Rite Aid 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

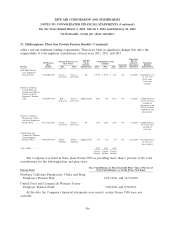

15. Stock Option and Stock Award Plans (Continued)

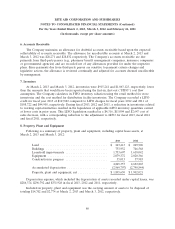

Stock Options

The Company determines the fair value of stock options issued on the date of grant using the

Black-Scholes-Merton option-pricing model. The following weighted average assumptions were used for

options granted in fiscal 2013, 2012 and 2011:

2013 2012 2011

Expected stock price volatility(1) ............ 85% 79% 79%

Expected dividend yield(2) ................. 0.00% 0.00% 0.00%

Risk-free interest rate(3) .................. 0.71% 1.45% 1.92%

Expected option life(4) ................... 5.5 years 5.5 years 5.5 years

(1) The expected volatility is based on the historical volatility of the stock price over the most

recent period equal to expected life of the option.

(2) The dividend rate that will be paid out on the underlying shares during the expected term

of the options. The Company does not currently pay dividends on its common stock, as

such, the dividend rate is assumed to be zero percent.

(3) The risk free interest rate is equal to the rate available on United States Treasury

zero-coupon issues as of the grant date of the option with a remaining term equal to the

expected term.

(4) The period of time for which the option is expected to be outstanding. The Company

analyzed historical exercise behavior.

96