Salesforce.com 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

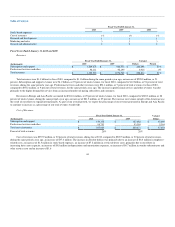

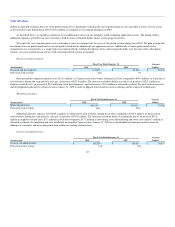

Provision for Income Taxes.

Fiscal Year Ended January 31,

(In thousands) 2010 2009 Dollars

Provision for income taxes $ (57,689) $ (37,557) $ (20,132)

Effective tax rate 41% 44%

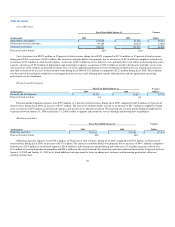

The provision for income taxes was $57.7 million during fiscal 2010, compared to $37.6 million during the same period a year ago.

Our effective tax rate decreased to 41 percent for fiscal 2010 compared to 44 percent for the same period a year ago. The decrease was due to a higher

proportion of income in countries with lower income tax rates than the U.S. statutory tax rate as well as increased tax credits. The total income tax benefit

recognized in the accompanying consolidated statements of operations related to stock-based compensation was $32.1 million for the current fiscal year. See

Note 7 "Income Taxes" to the Notes to the Consolidated Financial Statements for our reconciliation of income taxes at the statutory federal rate to the

provision for income taxes.

In addition, in February 2009, the State of California enacted several income tax law changes which include an election to apply a single sales factor

apportionment formula and adoption of a market sourcing approach for service income that will impact us beginning in fiscal 2012. As a result, we re-valued

the anticipated future tax effects of our California temporary differences including stock-based compensation and purchased intangibles. Accordingly, we

recorded an income tax expense of $2.7 million during the fiscal 2010 related to this tax law change.

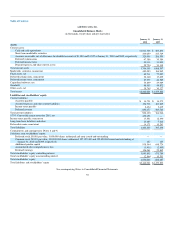

Fiscal Years Ended January 31, 2009 and 2008

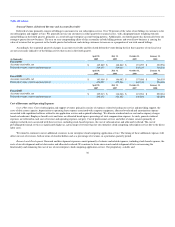

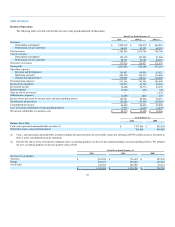

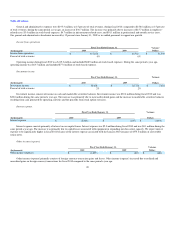

Revenues.

(In thousands)

Fiscal Year Ended January 31, Variance

2009 2008 Dollars Percent

Subscription and support $ 984,574 $ 680,581 $ 303,993 45%

Professional services and other 92,195 68,119 24,076 35%

Total revenues $ 1,076,769 $ 748,700 $ 328,069 44%

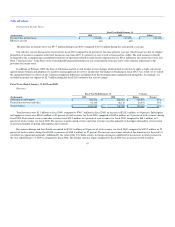

Total revenues were $1.1 billion for fiscal 2009, compared to $748.7 million for fiscal 2008, an increase of $328.1 million, or 44 percent. Subscription

and support revenues were $984.6 million, or 91 percent of total revenues, for fiscal 2009, compared to $680.6 million, or 91 percent of total revenues, during

fiscal 2008. Professional services and other revenues were $92.2 million, or 9 percent of total revenues, for fiscal 2009, compared to $68.1 million, or 9

percent of total revenues, for fiscal 2008. The increase in professional services and other revenues was due primarily to the higher demand for services from

an increased number of paying subscriptions and customers.

Revenues in Europe and Asia Pacific accounted for $300.3 million, or 28 percent of total revenues, for fiscal 2009, compared to $190.7 million, or 25

percent of total revenues, during fiscal 2008, an increase of $109.6 million, or 57 percent. The increase in revenues outside of the Americas was the result of

our efforts to expand internationally. Additionally, the value of the U.S. dollar relative to foreign currencies contributed to the increase in total revenues for

the year ended January 31, 2009 as compared to fiscal 2008. The foreign currency impact compared to fiscal 2008 was an increase of $16.6 million.

47