Sharp 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52 SHARP CORPORATION

Financial Section

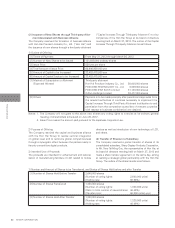

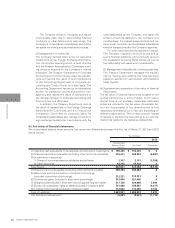

(2) Issuance of New Shares through Third-party Allot-

ment Associated with Business Alliance

The Company resolved the formation of business alliance

with Hon Hai Precision Industry Co., Ltd. (“Hon Hai”) and

the issuance of new shares through a third-party allotment

(“Capital Increase Through Third-party Allotment”) to four

companies of the Hon Hai Group at its board of directors

meeting held on March 27, 2012. The outline of the Capital

Increase Through Third-party Allotment is as follows.

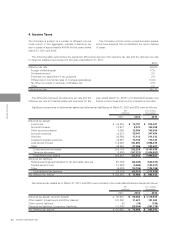

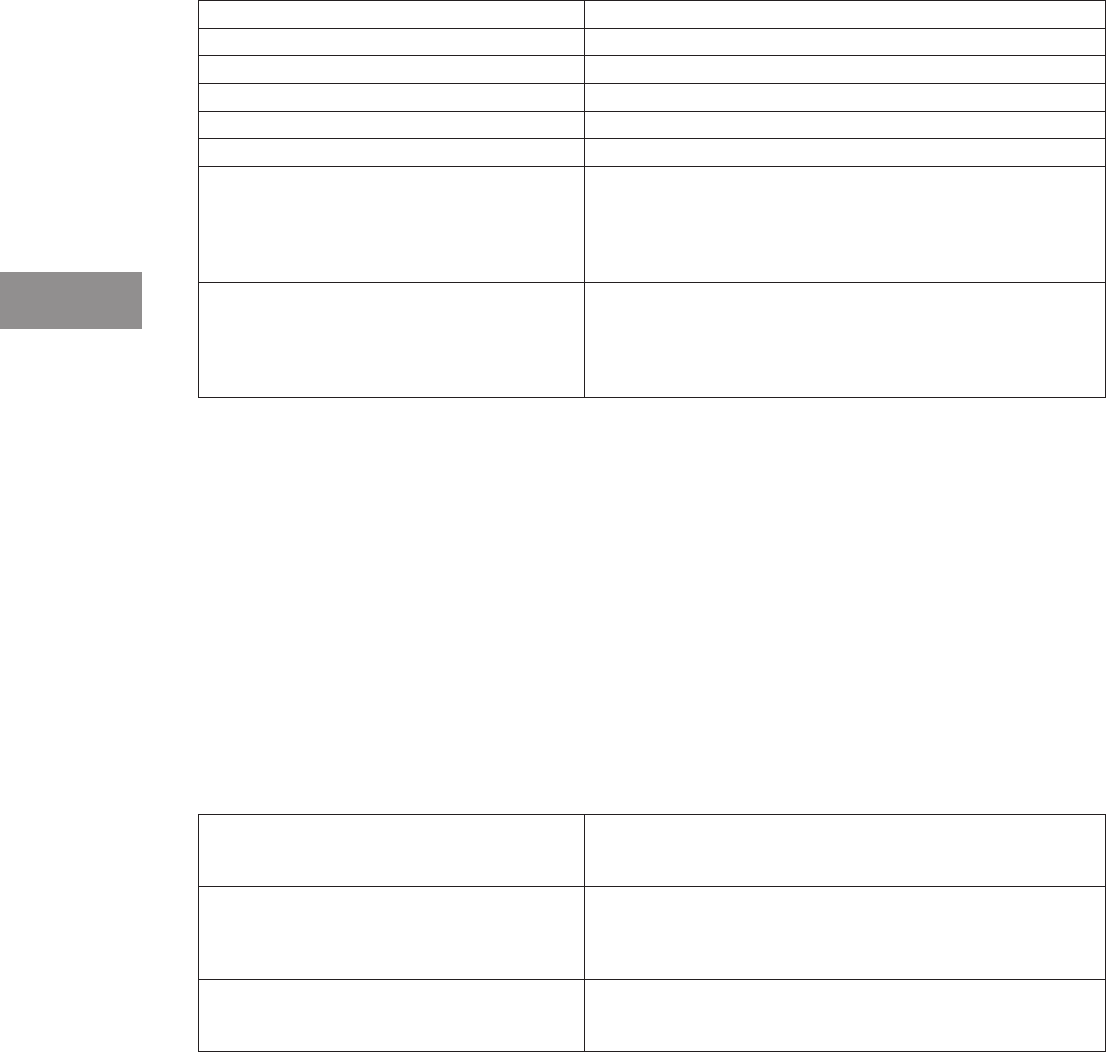

1) Outline of Offering

[1] Terms of Payment From May 31, 2012 through March 26, 2013

[2] Number of New Shares to be Issued 121,649,000 ordinary shares

[3] Issue Price 550 yen per share

[4] Total Amount of Issue Price 66,906,950,000 yen

[5] Amount of Capital to be Increased 33,453,475,000 yen

[6] Amount of Capital Surplus to be Increased 33,453,475,000 yen

[7] Method of Subscription or Allotment Third-party allotment

(Expected Allottee) Hon Hai Precision Industry Co., Ltd. 50,000,000 shares

FOXCONN TECHNOLOGY Co., Ltd. 8,029,000 shares

FOXCONN (FAR EAST) Limited 31,143,000 shares

Q-Run Holdings Limited 32,477,000 shares

[8] Others Payment is to be made promptly after permits and approvals from

the relevant authorities of countries necessary to implement the

Capital Increase Through Third-Party Allotment (notification to and

permission from the competition authorities of relevant countries

with respect to business combination) are obtained.

Notes: 1. The Company will not grant to the above new shares any voting rights to exercise at its ordinary general

meeting of shareholders scheduled on June 26, 2012.

2. Issue Price means the amount paid pursuant to the Japanese Corporate Law.

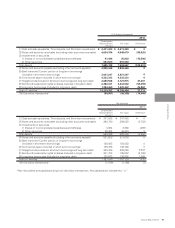

2) Purpose of Offering

The Company resolved the capital and business alliance

with the Hon Hai Group to realize vertical integration

on global level and to reinforce global competitiveness

through a synergistic effect between the parties mainly in

fiercely competitive digital products.

3) Intended Use of Proceeds

The proceeds are intended for enhancement and rational-

ization of manufacturing facilities of LCD related to mobile

devices as well as introduction of new technology of LCD,

and others.

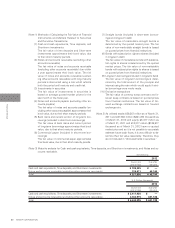

(3) Transfer of Shares in a Subsidiary

The Company resolved a partial transfer of shares of its

consolidated subsidiary, Sharp Display Products Corporation,

to Mr. Terry Tai-Ming Gou, the representative of Hon Hai, at

its board of directors meeting held on March 27, 2012 and

made a share transfer agreement on the same day, aiming

at realizing a strategic global partnership with the Hon Hai

Group. The outline of the share transfer is as follows.

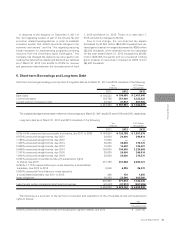

1) Number and Amount of Shares to be Transferred, and Status of Shares Held before and after Transfer

[1] Number of Shares Held Before Transfer 2,640,000 shares

(Number of voting rights: 2,640,000 units)

(Holding rate: 92.96%)

[2] Number of Shares Transferred 1,320,000 shares

(Number of voting rights: 1,320,000 units)

(Ratio to total number of issued shares: 46.48%)

(Transfer price: 66,000 million yen)

[3] Number of Shares Held After Transfer 1,320,000 shares

(Number of voting rights: 1,320,000 units)

(Holding rate: 46.48%)