Salesforce.com 2009 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

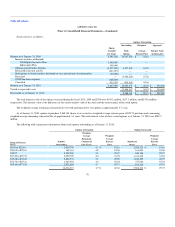

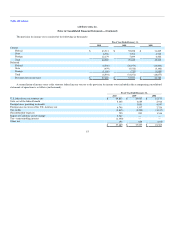

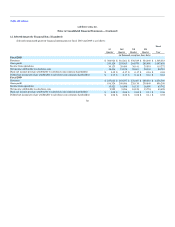

As of January 31, 2010, the future minimum lease payments under noncancelable operating and capital leases are as follows (in thousands):

Capital

Leases

Operating

Leases

Fiscal Period:

Fiscal 2011 $ 7,901 $ 81,941

Fiscal 2012 7,550 58,299

Fiscal 2013 1,074 44,103

Fiscal 2014 — 31,820

Fiscal 2015 — 13,360

Thereafter — 50,686

Total minimum lease payments $ 16,525 $ 280,209

Less: amount representing interest (942)

Present value of capital lease obligation $ 15,583

The terms of the lease agreements provide for rental payments on a graduated basis. The Company recognizes rent expense on the straight-line basis

over the lease period and has accrued for rent expense incurred but not paid. Of the total operating lease commitment balance of $280.2 million, $229.2

million is related to facilities space. The remaining $51.0 million commitment is related to computer equipment and other leases.

The Company's agreements for the facilities and certain services provide the Company with the option to renew. The Company's future contractual

obligations would change if the Company exercised these options.

Rent expense for fiscal 2010, 2009 and 2008 was $47.3 million, $36.0 million and $23.0 million, respectively.

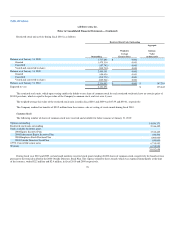

9. Legal Proceedings

The Company is involved in various legal proceedings and receives claims from time to time, arising from the normal course of business activities. In

the Company's opinion, resolution of these matters is not expected to have a material adverse impact on its consolidated results of operations, cash flows or its

financial position.

During fiscal 2009, the Company received a communication from a large technology company alleging that the Company infringed some of its patents.

The Company continues to analyze the potential merits of these claims, the potential defenses to such claims and potential counter claims, and the possibility

of a license agreement as an alternative to litigation. The Company is currently in discussions with this company and no litigation has been filed to date.

However, there can be no assurance that this claim will not lead to litigation in the future. The resolution of this claim is not expected to have a material

adverse effect on the Company's financial condition, but it could be material to the net income or cash flows or both of a particular quarter. The Company has

been, and may in the future be, sued by third parties for alleged infringement of their proprietary rights. The Company's technologies may be subject to

injunction if they are held to infringe the rights of a third party. The outcome of any litigation is inherently uncertain. Any intellectual property claims,

including the one referenced above, with or without merit, could be time-consuming and expensive to resolve, could divert management attention from

executing the Company's business plan and could require the Company to change the Company's technology, change the Company's business practices and/or

pay monetary damages or enter into short- or long-term royalty or licensing agreements which may not be available in the future at the same terms or

86