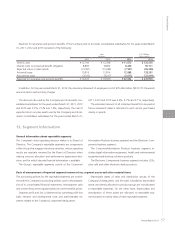

(4) Supplementary explanation of fair value of financial

instruments

The fair value of financial instruments is based on the quoted

market price in the active market, but in case a market price is

not available, reasonably estimated prices are included in fair

value. As variable factors are incorporated in the determina-

tion of this reasonably estimated price, it may vary depend-

ing on different assumptions. The contract amount related to

derivative transactions has nothing to do with the market risk

related to the derivative transactions.

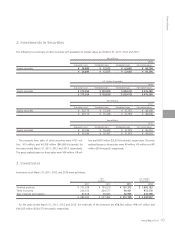

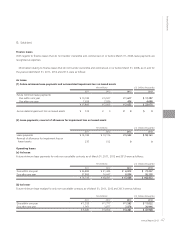

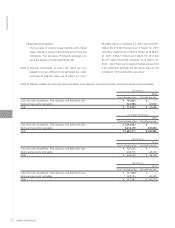

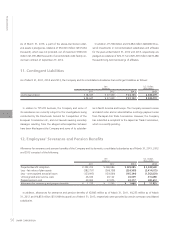

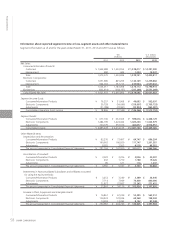

(b) Fair values of financial instruments

The consolidated balance sheet amounts, fair values and dif-

ferences between the two as of March 31, 2011, 2012 and

2013 are included in the tables below. Financial instruments

of which fair values are considered to be too difficult to be

estimated are not included in the tables. Refer to (Note 2) for

the details of such financial instruments.

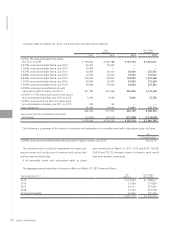

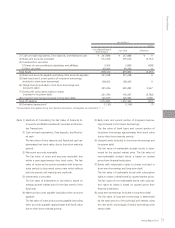

Yen (millions)

2013

Consolidated Balance

Sheet Amount Fair Value Difference

(1) Cash and cash equivalents, Time deposits, and Restricted cash ¥ 191,941 ¥ 191,941 ¥ 0

(2) Notes and accounts receivable 563,488 559,611 (3,877)

(3) Investments in securities

1) Shares of nonconsolidated subsidiaries and affiliates 1,419 1,433 14

2) Other securities 44,294 44,294 0

Total Assets 801,142 797,279 (3,863)

(4) Notes and accounts payable (excluding other accounts payable) 365,121 365,121 0

(5) Bank loans and Current portion of long-term borrowings

(included in short-term borrowings) 674,941 674,941 0

(6) Straight bonds (included in short-term borrowings and

long-term debt) 195,000 156,441 (38,559)

(7) Bonds with subscription rights to shares

(included in short-term borrowings) 200,354 175,897 (24,457)

(8) Long-term borrowings (included in long-term debt) 73,087 73,749 662

Total of Liabilities 1,508,503 1,446,149 (62,354)

(9) Derivative transactions* 1,508 1,914 406