Sharp 2013 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2013 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

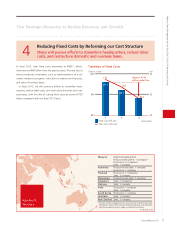

Overseas Sales Composition

by Region (Products Business Group)

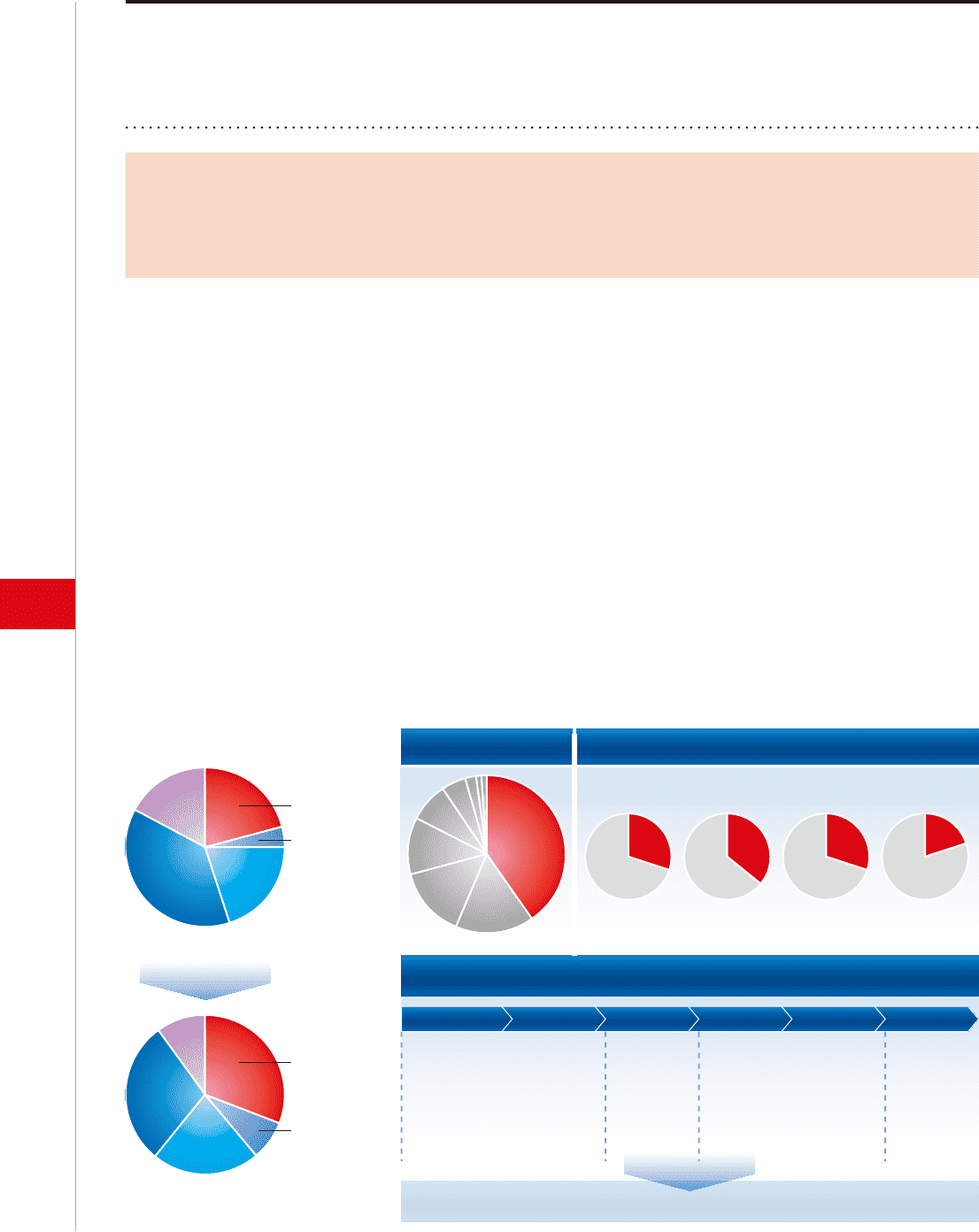

Strengthen Initiatives at Indonesian Business

FY2012

TVs Refrigerators Washing

machines

Air

conditioners

N o .1 N o.1 N o .1 No.2

Sharp’s Position in Indonesian Market

Population Ratio by

ASEAN Member

Sharp’s Business Development in Indonesia

To structure the most powerful value chain for local production for local consumption

30% 36% 30% 20%

Planning Development Production Marketing

Develop an Indonesian-type business model in other nations and regions

Indonesia-completing

structure already in place

(focusing on creating

local-fit products)

New plant

operation

start

(2013)

No. 1 service

network in

the industry

(352 bases)

2012 market shares (Source: Sharp)

Sales Service

Strong relations with

retailers

• No. 1 sales channel coverage

(81%)

• Unique marketing utilizing

an industry-leading brand

Asia

21%

2011

Indonesia

40.5%

Middle East/Africa

ChinaThe Americas

Europe

FY2015

Asia

31%

Middle East/Africa

China

The Americas

Europe

( )

8 SHARP CORPORATION

Medium-Term Management Plan for Fiscal 2013-2015: For Recovery and Growth

3Expanding Overseas Businesses Focusing on the

ASEAN Market

Sharp will strategically allocate core management resources to

regions in which it can demonstrate its competitive strengths.

In our overseas business, we will strategically allocate core man-

agement resources to regions in which we can demonstrate our

competitive strengths.

In the ASEAN region, where economic growth has been ro-

bust in recent years, we have sales operations in six nations and

production facilities in four.

We will step up initiatives in the region with the aim of raising

the ratio of Asian sales to total Products Business Group* sales from

21% in fiscal 2012 to 31% in fiscal 2015. This will propel Asia to the

top regional spot in Sharp’s overseas sales, surpassing the Americas.

In Indonesia, which accounts for around 40% of ASEAN’s

population and is expected to see strong economic growth in

the future, Sharp holds the No. 1 market share for TVs, refrig-

erators and washing machines, and the No. 2 share for air con-

ditioners. The source of our competitive edges lies in our value

chain, which is the strongest in Indonesia, including our locally

driven product development, rock-solid relationships with retail-

ers and the No. 1 service network in the industry.

To address flourishing demand, Sharp fast-tracked the open-

ing of a new plant in Indonesia to manufacture washing ma-

chines and refrigerators. Originally scheduled for late fiscal

2013, the new plant opened in September 2013. In this way, we

will accelerate the pace of business expansion and build a robust

market foundation.

Going forward, Sharp will work to replicate its success in Indo-

nesia across various ASEAN nations, including Thailand where it

has a white goods plant, in order to expand its business region-

wide and boost its market share.

* Businesses which do not include LCDs and Other Electronic Devices

Five Strategic Measures to Realize Recovery and Growth