Sharp 2012 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2012 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2012 55

Financial Section

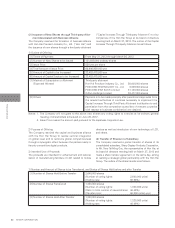

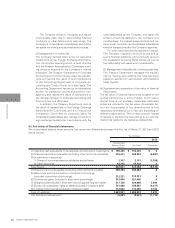

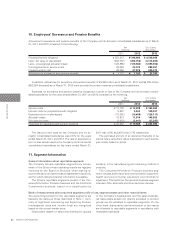

In response to the issuance on December 2, 2011 of

the “Act regulating revision of part of the Income Tax Act

and other related laws/regulations, in order to establish

a taxation system that reflects structural changes in the

economy and society” and the “Act regarding securing

funds necessary for implementing programs promoting

recovery from the Great East Japan Earthquake,” the

Company has changed the statutory tax rate used for cal-

culating the deferred tax assets and deferred tax liabilities

as of March 31, 2012 from 40.6% to 37.9% for revenue

and payments made between the forecast period of April

1, 2012 and March 31, 2015. Those on or after April 1,

2015 will both be changed to 35.5%.

Due to this change, the net deferred tax assets

decreased by ¥1,951 million ($24,086 thousand) and de-

ferred gains (losses) on hedges decreased by ¥256 million

($3,160 thousand), while deferred income tax calculated

for the year ended March 31, 2012 increased by ¥2,054

million ($25,358 thousand) and net unrealized holding

gains (losses) on securities increased by ¥359 million

($4,432 thousand).

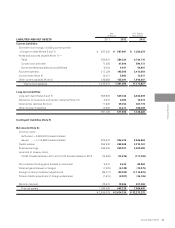

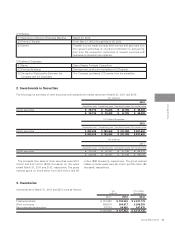

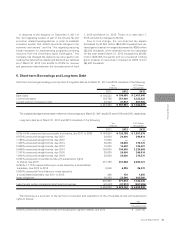

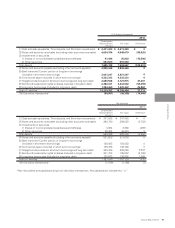

5. Short-term Borrowings and Long-term Debt

The weighted average interest rates of short-term borrowings as of March 31, 2011 and 2012 were 0.8% and 0.5%, respectively.

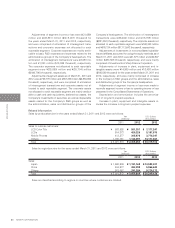

Short-term borrowings including current portion of long-term debt as of March 31, 2011 and 2012 consisted of the following:

Bank loans

Commercial paper

Current portion of long-term debt

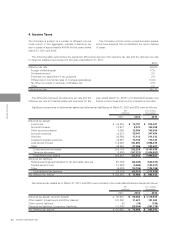

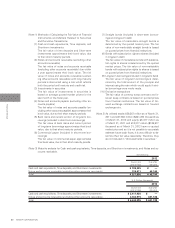

0.0%–8.0% unsecured loans principally from banks, due 2011 to 2034

0.970% unsecured straight bonds, due 2012

1.165% unsecured straight bonds, due 2012

1.423% unsecured straight bonds, due 2014

2.068% unsecured straight bonds, due 2019

0.846% unsecured straight bonds, due 2014

1.141% unsecured straight bonds, due 2016

1.604% unsecured straight bonds, due 2019

0.000% unsecured convertible bonds with subscription rights

to shares, due 2013

0.250%–1.177% unsecured Euroyen notes issued by a consolidated

subsidiary, due 2012 to 2013

0.500% unsecured Pound discount notes issued by

a consolidated subsidiary, due 2011 to 2012

lease obligations

Less-Current portion included in short-term borrowings

¥ 104,522

139,766

43,042

¥ 287,330

¥ 149,554

20,000

10,000

30,000

10,000

100,000

20,000

30,000

201,783

5,046

290

26,289

602,962

(43,042)

¥ 559,920

¥ 199,085

351,000

47,912

¥ 597,997

¥ 126,188

20,000

—

30,000

10,000

100,000

20,000

30,000

201,068

6,996

130

32,690

577,072

(47,912)

¥ 529,160

$ 2,457,840

4,333,333

591,506

$ 7,382,679

$ 1,557,876

246,914

—

370,370

123,457

1,234,568

246,914

370,370

2,482,321

86,370

1,605

403,580

7,124,345

(591,506)

$ 6,532,839

2011

2011

2012

2012

Yen

(millions)

Yen

(millions)

2012

2012

U.S. Dollars

(thousands)

U.S. Dollars

(thousands)

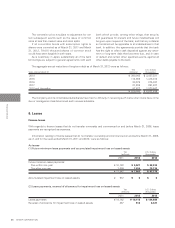

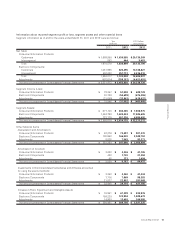

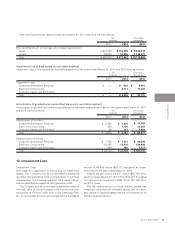

Long-term debt as of March 31, 2011 and 2012 consisted of the following:

The following is a summary of the terms for conversion and redemption of the convertible bonds with subscription

rights to shares:

0.000% unsecured convertible bonds with subscription rights to shares, due 2013 ¥ 2,531.00

Conversion price

Yen