Salesforce.com 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

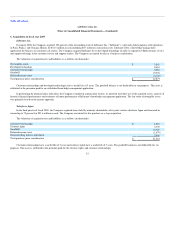

Notes to Consolidated Financial Statements—(Continued)

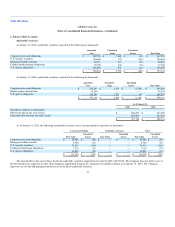

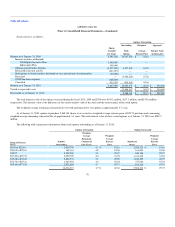

Intangible assets acquired resulting from the acquisitions described above as of January 31, 2010 are as follows (in thousands):

Gross

Fair Value

Accumulated

Amortization

Net

Book Value

Weighted

Average Remaining

Useful Life

Developed technology $ 8,610 $ (4,185) $ 4,425 1.5 years

Territory rights 2,196 (444) 1,752 5.5 years

Customer relationships 7,869 (3,881) 3,988 1.4 years

$ 18,675 $ (8,510) $ 10,165

The expected future amortization expense for these intangible assets for each of the fiscal years ended thereafter is as follows (in thousands):

Fiscal Period:

Fiscal 2011 $ 5,807

Fiscal 2012 3,233

Fiscal 2013 314

Fiscal 2014 314

Fiscal 2015 314

Thereafter 183

Total amortization expense $10,165

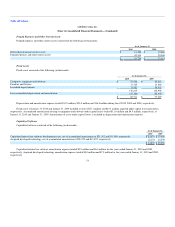

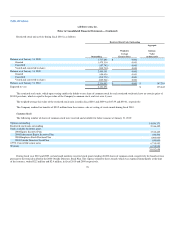

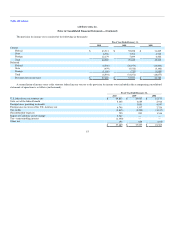

7. Income Taxes

The domestic and foreign components of income before provision (benefit) for income taxes and noncontrolling interest consisted of the following (in

thousands):

Fiscal Year Ended January 31,

2010 2009 2008

Domestic $ 125,095 $ 83,590 $ 51,911

Foreign 17,286 2,002 (5,698)

$ 142,381 $ 85,592 $ 46,213

82