Salesforce.com 2009 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2009 Salesforce.com annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

salesforce.com, inc.

Notes to Consolidated Financial Statements—(Continued)

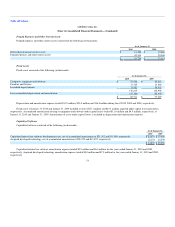

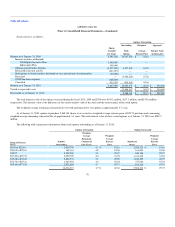

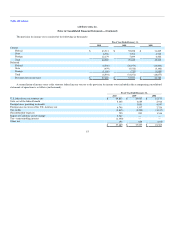

The provision for income taxes consisted of the following (in thousands):

Fiscal Year Ended January 31,

2010 2009 2008

Current:

Federal $ 43,313 $ 55,228 $ 31,245

State 8,788 7,701 4,515

Foreign 12,179 7,699 6,502

Total 64,280 70,628 42,262

Deferred:

Federal (4,506) (26,979) (13,800)

State (979) (5,372) (3,192)

Foreign (1,106) (720) (1,885)

Total (6,591) (33,071) (18,877)

Provision for income taxes $ 57,689 $ 37,557 $ 23,385

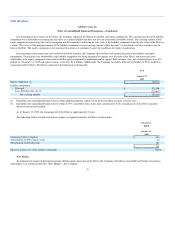

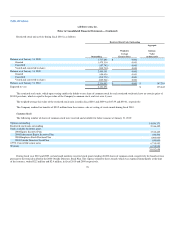

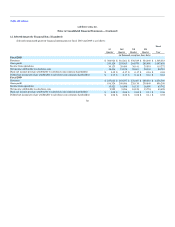

A reconciliation of income taxes at the statutory federal income tax rate to the provision for income taxes included in the accompanying consolidated

statements of operations is as follows (in thousands):

Fiscal Year Ended January 31,

2010 2009 2008

U.S. federal taxes at statutory rate $ 49,833 $ 29,957 $ 16,175

State, net of the federal benefit 8,645 4,685 2,916

Foreign losses providing no benefit — 3,091 4,547

Foreign taxes in excess of the U.S. statutory rate 6,748 3,537 2,326

Tax credits (9,845) (5,222) (3,817)

Non-deductible expenses 755 901 1,346

Impact of California tax law change 2,747 — —

Tax—noncontrolling interest (1,390) — —

Other, net 196 608 (108)

$ 57,689 $ 37,557 $ 23,385

83