Rite Aid 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

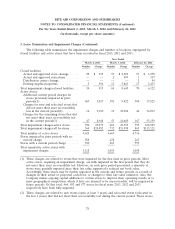

1. Summary of Significant Accounting Policies (Continued)

prescriptions that were filled but will not be picked up by the customer. For all periods presented,

there is no material difference between the revenue recognized at the time the prescription is filled and

that which would be recognized when the customer picks up the prescription. For cash prescriptions

and patient third party payor co-payments, the Company recognizes revenue when the patient picks up

the prescription and tenders the cash price or patient third party payor co-payment amount at the point

of sale. Prescriptions are generally not returnable.

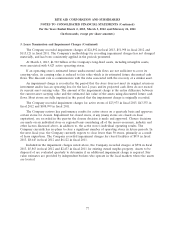

The Company offers a chain wide loyalty card program titled wellness +. Members participating in

the wellness + loyalty card program earn points on a calendar year basis for eligible front end

merchandise purchases and qualifying prescriptions. One point is awarded for each dollar spent towards

front end merchandise and 25 points are awarded for each qualifying prescription.

Members reach specific wellness + tiers based on the points accumulated during the calendar year,

which entitles such customers to certain future discounts and other benefits upon reaching that tier. For

example, any customer that reaches 1,000 points in a calendar year achieves the ‘‘Gold’’ tier, enabling

them to receive a 20% discount on qualifying purchases of front end merchandise for the remaining

portion of the calendar year and also the next calendar year. There are also similar ‘‘Silver’’ and

‘‘Bronze’’ levels with lower thresholds and benefit levels.

As wellness + customers accumulate points, the Company defers the retail value of the points

earned as deferred revenue (included in other current and noncurrent liabilities, based on the expected

usage). The amount deferred is based on historic and projected customer activity (e.g., tier level,

spending level). As customers receive discounted front end merchandise, the Company recognizes an

allocable portion of the deferred revenue.

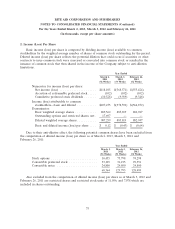

Cost of Goods Sold

Cost of goods sold includes the following: the cost of inventory sold during the period, including

related vendor rebates and allowances, LIFO credit or charges, costs incurred to return merchandise to

vendors, inventory shrink, purchasing costs and warehousing costs, which include inbound freight costs

from the vendor, distribution payroll and benefit costs, distribution center occupancy costs and

depreciation expense and delivery expenses to the stores.

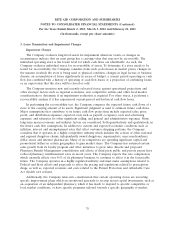

Vendor Rebates and Allowances

Rebates and allowances received from vendors relate to either buying and merchandising or

promoting the product. Buying and merchandising related rebates and allowances are recorded as a

reduction of cost of goods sold as product is sold. Buying and merchandising rebates and allowances

include all types of vendor programs such as cash discounts from timely payment of invoices, purchase

discounts or rebates, volume purchase allowances, price reduction allowances and slotting allowances.

Certain product promotion related rebates and allowances, primarily related to advertising, are

recorded as a reduction in selling, general and administrative expenses when the advertising

commitment has been satisfied.

70