Salesforce.com 2009 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Our business is subject to changing regulations regarding corporate governance and public disclosure that have increased both our costs and the

risk of non-compliance.

We are subject to rules and regulations by various governing bodies, including, for example, the Securities and Exchange Commission, which are

charged with the protection of investors and the oversight of companies whose securities are publicly traded. Our efforts to comply with new and changing

regulations have resulted in and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and

attention from revenue-generating activities to compliance activities.

Moreover, because these laws, regulations and standards are subject to varying interpretations, their application in practice may evolve over time as new

guidance becomes available. This evolution may result in continuing uncertainty regarding compliance matters and additional costs necessitated by ongoing

revisions to our disclosure and governance practices. If we fail to address and comply with these regulations and any subsequent changes, our business may be

harmed.

Unanticipated changes in our effective tax rate could adversely affect our future results.

We are subject to income taxes in the United States and various foreign jurisdictions, and our domestic and international tax liabilities are subject to the

allocation of expenses in differing jurisdictions.

Our effective tax rate could be adversely affected by changes in the mix of earnings and losses in countries with differing statutory tax rates, certain

non-deductible expenses arising from share-based compensation, the valuation of deferred tax assets and liabilities and changes in federal, state or

international tax laws and accounting principles. Increases in our effective tax rate could materially affect our net results.

In addition, we are subject to income tax audits by many tax jurisdictions throughout the world. Although we believe our income tax liabilities are

reasonably estimated and accounted for in accordance with applicable laws and principles, an adverse resolution of one or more uncertain tax positions in any

period could have a material impact on the results of operations for that period.

Natural disasters and other events beyond our control could materially adversely affect us.

Natural disasters or other catastrophic events may cause damage or disruption to our operations, international commerce and the global economy, and

thus could have a strong negative effect on us. Our business operations are subject to interruption by natural disasters, fire, power shortages, pandemics and

other events beyond our control. Although we maintain crisis management and disaster response plans, such events could make it difficult or impossible for us

to deliver our services to our customers, and could decrease demand for our services. The majority of our research and development activities, corporate

headquarters, information technology systems, and other critical business operations, are located near major seismic faults in the San Francisco Bay Area.

Because we do not carry earthquake insurance for direct quake-related losses, and significant recovery time could be required to resume operations, our

financial condition and operating results could be materially adversely affected in the event of a major earthquake or catastrophic event.

Risks Relating to Ownership of Our Common Stock and our Convertible Senior Notes due 2015

The market price of our common stock is likely to be volatile and could subject us to litigation.

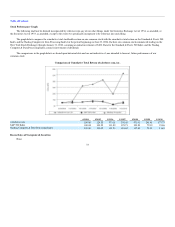

The trading prices of the securities of technology companies have been highly volatile. Accordingly, the market price of our common stock has been

and is likely to continue to be subject to wide fluctuations. Factors affecting the market price of our common stock include:

• variations in our operating results, earnings per share, cash flows from operating activities, deferred revenue, and other financial metrics and non-

financial metrics, and how those results compare to analyst expectations;

24