Sharp 2012 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 SHARP CORPORATION

Financial Section

The Company strives to recognize and reduce

irrecoverable risks, due to deteriorating financial

conditions or other factors at an early stage. The

Company’s consolidated subsidiaries also follow

the same monitoring and administration process.

[2] Management of market risk

The Company decides basic policy for derivative

transactions at the Foreign Exchange Administra-

tion Committee meeting which is held monthly

and the Finance Administration Committee meet-

ing which is required by the Company’s internal

procedure. The Treasury Department of Corporate

Accounting and Control Group executes transac-

tions and reports the result of such transactions

to the Accounting Department of Corporate Ac-

counting and Control Group on a daily basis. The

Accounting Department has set up the specialized

section for transaction results and position man-

agement, and reports the result of transactions to

the General manager of Corporate Accounting and

Control Group on a daily basis.

In addition, the Treasury Department reports

the result of transactions to the Foreign Exchange

Administration Committee and the Finance Ad-

ministration Committee on a periodic basis. Its

consolidated subsidiaries also manage forward for-

eign exchange transactions in accordance with the

rules established by the Company, and report the

content of such transactions to the Company on a

monthly basis. For interest swap contracts and cur-

rency swap contracts, its consolidated subsidiaries

execute transactions after the Company approves.

For other securities and investments in capital,

The Company regularly monitors prices and is-

suer’s financial positions, and continually reviews

the possession by taking these indices as well as

the relationship with issuers into consideration.

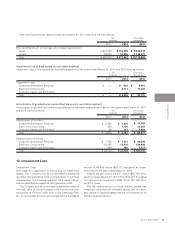

[3] Management of liquidity risk in financing activities

The Treasury Department manages the liquidity

risk by making and updating the financial plans

based on reports from each section, and maintains

ready liquidity.

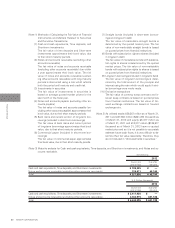

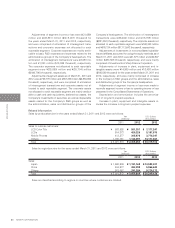

(4) Supplementary explanation of fair value of financial

instruments

The fair value of financial instruments is based on the

quoted market price in active market, but in case a

market price is not available, reasonably estimated

prices are included in the fair value. As variable fac-

tors are incorporated in the determination of this

reasonably estimated price, it may vary depending on

different assumptions. The contract amount related

to derivative transactions has nothing to do with the

market risk related to the derivative transactions.

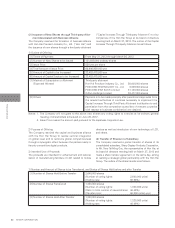

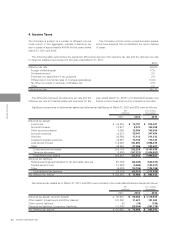

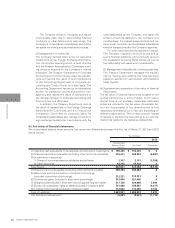

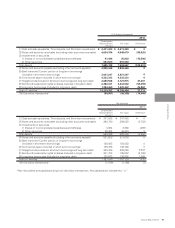

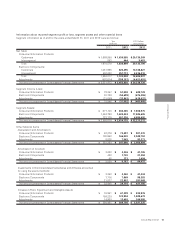

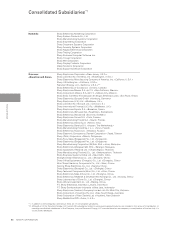

(b) Fair values of financial instruments

The consolidated balance sheet amounts, fair values and differences between the two, as of March 31, 2011 and 2012

are as follows:

(1) Cash and cash equivalents, Time deposits, and Short-term investments

(2) Notes and accounts receivable (excluding other accounts receivable)

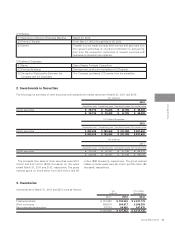

(3) Investments in securities

1) Shares of nonconsolidated subsidiaries and affiliates

2) Other securities

Total Assets

(4) Notes and accounts payable (excluding other accounts payable)

(5) Bank loans and Current portion of long-term borrowings

(included in short-term borrowings)

(6) Commercial paper (included in short-term borrowings)

(7) Straight bonds (included in short-term borrowings and long-term debt)

(8) Bonds with subscription rights to shares (included in long-term debt)

(9) Long-term borrowings (included in long-term debt)

Total of Liabilities

(10) Derivative transactions*

¥ 195,325

375,411

3,357

48,408

622,501

389,484

212,321

351,000

217,126

201,068

112,952

1,483,951

(6,881)

¥ 195,325

368,524

2,101

48,408

614,358

389,484

212,321

351,000

220,966

196,997

115,055

1,485,823

(8,051)

¥ 0

(6,887)

(1,256)

0

(8,143)

0

0

0

3,840

(4,071)

2,103

1,872

(1,170)

Yen (millions)

2012

DifferenceFair Value

Consolidated

Balance Sheet

Amount