Sharp 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32 SHARP CORPORATION

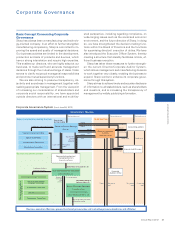

Corporate Governance

Status of Corporate Governance System

The Board of Directors Meetings of Sharp Corporation

are held on a monthly basis in principle to make deci-

sions on matters stipulated by law and management-

related matters of importance, and to supervise the

state of business execution. To improve management

agility and flexibility, and to clarify the responsibilities

of the company management during each accounting

period, the term of office for members of the Board of

Directors is set at one year.

As an advisory body to the Board of Directors, Sharp

has established an Internal Control Committee, which de-

liberates on basic policies, the state of development and

implementation regarding internal controls and internal

audits, then reports on and discusses important matters

with the Board of Directors. As advisory bodies to the

Board of Directors, Sharp has also established a Nominat-

ing Committee and a Compensation Committee.

To strengthen the decision-making functions within the

Board of Directors and the functions for supervising direc-

tors’ execution of duties, the Company appointed outside

directors. The outside directors serve as members of the

Nominating Committee and the Compensation Commit-

tee, as well as the Special Committee that forms part of the

takeover defense plan. The Company also introduced the

Executive Officer System to carry out swift and efficient

business execution, and to maximize the functions of the

Board of Directors by optimizing the number of members.

In addition to the Board of Directors, the Company

has an Executive Management Committee, where mat-

ters of importance related to corporate management

and business operation are discussed and reported

twice a month in principle. This committee facilitates

prompt executive decision making.

The Board of Corporate Auditors is composed of four

corporate auditors, three of whom are outside corporate

auditors with a high degree of independence. Each cor-

porate auditor meets regularly with the representative

directors, the directors, the executive officers, the ac-

counting auditors, the head of the Internal Audit Division

and others to exchange opinions and work to ensure that

business is executed legally, appropriately and efficiently.

Remuneration to Directors and

Corporate Auditors

Monthly remuneration is decided within the scope of

the respective maximum amount of total remuneration

as set forth by a resolution of the General Meeting of

Shareholders (directors: up to ¥60 million per month;

corporate auditors: up to ¥6.5 million per month).

Monthly remuneration for each director is decided by

the Compensation Committee as delegated by the

Board of Directors, taking into consideration the busi-

ness performance, extent of risks and other factors.

Monthly remuneration for each corporate auditor is de-

cided by consultation among the corporate auditors.

Bonuses are subject to approval of the total amount

payable to directors and corporate auditors, respec-

tively, by resolution of the Ordinary General Meeting

of Shareholders. Based on this approval, the amount

of the bonus for each director is decided by the Com-

pensation Committee as delegated by the Board of

Directors, taking into consideration the individual’s

performance and level of contribution. The amount of

bonus for each corporate auditor is decided by consul-

tation among the corporate auditors.

Retirement remuneration for both directors and cor-

porate auditors was abolished as of the conclusion of

the 114th Ordinary General Meeting of Shareholders

held on June 24, 2008.

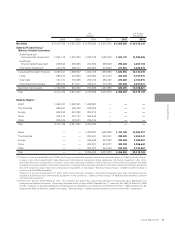

Information Concerning Outside Directors and Outside Corporate Auditors (As of June 26, 2012)

To be involved in decision making by the Board of Directors of

Sharp and supervise directors’ execution of duties, from knowledge

based on accounting, business administration, corporate

governance theories and other research that he has conducted

over many years at university, as well as his experience as an

outside executive of companies in different fields of business, etc.

To be involved in decision making by the Board of Directors of

Sharp and supervise directors’ execution of duties, from a broad

perspective drawn on experience in business and management of

a general trading company over many years

To audit legality and correctness of Sharp’s execution of business

from a broad perspective drawn on long experience in the financial

industry, which is a different field of business to Sharp’s

To audit legality and correctness of Sharp’s execution of business

from extensive experience as a lawyer specializing in corporate

legal work

To audit legality and correctness of Sharp’s execution of business

based on objective insight drawn on experience in serving in

important posts with the police

Professor, Graduate School of Commerce and

Management, Hitotsubashi University

Outside Director, Akebono Brake Industry Co., Ltd.

Outside Director, Mitsubishi Corporation

Outside Director, Tokio Marine Holdings, Inc.

—

—

Lawyer

Outside Corporate Auditor, Taiyo Kogyo Corporation

Outside Corporate Auditor, ARAYA INDUSTRIAL CO., LTD.

Chairperson, Japan Traffic Safety Association

Outside Corporate Auditor, TV Asahi Corporation

Outside

Director

Classification Name Responsibilities Important Concurrent Positions at Other Companies

Outside

Director

Outside

Corporate

Auditor

Outside

Corporate

Auditor

Outside

Corporate

Auditor

Kunio Ito

Makoto

Kato

Shinji

Hirayama

Yoichiro

Natsuzumi

Masuo

Okumura

Note: Sharp has designated all of the outside directors and outside corporate auditors as independent directors and independent corporate auditors as set forth by the finan-

cial instruments exchanges on which Sharp’s stock is listed.