Rite Aid 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

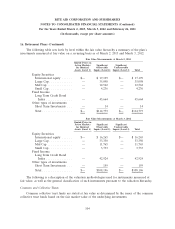

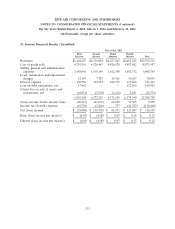

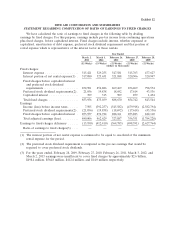

22. Financial Instruments

The carrying amounts and fair values of financial instruments at March 2, 2013 and March 3, 2012

are listed as follows:

2013 2012

Carrying Fair Carrying Fair

Amount Value Amount Value

Variable rate indebtedness ..... $2,296,001 $2,275,694 $1,512,313 $1,469,813

Fixed rate indebtedness ....... $3,622,351 $3,912,903 $4,688,904 $4,934,587

Cash, trade receivables and trade payables are carried at market value, which approximates their

fair values due to the short-term maturity of these instruments.

The following methods and assumptions were used in estimating fair value disclosures for financial

instruments:

LIBOR-based borrowings under credit facilities:

The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and term

notes are estimated based on the quoted market price of the financial instruments.

Long-term indebtedness:

The fair values of long-term indebtedness are estimated based on the quoted market prices of the

financial instruments. If quoted market prices were not available, the Company estimated the fair value

based on the quoted market price of a financial instrument with similar characteristics.

113