Salesforce.com 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

b. COBRA. The Company shall pay directly to the COBRA administrator 100% of the premium cost of Executive's group health plan

continuation coverage which is continuing pursuant to the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended ("COBRA"), for a period of

eleven (11) months following the Effective Date of this Supplemental Agreement, subject to Executive's timely election of COBRA benefits, Executive's

continued eligibility for COBRA continuation coverage and the conditions described in subsection (d)(i) below. To the extent any part or parts of the

Company's COBRA premium payments are taxable to Executive, the Company shall provide to Executive a one-time lump sum payment equal to the

aggregate tax on the taxable portion(s) of the premiums ("Additional Tax Payment"). The Additional Tax Payment under this Section 1.b. shall be made by

the end of Executive's taxable year following the year in which the related taxes are remitted to the taxing authorities in compliance with Section 409A of the

Internal Revenue Code (the "Code"). For the convenience of Executive only, it is anticipated that such taxable reimbursements will be in an amount of

approximately $55 per month (not including any Additional Tax Payment).

c. Stock Rights.

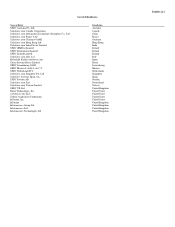

i. The Parties agree that for purposes of determining the number of shares of the Company's common stock that Executive is entitled to

purchase from the Company, pursuant to the exercise of outstanding stock options (together, the "Awards"), or is otherwise entitled to purchase and/or receive

from the Company pursuant to outstanding restricted stock unit award agreements with the Company, Executive will vest only up to the Separation Date and

no more. Executive acknowledges that as of the Separation Date, provided he is a service provider through such date, Executive shall vest in those Awards

that are described as "Vested as of Separation Date" and will be able to exercise such Awards described as "Vested as of Separation Date" up until and on the

date listed as "Last Day to Exercise" on Addendum 1 to Exhibit A and no more. In the case of restricted stock units, the Company shall deliver to Executive

all Company stock that has vested on or before the Separation Date pursuant to the terms of the applicable governing restricted stock unit equity agreements.

Notwithstanding the foregoing, the information listed in Addendum 1 is provided in good faith by the Company for the convenience of Executive only and the

Awards shall continue to be governed solely by the terms and conditions of the applicable stock plan and equity agreement governing each Award (the

"Award Agreements").

ii. Provided that all vested restricted stock units, performance shares and performance units are paid and/or distributed as required by the

applicable stock plan and equity agreement governing documents, Executive acknowledges that, as of the Separation Date all restricted stock units,

performance shares and performance units ("Stock Units") granted to Executive, have been cancelled or settled and Executive has no rights outstanding under

any such Stock Unit award.