Rite Aid 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 Rite Aid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

For the Years Ended March 2, 2013, March 3, 2012 and February 26, 2011

(In thousands, except per share amounts)

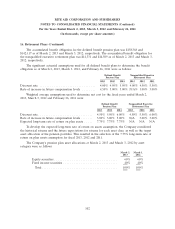

12. Leases (Continued)

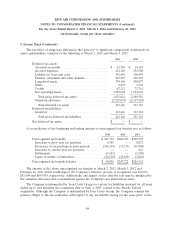

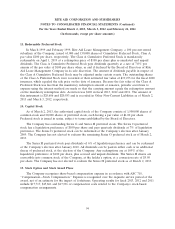

The net book values of assets under capital leases and sale-leasebacks accounted for under the

financing method at March 2, 2013 and March 3, 2012 are summarized as follows:

2013 2012

Land......................................... $ 6,692 $ 6,695

Buildings ...................................... 137,206 142,483

Leasehold improvements ........................... 1,691 1,236

Equipment ..................................... 21,316 19,261

Accumulated depreciation .......................... (103,381) (100,300)

$ 63,524 $ 69,375

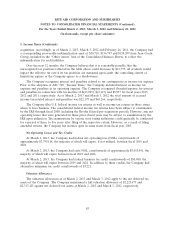

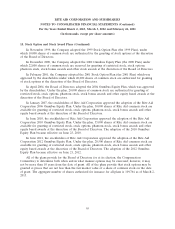

Following is a summary of lease finance obligations at March 2, 2013 and March 3, 2012:

2013 2012

Obligations under financing leases ..................... $107,308 $119,108

Sale-leaseback obligations ........................... 7,876 7,876

Less current obligation ............................. (23,334) (19,977)

Long-term lease finance obligations .................... $ 91,850 $107,007

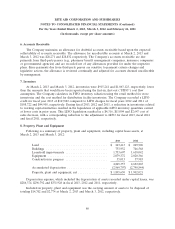

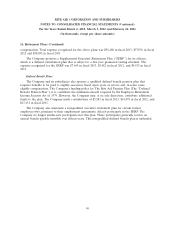

Following are the minimum lease payments for all properties under a lease agreement that will

have to be made in each of the years indicated based on non-cancelable leases in effect as of March 2,

2013:

Lease Financing Operating

Fiscal year Obligations Leases

2014 ...................................... $ 32,992 $ 997,548

2015 ...................................... 21,543 959,376

2016 ...................................... 21,459 905,031

2017 ...................................... 19,575 838,639

2018 ...................................... 13,674 751,161

Later years ................................. 45,949 3,820,698

Total minimum lease payments ................... 155,192 $8,272,453

Amount representing interest .................... (40,008)

Present value of minimum lease payments ........... $115,184

93