Salesforce.com 2009 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

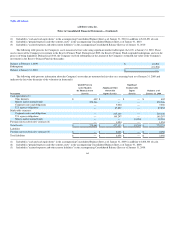

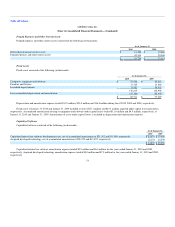

agreements. Deferred revenue also includes certain deferred professional services fees which are recognized as revenue ratably over the subscription contract

term. The Company defers the professional service fees in situations where the professional services and subscription contracts are accounted for as a single

unit of accounting. Deferred revenue that will be recognized during the succeeding 12-month period is recorded as current deferred revenue and the remaining

portion is recorded as noncurrent. Approximately 6 percent and 7 percent of total deferred revenue as of January 31, 2010 and January 31, 2009, respectively

related to deferred professional services revenue.

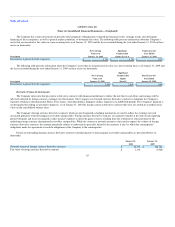

Deferred Commissions

Deferred commissions are the incremental costs that are directly associated with non-cancelable subscription contracts with customers and consist of

sales commissions paid to the Company's direct sales representatives. The commissions are deferred and amortized over the non-cancelable terms of the

related customer contracts, which are typically 12 to 24 months. The commission payments are paid in full the month after the customer's service commences.

The deferred commission amounts are recoverable through the future revenue streams under the non-cancelable customer contracts. The Company believes

this is the preferable method of accounting as the commission charges are so closely related to the revenue from the non-cancelable customer contracts that

they should be recorded as an asset and charged to expense over the same period that the subscription revenue is recognized. Amortization of deferred

commissions is included in marketing and sales expense in the accompanying consolidated statements of operations.

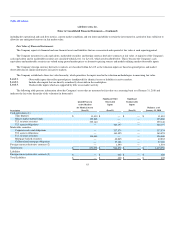

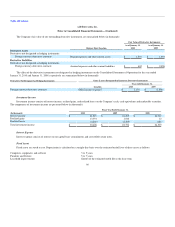

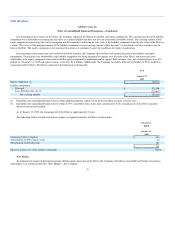

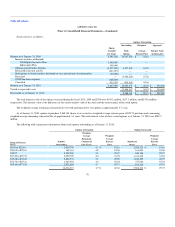

Accounting for Stock-Based Compensation

The Company recognizes share-based expenses on a straight-line over the requisite service period of the awards, which is the vesting term of four years.

Share-based expenses are recognized net of estimated forfeiture activity.

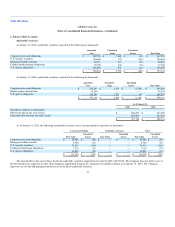

The fair value of each option grant was estimated on the date of grant using the Black-Scholes option pricing model with the following assumptions and

fair value per share:

2010 2009 2008

Volatility 50 - 60% 47 - 60% 46 - 47%

Weighted-average estimated life 3.8 - 4 years 4 years 4 years

Weighted-average risk-free interest rate 1.78 - 2.39% 1.47 - 3.08% 3.32 - 4.55%

Dividend yield — — —

Weighted-average fair value per share of grants $24.73 $15.39 $20.49

Since November 2009, the weighted-average estimated life was based on an actual analysis of expected life. Prior to November 2009, the weighted-

average estimated life assumption of 4 years was based on the average of the vesting term and the 5 year contractual lives of options awarded. The weighted

average risk free interest rate is based on the rate for a 4 year U.S. government security at the time of the option grant.

The Company estimated its future stock price volatility considering both its observed option-implied volatilities and its historical volatility calculations.

Management believes this is the best estimate of the expected volatility over the 4 year weighted-average expected life of its option grants.

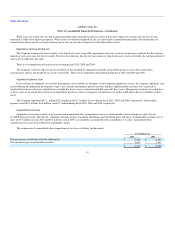

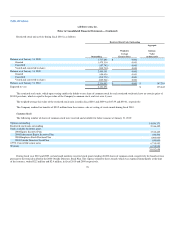

During fiscal 2010 and 2009, the Company capitalized $2.4 million and $1.9 million, respectively, of stock based expenses related to capitalized

internal-use software development and deferred professional services costs.

During fiscal 2010, the Company recognized stock-based expense of $88.9 million. As of January 31, 2010, the aggregate stock compensation

remaining to be amortized to costs and expenses was $283.6 million. The

70