Sharp 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66 SHARP CORPORATION

Financial Section

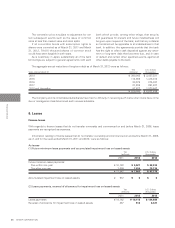

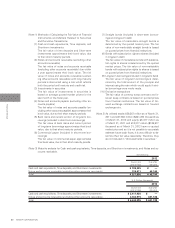

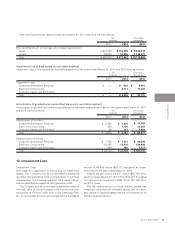

13. Loss on suspension of Large size LCD plant operation

This loss for the year ended March 31, 2012 comprises

extraordinary operating expenses caused by the tempo-

rary suspension of production of large-size LCD panels in

the Company and its consolidated subsidiary, Sharp Dis-

play Products Corporation.

14. Restructuring Charges

These restructuring charges for the year ended March

31, 2011 are mainly related to the reorganization of LCD

plants, including depreciation and maintenance charges of

plants that have been suspended due to production line

changes to meet the increasing demand for high value-

added products.

These restructuring charges for the year ended March

31, 2012 are related to the LCD business restructuring,

etc. Those mainly comprises depreciation and mainte-

nance changes of ¥37,717 million ($465,642 thousand)

concerning plants that were suspended in the Company

and its consolidated subsidiary, Sharp Display Products

Corporation to improve production to meet the increas-

ing demand for high value-added products, and costs of

¥68,125 million ($841,049 thousand) incurred to reinforce

business foundations (inventory write-down, etc.) in prep-

aration for promoting establishment of strategic vertical

integration of the large-size LCD business.

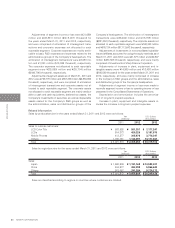

15. Significant Subsequent Events

Significant subsequent events occurring until June 26,

2012 were as follows:

Business Divestiture

The Company entered into an agreement to execute capi-

tal and business alliance with four companies of the Hon

Hai Group on March 27, 2012.

In association with the above capital and business alli-

ance, the Company entered into an agreement in regard

to the partial transfer of shares of its owned subsidiary,

Sharp Display Products Corporation (“SDP”), to Mr. Terry

Tai-Ming Gou, the representative of Hon Hai Precision

(“Hon Hai”). Furthermore, the Company, Toppan Print-

ing Co., Ltd. (“Toppan”) and Dai Nippon Printing Co.,

Ltd. (“DNP”) executed a basic agreement on April 10,

2012 and have conducted deliberations on concrete is-

sues with regard to the business integration of the LCD

color filter businesses into SDP, whereby the LCD color

filter businesses are operated by Toppan, DNP and DNP’s

wholly owned subsidiary, DNP Color Techno Sakai Co.,

Ltd. (“DNP Color Techno Sakai”) at the Sakai Plant.

The Company resolved at its board of directors meet-

ing held on May 24, 2012 to execute business integration

agreements with Toppan and DNP respectively and

transfer the LCD color filter businesses at the Sakai Plant

operated by Toppan, DNP and DNP Color Techno Sakai, to

SDP in the manner of an absorption-type company split.

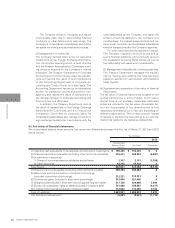

(a) Outline of Business Divestiture

(1) Name of parties who succeed the divested business

Mr. Terry Tai-Ming Gou, Toppan Printing Co., Ltd., Dai Nip-

pon Printing Co., Ltd. and DNP Color Techno Sakai Co., Ltd.

(2) Nature of divested business

Development, production and sales of LCD panels

(3) Aim of business divestiture

With the efforts such as 1) promotion of the enhance-

ment of cost competitiveness and profit performance

through maintaining a high facility operation rate of SDP

by making practical use of Hon Hai’s purchasing power

and 2) integration of the LCD color filter businesses, the

Company is seeking to promote further efficiency of the

large-size LCD business including the businesses of color

filters, the primary component of LCD panels, as well as

to achieve improvement of the competitiveness of such

businesses.

(4) Date of business divestiture

[1] Transfer of shares through March 26,

2013 (Planned)

[2] Absorption-type company split June 30, 2012 (Planned)

(5) Other items with regard to outline of transactions

which includes description of legal form

[1] Transfer of shares

The Company will receive only assets such as cash as

consideration for the transfer of shares.

[2] Absorption-type company split

The method to be employed is an absorption-type com-

pany split which designates Toppan, DNP and DNP Color

Techno Sakai as split companies and SDP as their suc-

ceeding company.

(b) Name of Reporting Segment which involves the

divested business

Electronic Components