Rite Aid 2013 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

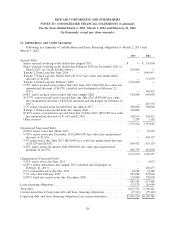

11. Indebtedness and Credit Agreement (Continued)

Credit Facility

The Company has a senior secured credit facility that consists of a $1,795,000 revolving credit

facility and a $1,161,000 senior secured term loan (the ‘‘Tranche 6 Term Loan’’). Borrowings under the

revolving credit facility bear interest from February 21, 2013 through May 31, 2013 at a rate per annum

of LIBOR plus 2.50%, if we choose to make LIBOR borrowings, or Citibank’s base rate plus 1.50%,

and thereafter at a rate per annum between LIBOR plus 2.25% and LIBOR plus 2.75%, if the

Company chooses to make LIBOR borrowings, or between Citibank’s base rate plus 1.25% and

Citibank’s base rate plus 1.75% in each case based upon the amount of revolver availability as defined

in the senior secured credit facility. The Company is required to pay fees between 0.375% and 0.50%

per annum on the daily unused amount of the revolver, depending on the amount of revolver

availability. Amounts drawn under the revolver become due and payable on February 21, 2018,

provided that such maturity date shall be accelerated to ninety-one days prior to the maturity of the

7.5% senior secured notes due 2017, in the event that the Company does not repay or refinance such

notes on or prior to such date, or ninety-one days prior to the maturity of the 9.5% senior notes due

2017, in the event that the Company does not repay or refinance such notes on or prior to such date.

The Tranche 6 Term Loan matures on February 21, 2020 and currently bears interest at a rate per

annum equal to LIBOR plus 3.00%, if the Company chooses to make LIBOR borrowings, or at

Citibank’s base rate plus 2.00%. The Tranche 6 Term Loan is subject to a 1.00% LIBOR floor per

annum.

The Company’s ability to borrow under the revolver is based upon a specified borrowing base

consisting of accounts receivable, inventory and prescription files. At March 2, 2013, the Company had

$665,000 of borrowings outstanding under the revolver and had letters of credit outstanding against the

revolver of $114,970, which resulted in additional borrowing capacity of $1,015,030.

The senior secured credit facility contains certain restrictions on the ability of the Company and

the subsidiary guarantors to accumulate cash on hand, and under certain circumstances, requires the

funds in the Company’s deposit accounts to be applied first to the repayment of outstanding revolving

loans under the senior secured credit facility and then to be held as Collateral for the senior

obligations.

The senior credit facility restricts the amount of secured and unsecured debt the Company may

have outstanding in addition to borrowings under the senior secured credit facility and existing

indebtedness, subject to limitations on the amount of such debt that shall mature or require scheduled

payments of principal prior to May 21, 2020. The senior secured credit facility allows the Company to

incur an unlimited amount of unsecured debt with a maturity beyond May 21, 2020. However, the

Company’s second priority secured term loan facility and the indentures that govern the Company’s

secured and guaranteed unsecured notes contain restrictions on the amount of additional secured and

unsecured debt that can be incurred by the Company. The Company could not incur any additional

secured debt assuming a fully drawn revolver and the outstanding letters of credit. The ability to issue

additional unsecured debt under the second priority secured term loan facility and the indentures is

generally governed by an interest coverage ratio test.

89