Sharp 2012 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 SHARP CORPORATION

Financial Section

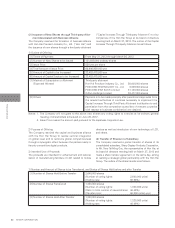

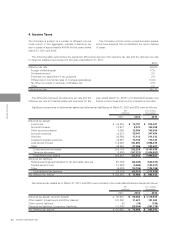

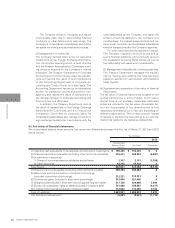

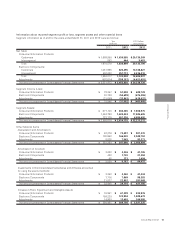

4. Income Taxes

The Company is subject to a number of different income

taxes which, in the aggregate, indicate a statutory tax

rate in Japan of approximately 40.6% for the years ended

March 31, 2011 and 2012.

The Company and its wholly owned domestic subsid-

iaries have adopted the consolidated tax return system

of Japan.

Statutory tax rate

Foreign withholding tax

Dividends income

Expenses not deductible for tax purposes

Differences in normal tax rates of overseas subsidiaries

Tax effect on equity in earnings of affiliates, net

Other

Effective tax rate

40.6 %

17.9

3.3

2.0

(14.6)

(3.3)

2.2

48.1 %

2011

The following table summarizes the significant differences between the statutory tax rate and the effective tax rate

for financial statements purposes for the year ended March 31, 2011:

The difference between the statutory tax rate and the

effective tax rate for financial statement purposes for the

year ended March 31, 2012 is not disclosed because loss

before income taxes and minority interests is recorded.

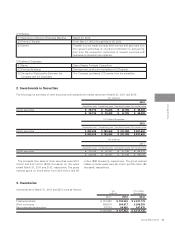

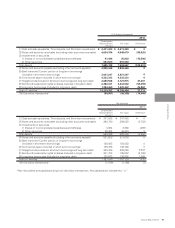

Significant components of deferred tax assets and deferred tax liabilities as of March 31, 2011 and 2012 were as follows:

Deferred tax assets:

Inventories

Accrued bonuses

Other accounts payable

Accrued expenses

Software

Long-term prepaid expenses

Loss carried forward

Other

Gross deferred tax assets

Valuation allowance

Total deferred tax assets

Deferred tax liabilities:

Retained earnings appropriated for tax allowable reserves

Prepaid pension cost

Other

Total deferred tax liabilities

Net deferred tax assets

¥ 40,804

10,972

9,765

14,572

20,569

16,567

115,026

36,864

265,139

(2,897)

262,242

(61,752)

(11,539)

(5,488)

(78,779)

¥ 183,463

¥ 70,797

8,372

12,904

20,047

17,113

14,104

161,893

27,006

332,236

(197,223)

135,013

(42,445)

(9,966)

(10,106)

(62,517)

¥ 72,496

$ 874,037

103,358

159,309

247,494

211,272

174,123

1,998,679

333,407

4,101,679

(2,434,852)

1,666,827

(524,012)

(123,037)

(124,766)

(771,815)

$ 895,012

2011 2012

Yen

(millions)

2012

U.S. Dollars

(thousands)

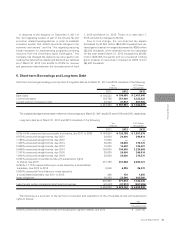

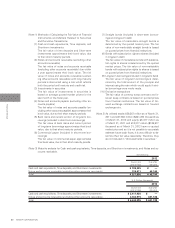

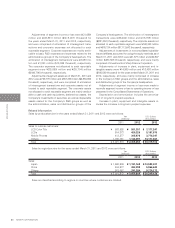

Net deferred tax assets as of March 31, 2011 and 2012 were included in the consolidated balance sheets as follows:

Deferred tax assets (Current Assets)

Other assets (Investments and Other Assets)

Other current liabilities

Deferred tax liabilities (Long-term Liabilities)

Net deferred tax assets

¥ 93,810

101,259

(6)

(11,600)

¥ 183,463

¥ 90,394

11,421

(15)

(29,304)

¥ 72,496

$ 1,115,975

141,000

(185)

(361,778)

$ 895,012

2011 2012

Yen

(millions)

2012

U.S. Dollars

(thousands)