Sharp 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64 SHARP CORPORATION

Financial Section

Related information

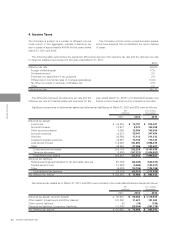

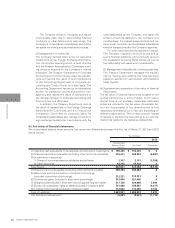

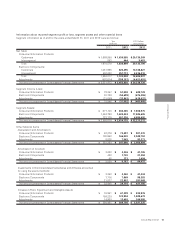

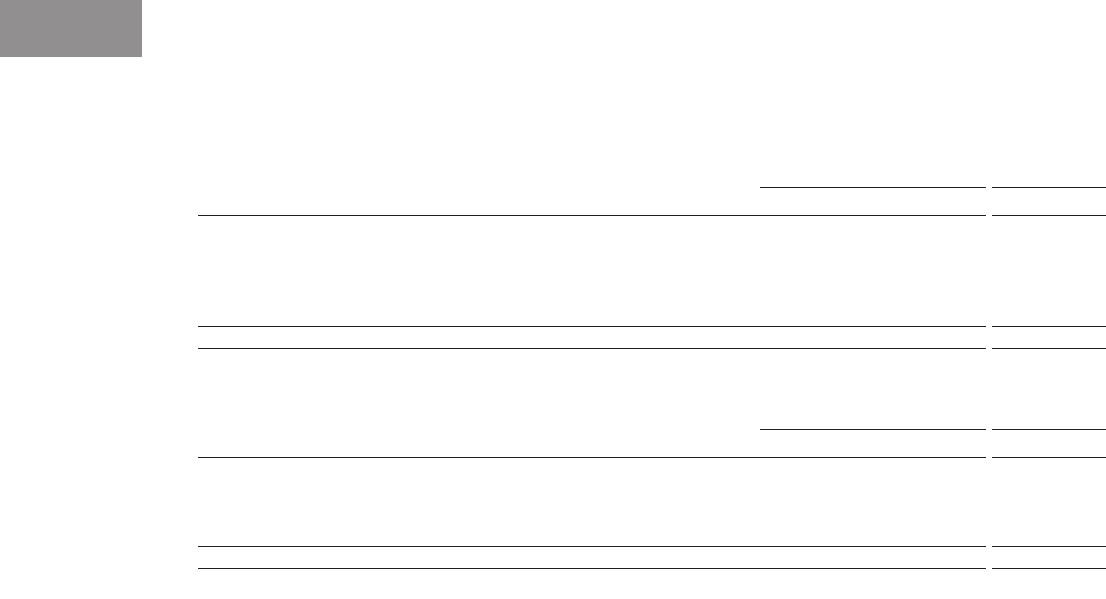

Sales by product/service for the years ended March 31, 2011 and 2012 were as follows:

Sales to outside customers:

LCD Color TVs

LCDs

Mobile Phones

Others

Total

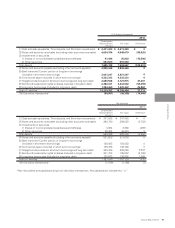

Sales:

Japan

China

Others

Total

¥ 581,357

420,226

305,876

1,148,391

¥ 2,455,850

¥ 1,181,168

483,298

791,384

¥ 2,455,850

¥ 803,592

614,373

413,277

1,190,731

¥ 3,021,973

¥ 1,592,909

516,977

912,087

¥ 3,021,973

$ 7,177,247

5,187,975

3,776,247

14,177,667

$ 30,319,136

$ 14,582,321

5,966,642

9,770,173

$ 30,319,136

2012

2012

2011

2011

Yen

(millions)

Yen

(millions)

2012

2012

U.S. Dollars

(thousands)

U.S. Dollars

(thousands)

Sales by region/country for the years ended March 31, 2011 and 2012 were as follows:

Sales are classified according to regions or countries where customers are located.

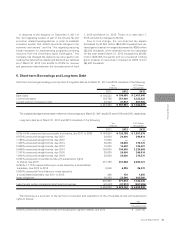

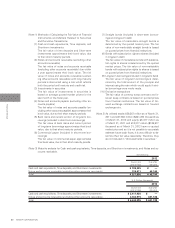

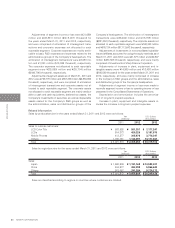

Adjustments of segment income or loss were ¥(31,089)

million and ¥(33,861) million ($(418,037) thousand) for

the years ended March 31, 2011 and 2012, respectively,

and were comprised of elimination of intersegment trans-

actions and corporate expenses not allocated to each

reportable segment. Corporate expenses are mainly attrib-

utable to basic R&D expenses and expenses related to the

administrative groups of the Company’s headquarters. The

elimination of intersegment transactions were ¥3,083 mil-

lion and ¥1,061 million ($13,099 thousand), respectively.

The corporate expenses not allocated to each reportable

segment were ¥(35,880) million and ¥(35,704) million

($(440,790) thousand), respectively.

Adjustments of segment assets as of March 31, 2011 and

2012 were ¥723,779 million and ¥557,336 million ($6,880,692

thousand), respectively, and were comprised of elimination

of intersegment transactions and corporate assets not al-

located to each reportable segment. The corporate assets

not allocated to each reportable segment are mainly attribut-

able to cash and cash equivalents, deferred tax assets, the

Company’s investments in securities, as well as depreciable

assets related to: the Company’s R&D groups as well as

the administrative, sales and distribution groups of the

Company’s headquarters. The elimination of intersegment

transactions were ¥(36,464) million and ¥(18,788) million

($(231,951) thousand), respectively. The corporate assets not

allocated to each reportable segment were ¥760,243 million

and ¥576,124 million ($7,112,642 thousand), respectively.

Adjustments of investments in nonconsolidated subsidiar-

ies and affiliates accounted for using the equity methods as of

March 31, 2011 and 2012 were ¥21,877 million and ¥22,807

million ($281,568 thousand), respectively, and were mainly

comprised of investments in Sharp Finance Corporation.

Adjustments of increase in plant, equipment and in-

tangible assets were ¥14,900 million and ¥13,493 million

($166,580 thousand) for the years ended March 31, 2011 and

2012, respectively, and were mainly comprised of increase

in the Company’s R&D groups and the administrative, sales

and distribution groups of the Company’s headquarters.

Adjustments of segment income or loss were made to

reconcile segment income or loss to operating income or loss

presented in the Consolidated Statements of Operations.

Depreciation and amortization includes the amortiza-

tion of long-term prepaid expenses.

Increase in plant, equipment and intangible assets in-

cludes the increase in long-term prepaid expenses.