Rite Aid 2013 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

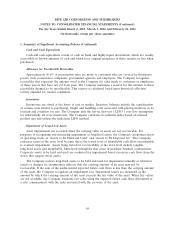

1. Summary of Significant Accounting Policies (Continued)

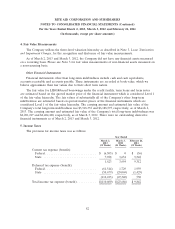

Derivatives

The Company may enter into interest rate swap agreements to hedge the exposure to increasing

rates with respect to its variable rate debt, when the Company deems it prudent to do so. Upon

inception of interest rate swap agreements, or modifications thereto, the Company performs a

comprehensive review of the interest rate swap agreements based on the criteria as provided by ASC

815, ‘‘Derivatives and Hedging.’’ As of March 2, 2013 and March 3, 2012, the Company had no interest

rate swap arrangements or other derivatives.

Discontinued Operations

For purposes of determining discontinued operations, the Company has determined that the store

level is a component of the entity within the context of ASC 360, ‘‘Property, Plant and Equipment.’’ A

component of an entity comprises operations and cash flows that can be clearly distinguished,

operationally and for financial reporting purposes, from the rest of the Company. The Company

routinely evaluates its store base and closes non-performing stores. The Company evaluates the results

of operations of these closed stores both quantitatively and qualitatively to determine if it is

appropriate for reporting as discontinued operations. Stores sold where the Company retains the

prescription files are excluded from the analysis as the Company retains direct cash flows resulting

from the migration of revenue to existing stores.

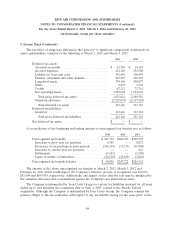

Recent Accounting Pronouncements

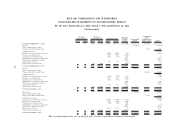

In June 2011, the Financial Accounting Standards Board (‘‘FASB’’) issued an amendment related

to statements of comprehensive income. This amendment requires an entity to present the total of

comprehensive income, the components of net income, and the components of other comprehensive

income in either a single continuous statement of comprehensive income or in two separate but

consecutive statements. The Company elected to report other comprehensive income and its

components in a separate statement of comprehensive income beginning in the first quarter of fiscal

2013. The adoption did not have a material effect on the Company’s financial statements. In February

2013, the FASB issued an amendment which adds new disclosure requirements for items classified out

of accumulated other comprehensive income. These changes are effective for interim and annual

periods beginning after December 15, 2012. The Company will adopt this guidance in the first quarter

of fiscal 2014.

In August 2010, the FASB issued an exposure draft regarding lease accounting that would require

an entity to recognize assets and liabilities arising under lease contracts on the balance sheet. On the

basis of feedback received from comment letters, roundtables, and outreach sessions, the FASB has

made significant changes to the proposals in the original exposure draft and therefore has decided to

re-expose the revised exposure draft in the second quarter of calendar 2013. The proposed standard, as

currently drafted, will have a material impact on the Company’s reported results of operations and

financial position.

74