Salesforce.com 2009 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

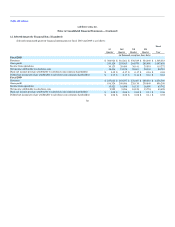

Notes to Consolidated Financial Statements—(Continued)

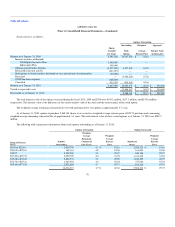

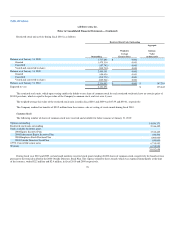

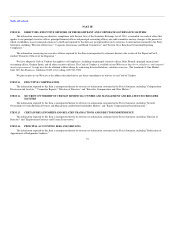

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amounts of assets and liabilities for financial reporting

purposes and the amounts used for income tax purposes. Significant components of the Company's deferred tax assets and liabilities were as follows (in

thousands):

As of January 31,

2010 2009

Deferred tax assets:

Net operating loss carryforwards $ 5,284 $ 6,212

Deferred stock compensation 30,451 26,288

Tax credits 20,836 14,004

Deferred rent expense 7,360 6,244

Accrued liabilities 22,006 19,304

Deferred revenue 10,802 11,372

Other 6,816 8,208

Total deferred tax assets 103,555 91,632

Less valuation allowance (1,540) (2,344)

Net deferred tax assets 102,015 89,288

Deferred tax liabilities:

Deferred commissions (22,613) (18,274)

Purchased intangibles (4,184) (7,912)

Unrealized gains on investments (3,873) (626)

Other (3,650) (3,987)

Total deferred tax liabilities (34,320) (30,799)

Net deferred tax assets $ 67,695 $ 58,489

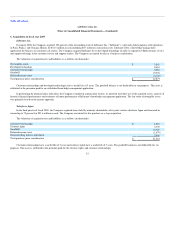

Realization of deferred tax assets is dependent on future earnings, if any, the timing and amount of which are uncertain. Accordingly, the deferred tax

assets have been partially offset by a valuation allowance. The valuation allowance relates to net deferred tax assets from operating losses of certain foreign

subsidiaries. The excess tax benefits associated with stock option exercises are recorded directly to stockholders' equity controlling interest only when

realized. As a result, the excess tax benefits included in net operating loss carryforwards but not reflected in deferred tax assets for fiscal year 2010 and 2009

are $8.5 million and $30.4 million, respectively.

At January 31, 2010, the Company had net operating loss carryforwards for federal income tax purposes of approximately $33.5 million, which expire

in 2020 through 2030, federal research and development tax credits of approximately $12.8 million, which expire in 2022 through 2030, foreign tax credits of

$2.1 million, which expires in 2020, and minimum tax credits of $0.7 million, which have no expiration date. The Company also has state net operating loss

carryforwards of approximately $166.0 million which expire beginning in 2012 and state research and development tax credits of approximately $11.8 million

and $2.4 million of state enterprise zone tax credits, which do not expire.

Utilization of the Company's net operating loss carryforwards may be subject to substantial annual limitation due to the ownership change limitations

provided by the Internal Revenue Code and similar state provisions. Such an annual limitation could result in the expiration of the net operating loss and tax

credit carryforwards before utilization.

84